|

VoiceStream: No fears

|

|

September 19, 2000: 4:34 p.m. ET

Stapleton says even if DT merger approval drags on, firm still better off

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - VoiceStream Wireless Corp. President Bob Stapleton said Tuesday he had no fears about legislative efforts to block the wireless carrier's planned $30.9 billion merger with Deutsche Telekom, noting his company is already in a better competitive position today than it was before the union was announced.

In an interview with CNNfn.com Tuesday, Stapleton said despite recent investor angst, he anticipates cooler heads ultimately will prevail in the company's ongoing battle to gain U.S. legislative and regulatory approval for the merger.

However, he said the $5 billion investment made by Deutsche Telekom in advance of the acquisition has left VoiceStream with an immediate mechanism to grow its footprint even if the merger approval process drags on for months, which many now expect.

"I don't think that we have any fears," he said. "I think with the investment that Deutsche Telekom has made, we feel the future of the company is quite secure. We obviously feel we are going to complete this transaction, but there's no downside for this company, this organization or our customers in this."

Other acquisitions possible

Stapleton said a portion of that money advanced by Deutsche Telekom would be used during an upcoming federal wireless-license auction, but he would not rule out other acquisitions as well.

"We're going to use that money to continue to build our operation and participate in the upcoming wireless-spectrum auction," he said. "But there are other ways to acquire spectrum [outside the auction] and there are other acquisitions that are out there. So we won't live or die on any single auction. But the sooner the better, in terms of continuing our expansion."

Indeed, VoiceStream (VSTR: Research, Estimates) has already inked one deal, agreeing to acquire Powertel Inc., a fast-growing mobile operator in the Southeast, for $4.7 billion last month.

Deutsche Telekom (DT: Research, Estimates) also agreed to acquire the West Point, Ga.-based Powertel for $6 billion -- a deal that will take effect if the German company's acquisition of VoiceStream is approved. However, if regulators block that deal, VoiceStream will still acquire the company at what is essentially a below-market cost.

The aggressive expansion strategy comes as a cadre of federal lawmakers, led by Sen. Ernest Hollings, D-S.C., has filed legislation that would block the acquisition, citing national security concerns. The German government owns a 57 percent stake in Deutsche Telekom, an interest that would be reduced to roughly 45 percent after the merger. Hollings and others want to prohibit acquisitions of U.S. telecom companies where foreign governments would control a more-than-25 percent stake. The aggressive expansion strategy comes as a cadre of federal lawmakers, led by Sen. Ernest Hollings, D-S.C., has filed legislation that would block the acquisition, citing national security concerns. The German government owns a 57 percent stake in Deutsche Telekom, an interest that would be reduced to roughly 45 percent after the merger. Hollings and others want to prohibit acquisitions of U.S. telecom companies where foreign governments would control a more-than-25 percent stake.

But as VoiceStream's Chairman and Chief Executive John Stanton testified in Washington two weeks ago, Stapleton said he believes legislation ultimately will fail, leaving the FCC and other federal agencies to decide if the merger is in the public's and country's best interests.

The betrothed companies pressed forward with those efforts Monday, filing with the FCC for approval to transfer VoiceStream's wireless licenses into Deutsche Telekom's control.

"We think that this is so overwhelmingly in the public good that I think ultimately the strong factors [in favor of the deal] will prevail," he said.

Still, investors clearly remain nervous about the final outcome.

VoiceStream shares inched forward 25 cents to $110.69 in mid-afternoon trading Monday, but the stock remains nearly 25 percent below its closing price the day before the merger was announced, which initially valued the Bellevue, Wash.-based company's stock at $174 per share. VoiceStream shares inched forward 25 cents to $110.69 in mid-afternoon trading Monday, but the stock remains nearly 25 percent below its closing price the day before the merger was announced, which initially valued the Bellevue, Wash.-based company's stock at $174 per share.

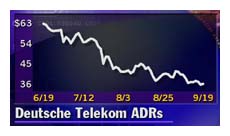

Deutsche Telekom shares have been hit even harder. Even accounting for their 19-cents-per-share gain, to trade at $35.81 in mid-afternoon trading Monday, the company's American Depository Receipts remain more than 30 percent below their closing price prior to the deal.

Stapleton noted wireless-industry stocks have fallen across the board during the same period, but said the company had no immediate plans to try and boost the stock price other than to continue pleading its case in Washington and executing its expansion strategy.

"I would think that gap would close as the process moves along," he said.

|

|

|

|

|

|

|