|

Thames in $5.8B sale talks

|

|

September 20, 2000: 7:24 a.m. ET

Water utility in talks about offer at 1,250 pence from unnamed bidder

|

LONDON (CNNfn) - Thames Water PLC, the British owner of New Jersey-based utility E'town Corp., is in advanced talks Wednesday with an unnamed party about a possible recommended cash offer to buy the U.K. company for about £4.1 billion ($5.8 billion).

Britain's biggest water utility, with 12 million customers, said the buyer might offer 1,215 pence for every Thames (TW-) share. Its announcement sent the company's stock surging 24 percent, or 220 pence, to 1,135 pence.

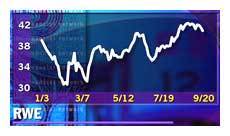

The offer price would be 33 percent above Thames' closing price on  Tuesday, after the shares jumped 5.6 percent to close at 915. The stock had rallied on speculation that cash-rich German power utility RWE AG (FRWE) would make a bid for the utility, which supplies water and sewerage services to householders and businesses in the London area. RWE declined to comment, as its shares slipped 1.4 percent to Tuesday, after the shares jumped 5.6 percent to close at 915. The stock had rallied on speculation that cash-rich German power utility RWE AG (FRWE) would make a bid for the utility, which supplies water and sewerage services to householders and businesses in the London area. RWE declined to comment, as its shares slipped 1.4 percent to  40. 40.

"RWE is the big bet at the moment," Iain Turner, an analyst at Deutsche Bank, told CNNfn.com. "They have a lot of cash and have made it clear that they want to be one of the top three multi-utilities in Europe behind Suez and Vivendi Environmental."

Thames Water has been expanding rapidly outside the U.K. in the past two years as the regulator of the British water industry cut the prices that companies could charge domestic water consumers. London-based Thames now operates in Australia, China, Indonesia, Puerto Rico, Thailand and Turkey, as well as the U.S. and U.K.

"Water stocks have performed abysmally over the last three years." Turner said. "Thames has been driving through international expansion, but because its share price has been impacted by sentiment in the rest of the sector that has affected what it can and cannot do."

Turner believes investors should sell their shares at the indicated offer price. "The price represents a 20 percent premium to our target price of £9.60," he added.

Other water shares also rose in London Wednesday morning. Severn Trent PLC (SVT) leaped 5.8 percent to 715.25 pence, Pennon Group PLC (PNN) gained 5.9 percent to 636 pence, and Anglian Water PLC (AW-) jumped 7 percent to 565 pence.

Turner said he doubted that a purchase of Thames would herald further consolidation in the industry. "International companies may think twice before bidding, because any bid has to be automatically referred to the competition commission." Turner said. "And any offer would mean an offer to cut prices." Turner said he doubted that a purchase of Thames would herald further consolidation in the industry. "International companies may think twice before bidding, because any bid has to be automatically referred to the competition commission." Turner said. "And any offer would mean an offer to cut prices."

The acquisition would be the second takeover of a U.K. water company this year. U.S.-based Western Power Distribution, which is owned by Southern Co. (SO: Research, Estimates) of Atlanta and Allentown, Pa.-based PPL Corp. (PPL: Research, Estimates), agreed in August to pay $849 million for Welsh water utility Hyder PLC after at battle for control with Japanese investment bank Nomura International.

|

|

|

|

|

|

Thames Water

RWE

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|