|

Euro: time to intervene?

|

|

September 20, 2000: 7:44 a.m. ET

ECB faces calls to buy euros, but some warn intervention won't revive currency

|

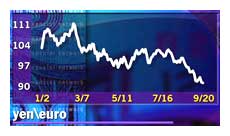

LONDON (CNNfn) - As the euro plumbs new depths against the dollar and Japanese yen, debate is intensifying among economists about whether now is the time for the European Central Bank to use its currency reserves to buy euros in an effort to boost its value.

The euro dropped to a new low against the dollar of 84.44 cents Wednesday, and traded recently at 84.59 cents, at the same time as International Monetary Fund Managing Director Horst Koehler joined the growing chorus of voices urging the ECB not to rule out so-called intervention in the currency market.

"The euro is heavily undervalued, and in my view it is also clear that intervention cannot be a taboo," Koehler said at the IMF's meeting in Prague, reinforcing comments made yesterday by the fund's chief economist Michael Mussa. Koehler also called for greater coordination and less talk among euro-zone officials. "The euro is heavily undervalued, and in my view it is also clear that intervention cannot be a taboo," Koehler said at the IMF's meeting in Prague, reinforcing comments made yesterday by the fund's chief economist Michael Mussa. Koehler also called for greater coordination and less talk among euro-zone officials.

But the ECB, not the IMF, is the overseer of monetary policy for the euro-zone, with the mandate of maintaining price stability. Government leaders in Germany and Portugal, while asserting that the state of the European economy doesn't justify the euro's dramatic decline, snapped back at the IMF officials for overstepping their role.

Behind the turmoil for the common currency has been a recent upswing in European investment in the United States - through purchases of U.S. companies, for example - a rate of U.S. economic growth that outstrips the pace of the euro zone, and higher U.S. interest rates, which lure investors into dollar-denominated assets.

The weak euro threatens to quicken inflation and curb economic growth in the 11-nation currency bloc by making imports more costly. It has also trimmed profits of some U.S. companies doing business in the zone by reducing the value of European revenue translated back into dollars, and making their exports less competitive to euro-based consumers.

Action, not words, needed

Among those joining the fray this week was Bundesbank President Ernst Welteke, maintaining that the euro is undervalued "by any measure" and would recover once financial markets recognized this fact. Attempts to talk up the euro have had little effect, though, and currency traders say only action, not words, will work now.

But can even direct intervention in the currency markets do the trick?

"It's not that clear cut that intervention will have an impact," said Bank of America economist Lorenzo Codogno. "What appears to be driving down the euro are money flows out of the euro zone. If this is the case, it is not the optimal moment for currency intervention."

The problem, economists and traders say, is that a move by European Central Bank officials into the market would have to be accompanied by a strong pledge for economic reforms to help keep the euro-zone economy on a growth track. But that won't be a quick fix.

"On its own, it won't work," said a currency market trader in London. "There need to be some fundamental structural changes in Europe. And if the [U.S. Federal Reserve Bank] were to agree to support the euro, it would want something in return - such as assurance of those structural changes."

"But I don't think Europe is in the position to offer anything in return," the trader said.

In addition, the history of intervention has been spotty. Britain's effort to revive the pound in the early 1990s amid an onslaught from speculators led to billions of pounds in losses as it poured money into the market, where traders and investors were firmly set on selling the currency.

The government's failure to stem the pound's decline - despite cranking interest rates up sharply - ended with Britain backing out of a system of partially fixed exchange rates with its European Union partners, the precursor to the euro.

Baby steps toward intervention

The European Central Bank, in what many observers said was a form of currency intervention, said last week it would spend the equivalent of  2.5 billion ($2.2 billion) buying euros, using the interest accrued over the past 20 months from its international currency reserves. There is little sign that has done the job, however. 2.5 billion ($2.2 billion) buying euros, using the interest accrued over the past 20 months from its international currency reserves. There is little sign that has done the job, however.

The latest economic news also offered little relief for the euro. The index of German business confidence published on Wednesday by the Ifo research institute fell for a third consecutive month in August, suggesting that growth in Europe's largest economy might be slowing.

"The Ifo survey was supposed to have been better," said Bank of America's Codogno. "The market must be convinced of the slowdown in the U.S., and that slowdown in Europe is not as significant as the market had expected."

"Any support for the euro would have to be engineered with interest-rate  increases and a strong statement not only from ECB but from other central banks," he added. increases and a strong statement not only from ECB but from other central banks," he added.

The market is expected to remain edgy ahead of this weekend's meeting in Prague of ministers of the Group of Seven industrialized nations.

Speaking earlier this week, Japanese Finance Minister Kiichi Miyazawa said he was looking to achieve a stable exchange rate with his counterparts at the G-7 meeting.

"Japan will cooperate to achieve overall foreign exchange stability," said Miyazawa. "As to whether we actually do anything or not, we will respond flexibly."

The euro, which is down more than 31 percent against the Japanese yen since the common currency's launch last January, recently fetched ¥90.25, after falling as low as ¥90.02 earlier in the session.

-- from staff and wire reports

|

|

|

|

|

|

European Central Bank

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|