|

Stock picks by the pros

|

|

September 20, 2000: 5:11 p.m. ET

Talking about American General, Fedex, Microsoft, JDS Uniphase, Exxon

|

NEW YORK (CNNfn) - Market strategists and sector analysts reviewed the technology, financial, fiber optics, semiconductor and oil sectors Tuesday, recommending such stocks as Qualcomm, Goldman Sachs, Corning and Schlumberger.

While the markets slipped in Wednesday midday trading, recent guests on CNNfn commented on the stocks they are buying and why.

"I suspect we're still in a seasonal downtrend, the worst seasonal time of the year. It was an impressive rally yesterday. The Nasdaq 100, the larger Nasdaq companies, rose above their previous two-days' highs on the close. So there was less momentum on the charts on the downside there than the few days before. So that was encouraging. But I still think we need to focus on the fact that it's early in the negative seasonal time frame. And it's a very reliable negative event where you've got tax loss, selling, the lack of new funds flows that are already invested earlier in the year, and companies that really can't stretch too much further as time's running out on meeting their year-end goals. So this is a normal kind of thing. It's no big deal. We were 5.6 percent off the all-time high at the day-before-yesterday's close on the S&P 500. I moved 5 percent from bonds to stocks to try to hedge against the possibility of an earlier-than-expected low. But I think we're about 3 or 4 percent from the final low on the S&P 500. In other words, a garden-variety 7-to-11 percent correction from the all-time high," said Robert Robbins, chief investment strategist at Robinson-Humphrey. "I suspect we're still in a seasonal downtrend, the worst seasonal time of the year. It was an impressive rally yesterday. The Nasdaq 100, the larger Nasdaq companies, rose above their previous two-days' highs on the close. So there was less momentum on the charts on the downside there than the few days before. So that was encouraging. But I still think we need to focus on the fact that it's early in the negative seasonal time frame. And it's a very reliable negative event where you've got tax loss, selling, the lack of new funds flows that are already invested earlier in the year, and companies that really can't stretch too much further as time's running out on meeting their year-end goals. So this is a normal kind of thing. It's no big deal. We were 5.6 percent off the all-time high at the day-before-yesterday's close on the S&P 500. I moved 5 percent from bonds to stocks to try to hedge against the possibility of an earlier-than-expected low. But I think we're about 3 or 4 percent from the final low on the S&P 500. In other words, a garden-variety 7-to-11 percent correction from the all-time high," said Robert Robbins, chief investment strategist at Robinson-Humphrey.

"Yes, I think it's going to be a fantastic buy. I think we're going to pack the whole year's Super Bowl rate-of-gain, which tend to average 16 percent during the last 18 years, compound annual growth of the S&P 500, 16 percent a year. We've had zero so far and the outlook is improving very, very significantly for the worst worry that people have had. And that is the Fed rate-hiking. It really looks like the probability is increasing dramatically that the Fed rate hikes are over and inflation pressure is in check. And as that continues to happen through year-end, we can get a fantastic rally, 15 to 20 percent on the S&P 500 in three months," Robbins said.

"I'd be buying in the finance area right now. And this defensive -- in this time of the year, where you get your worst seasonality, your riskier stocks don't do well. So we want to buy stocks at lower P/E ratios. We're talking about stocks like American General (AGC: Research, Estimates), National Commerce Bancorp (NCBC: Research, Estimates), in that general area. And then we want to, sort of, identify special - that's in the banking area, a large Southeast bank, National Commerce Bancorp. And finally, Qualcomm (QCOM: Research, Estimates) is an example, sort of the exception to the rule, where we try to pick a turnaround, a stock that's a great growth stock, a $60 billion company looks like it's turned up and made a nice base after a tremendous decline. So, it's an unusual situation that's repairing itself," he said.

"Investment banking continues to be pretty strong pretty much for all these players. Goldman yesterday talked about a record backlog and I think that would also be true for Lehman. Morgan Stanley will be reporting tomorrow. That's been a pretty steady drumbeat. Underwriting activity was a little slower. Fixed income business has been picking up with the Federal Reserve seeming to go on hold," said David Berry, a banking analyst and director of research at Keefe Bruyette & Woods. "Investment banking continues to be pretty strong pretty much for all these players. Goldman yesterday talked about a record backlog and I think that would also be true for Lehman. Morgan Stanley will be reporting tomorrow. That's been a pretty steady drumbeat. Underwriting activity was a little slower. Fixed income business has been picking up with the Federal Reserve seeming to go on hold," said David Berry, a banking analyst and director of research at Keefe Bruyette & Woods.

"On the equity side, clearly results are going to down from the prior quarter, summer slowdown in equity trading volumes, and I think we're still recovering from the crack in the Nasdaq earlier this year," Berry said.

"We have talked about Lehman as a possible merger scenario. One of our partners, of course, was with J.P. Morgan and J.P. made a different decision last week. So in some sense we're coming down to fewer buyers and fewer potential sellers. So I think Lehman is very attractive. Whether we actually get a deal done with somebody, maybe a European bank, I think is not clear," he said.

"We think Lehman (LEH: Research, Estimates) is still a pretty attractive value here. The company is very successfully built out from its traditional fixed-income strength into a much better-diversified investment banking business over the last several years. Even with the run-up, which might in part be takeover-induced, the stock still looks cheaper than its peers. Goldman Sachs (GS: Research, Estimates) is all about market leadership. And we think the acquisition last week of the Speers Leed franchise could prove to be significantly accretive to earnings. And the third would be the J.P. Morgan-Chase (JPM: Research, Estimates), Chase (CMB: Research, Estimates) the new giant that was formed last week. This stock is statistically very, very cheap. Chase has got a terrific record of integrating these big mergers and making it work and Morgan does bring critical mass in the equity business that Chase had lacked," Berry said.

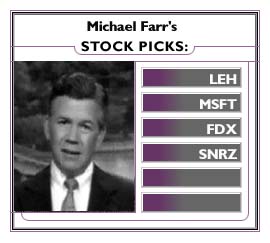

"  I like Lehman Brothers (LEH: Research, Estimates). I kind of like all of the brokerage stocks. And I like the financial sector pretty well. Sixty-three cents ahead of estimates is a strong gain; that stock ought to rally pretty nicely today," said Michael Farr, president of Farr Miller & Washington. I like Lehman Brothers (LEH: Research, Estimates). I kind of like all of the brokerage stocks. And I like the financial sector pretty well. Sixty-three cents ahead of estimates is a strong gain; that stock ought to rally pretty nicely today," said Michael Farr, president of Farr Miller & Washington.

"For a firm that came out in their early morning report yesterday with a No. 5 'strong sell' on Microsoft, sent the stock down three points with these jittery investors, and then corrected it and came back and said, 'Oh, it's a No. 1 'strong,' not a [No.] 5 'sell'; sorry,'" Farr observed.

"I do like Microsoft (MSFT: Research, Estimates)," he continued. "I think at this price that, you know, where we're at -- much more reasonable valuation we've ever seen. Microsoft's earnings are great. Look, if they split the company into two groups and you get Steve Ballmer running one company, you get Bill Gates running the other company. Doesn't sound bad to me. And I think you get big premiums, particularly for the company that Gates gets. So I think that Microsoft, at these levels, will make you very happy five years from now.

"FedEx (FDX: Research, Estimates) watching FedEx has kind of been painful, because as oil prices went up, FedEx started coming down. They put in an oil surcharge and they're, of course, expanding their business. They're talking about deals with the Post Office. They want to be the point-to-point international business delivery system. They want to be your solution. They use all of these wonderful buzz words, 'point-to-point.' It's your international business," Farr said.

"The earnings are there and the numbers are coming through. And, sort of the idea is if they're managing oil prices at these levels and growing profits, that's a good thing. When oil prices come back down, it should be a better thing for FedEx," he noted.

"The aging of America, the graying of America: This is the leader in the industry. Sunrise Assisted Living (SNRZ: Research, Estimates) will earn -- probably beat the dollar estimate this year. They're going to do $1.25 next year. The stock's close to $20 a share. Twenty times earnings, they're going to grow their earnings by 25 percent. Fabulous management; Paul Klaassen's a good manager. They're in a great sector of the industry, you'll make money on this stock, too," Farr concluded.

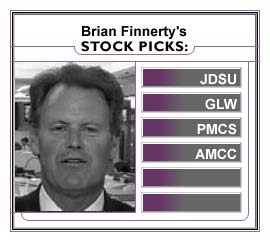

"I think the stocks that have the biggest earnings potential and top-line and bottom-line growth (potential)... are fiber optic stocks. They will come back into play big, I think," C.E. Unterberg, Towbin analyst Brian Finnerty said.

"That would be JDS Uniphase (JDSU: Research, Estimates) [and] probably Corning (GLW: Research, Estimates); even though Corning is not a Nasdaq stock, it is a big tech stock. "That would be JDS Uniphase (JDSU: Research, Estimates) [and] probably Corning (GLW: Research, Estimates); even though Corning is not a Nasdaq stock, it is a big tech stock.

"In the semiconductor [sector], the big winners [are] PMC-Sierra (PMCS: Research, Estimates) and Applied Micro Circuits (AMCC: Research, Estimates). I think those two will be big leaders. They have been the leaders. They are very volatile stocks, but the earnings will there. So when that earning growth finally hits, [in the] middle of October, I think it will be off to the races for those stocks."

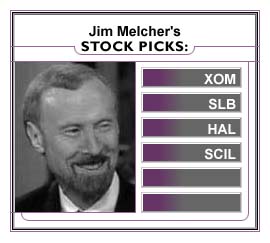

"I think oil stocks are very attractive, stocks like Exxon-Mobil (XOM: Research, Estimates) and Schlumberger (SLB: Research, Estimates), as one of the oil-field service companies. When oil companies start to make money, the price of oil goes up, they drill more. It's just that simple. And so oil service looks pretty attractive," Jim Melcher, president of Balestra Capital,  said. said.

"Halliburton (HAL: Research, Estimates) looks good. But there are several of them... the whole field looks good, and it really hasn't kept up with the price of oil. A lot of people think oil's going to come right back down. [But] oil prices look like they're going to stay up for a long time, and certainly the oil-service companies are going to do real well here. Some of them aren't so cheap, but the earnings are going to come up very fast, and then they're going to get cheaper.

"[In the health-care sector, Scientific Learning (SCIL: Research, Estimates) is] an interesting little company. It's not really health care, but they have what amounts to a cure of dyslexia. It's an extraordinary thing. They reprogram the kids' brains by training them on computer games.

"Most of dyslexia is caused by an inability to differentiate between two sounds in a short time span. And that's the case with a lot of consonants. So the kids don't really hear things right when they're babies learning how to talk, and so they don't learn how to read well. I'm giving you a capsule view.

"But this program [lets] the computer stretch sound much longer than the normal human voice could possibly do. And over a period of a few weeks, the kids play the games, and the sound is gradually compressed back. And it cures them, basically."

-- compiled by Staff Writers Lucy Banduci and Mark Gongloff

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|