|

New IMF chief talks tough

|

|

September 20, 2000: 10:01 a.m. ET

Horst Koehler, IMF's new managing director, unveils no-nonsense side

By Staff Writer M. Corey Goldman

|

LONDON (CNNfn) - Few words, tough talk.

That's the impression Horst Koehler, the new managing director of the International Monetary Fund, has left in the wake of his first public appearance Wednesday, which kicked off both the IMF-World Bank annual meetings and his tenure as the new head of the world's largest and most influential fund.

Koehler spoke candidly about the work that needs to be done at this week's meetings in Prague. On his agenda will be discussions about everything from the way the IMF accepts repayments on its loans to ways of encouraging private sources of capital to invest in lesser-developed economies. Koehler spoke candidly about the work that needs to be done at this week's meetings in Prague. On his agenda will be discussions about everything from the way the IMF accepts repayments on its loans to ways of encouraging private sources of capital to invest in lesser-developed economies.

At the same time, the 52-year-old German left the impression that he has no intention of running the fund in the same manner as his predecessor, Michel Camdessus. He also made clear that he has no special allegiance to any of the fund's 182 member countries, including the Group of Seven industrial nations, which carry hold the greatest influence.

"I am listening to everybody, in the sense that I feel myself in charge of an organization that has 182 members," Koehler told reporters in Prague, possibly seeking to differentiate his approach from that of his predecessor. "I owe my duty to the fund and to no other authority," he said, adding that he plans to listen to the G7 and to try to continue working with them on global issues.

A different kind of reign

Koehler took over the top job at the IMF in May, after Camdessus abruptly resigned at the end of last year.

Camdessus, both praised and scorned for his iron-fist rule of the IMF, left the job in mid-February, half way through his third five-year term. He was praised for helping steer the world clear of the threat of economic meltdown following financial crises in 1997 and 1998, and criticized for not always bowing to consensus.

While Koehler has been in the top office for more than four months, he has not yet made any clear statement regarding his vision for the agency, which lends cash to countries in need and monitors global economies for signs of trouble. Koehler's appearance Wednesday was his first at the annual meetings. While Koehler has been in the top office for more than four months, he has not yet made any clear statement regarding his vision for the agency, which lends cash to countries in need and monitors global economies for signs of trouble. Koehler's appearance Wednesday was his first at the annual meetings.

For Jerome Booth, head of research with Ashmore Investment in London and a former senior planning officer with the Inter-American Development Bank, Koehler's brief words were precisely what he wanted to hear.

"The biggest issue as far as I'm concerned is getting a sense that the new managing director is going to stand up to the G7 and exert independence," Booth said. "The IMF has been abominably treated by its shareholders, who have used it to gain some share of popular opinion, and I think it needs to fight back."

Words louder than actions?

Even with his brief remarks, Koehler managed to do just that - at least in part. Critics, while pleased by initiatives that Koehler announced Wednesday to increase debt relief and encourage growth in poorer countries, noted that the new managing director still has the difficult task of changing IMF internal attitudes, that have been criticized for failing to reach quick enough resolutions on global economic and social problems.

"Kohler spoke more about dialogue than we have heard before from the Fund, "Kohler spoke more about dialogue than we have heard before from the Fund,

but on debt relief we believe we will be disappointed by the outcome of the

meeting," said Lucy Matthew, spokesperson for Jubliee2000, an international group campaigning for the cancellation of Third World debt.

"He is beginning to talk in a language that we understand and relate to, but he still has to talk with shareholders and the IMF. At the end of the day, he is a manager and does not make the final decisions."

Forgiving debt

Among other issues, Koehler said the fund hopes to put 20 poor nations on the path toward relief from their crushing debts by the end of the year, part of the Fund's Heavily Indebted Poor Countries, or HIPC initiative. "Debt relief is an important element to fight poverty, but it is no quick fix," he said.

Koehler's forecast was welcomed as a better-than-expected indicator of the HIPC project's progress. Although World Bank President James Wolfensohn last year set out the ambitious goal that as many as 24 HIPC's would receive some amount of debt relief by the end of 2000, few observers expected the program to come close to achieving that target over the coming months.

To be sure, there appears to be dissent in the ranks concerning Koehler's vision of the fund's role in the world and the vision of his colleagues.

At a press conference Tuesday, Michael Mussa, IMF Economic Counselor, all but dismissed dire economic conditions in countries with small populations. By contrast, Koehler said Wednesday that he wants to give representatives of some of the lesser-developed regions of the world a bigger voice within the IMF than they currently have.

Stepping up for the euro

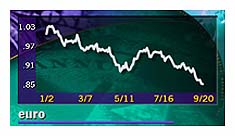

Koehler also addressed the ailing euro, joining a growing contingent of economists and politicians who are urging the European Central Bank to consider intervening in currency markets. Intervention is the technical term traders use to describe when a central bank buys up large amounts of its own currency to try to bolster its value.

"The euro is heavily undervalued, and in my view it is also clear that intervention cannot be a taboo," Koehler said, calling for greater coordination and less talk among euro-zone officials.

The euro dropped to a new low of 84.44 U.S. cents Wednesday; it recently traded at 84.59 U.S. cents. The euro dropped to a new low of 84.44 U.S. cents Wednesday; it recently traded at 84.59 U.S. cents.

Among other issues, Koehler said the fund hopes to put 20 poor nations on the path toward relief from their crushing debts by the end of the year, part of the Fund's Heavily Indebted Poor Countries, or HIPC initiative. "Debt relief is an important element to fight poverty, but it is no quick fix," he said.

Koehler's forecast was welcomed as a better-than-expected indicator of the HIPC project's progress. Although World Bank President James Wolfensohn last year set out the ambitious goal that as many as 24 HIPC's would receive some amount of debt relief by the end of 2000, few observers expected the program to some close to achieving that target over the coming months.

And Koehler also addressed the role capital markets should play in promoting global growth and ensuring a more equal balance of trade between rich and poorer countries.

"The IMF should work with capital markets, not against," said Koehler. "It is not the function of the IMF to over-regulate but to ensure risks of capital flows from turbulence are contained."

-- Heather Bourbeau in Prague contributed to this report

|

|

|

|

|

|

|