NEW YORK (CNNfn) - The Nasdaq composite index erased nearly all of its earlier 214-point loss Friday as investors bet that a revenue warning by Intel would not severely batter the rest of the tech sector.

And the Dow Jones industrial average, of which Intel is a component, came back from an earlier 100-point loss as investors shifted money into more defensive issues.

"The rebound is due to many of the sectors moving higher and a big portion of this rise is due to Hewlett-Packard (on the Dow)," said Peter Cardillo, director of research at Westfalia Investments. "What the market is telling us is, this morning we panicked but this is probably just an isolated situation and a temporary situation for Intel."

Intel stunned the markets late Thursday when it revealed that weakening demand in Europe will result in third-quarter revenue growth that may amount to as little as half what some analysts had expected.

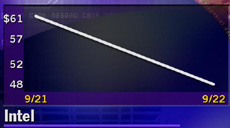

Intel (INTC: Research, Estimates) shares tumbled $13.53, or 22 percent, to $47.94. Volume was a record 308 million shares, trouncing the 200.4 million JDS Uniphase (JDSU: Research, Estimates) shares traded July 26 in what was the previous single-day, single-stock mark. Intel (INTC: Research, Estimates) shares tumbled $13.53, or 22 percent, to $47.94. Volume was a record 308 million shares, trouncing the 200.4 million JDS Uniphase (JDSU: Research, Estimates) shares traded July 26 in what was the previous single-day, single-stock mark.

The company's share volume counted for about 15 percent of the day's volume on the Nasdaq, and also exceeded the nation's population.

The day's selling was widespread, with both institutional and retail investors participating in the melee. Analysts said the volume was not unexpected, given Intel's market leadership.

"They're (Intel) not citing problems like currency or raw material costs; they're citing demand, and that puts a spook in all of the markets," said Art Hogan, chief market analyst at Jefferies & Co. "There's a little bit of a flight to safety and Hewlett is a news-related purchase."

Linda Jay, NYSE floor trader for RPM Specialists, told CNNfn's Market Call that the Intel sell-off may have a purging effect on the markets. (249K WAV) (249K AIFF)

The Nasdaq composite index fell 25.14 to 3,803.73, falling 0.8 percent on the week. While that's still a measurable decline, it's only about quarter of the 214-point drop in the index during the first few minutes of trading. The decline brings the index's September loss to 9.6 percent. The Nasdaq composite index fell 25.14 to 3,803.73, falling 0.8 percent on the week. While that's still a measurable decline, it's only about quarter of the 214-point drop in the index during the first few minutes of trading. The decline brings the index's September loss to 9.6 percent.

While the Dow Jones industrial average initially tumbled on the Intel news, 22 of its 30 issues attracted enough buyers to offset the Intel selling. The buying was led by Hewlett-Packard (HWP: Research, Estimates), which said it will meet revenue and earnings goals for its fiscal fourth quarter and that it will conduct a $1 billion share buyback program. The computer maker gained $8.69 to close at $103.69.

The Dow was up 81.85 to 10,847.37, wiping out its earlier losses, but the blue chip index is still down 0.7 percent for the week. The S&P 500 was little changed, losing 0.34 to 1,448.71, falling 1.1 percent this week. The Dow was up 81.85 to 10,847.37, wiping out its earlier losses, but the blue chip index is still down 0.7 percent for the week. The S&P 500 was little changed, losing 0.34 to 1,448.71, falling 1.1 percent this week.

Market breadth was negative on volume that was far in excess of recent sessions. On the New York Stock Exchange, decliners outpaced advancers 1,509 to 1,354, as more than 1.1 billion shares were traded. On the Nasdaq, losers topped winners 2,238 to 1,786, as more than 2.1 billion shares changed hands.

Treasury securities fell. The dollar rose against the yen but fell versus the euro, which surged after the European Central Bank (ECB) asked central banks of the U.S. and Japan to help prop up the struggling currency.

The euro tumbled to a new lifetime low below 85 cents earlier in the week while crude oil prices surged above $37, a 10-year high.

"The market has to go through a process of elimination of the three 'e's,'" said Cardillo. "It looks as though two of them have been addressed - the euro and energy prices are headed lower, so perhaps some of the nervousness has dissipated," leaving earnings as the sole "e" factor contributing to some underlying uncertainty.

Appeal for euro help boosts buying

Helping keep some of the tech-bashing at bay was the appeal to other central banks by the ECB to help the ailing euro along with investors favoring more defensive issues.

"The stocks that are up today are euro-based," said Weatherly's Hyman. "Let's hope we can make the case that the euro problem is closer to (being) resolved than before and that's a good sign today. Whatever overhanging concerns can be relieved will help the market."

Analysts also said the selling was a logical market reaction, since it came from one of the largest technology issues. But they said money would merely be moved into more defensive areas, such as drug stocks.

"I would tell people who are overweight in technology to use any bounces to lighten up in those areas, raise some cash and shift portfolios into more defensive positions," said Bill Meehan, chief market analyst at Cantor Fitzgerald. "I would tell people who are overweight in technology to use any bounces to lighten up in those areas, raise some cash and shift portfolios into more defensive positions," said Bill Meehan, chief market analyst at Cantor Fitzgerald.

Among the Dow components, Johnson & Johnson (JNJ: Research, Estimates) gained $1.63 to $95.88, Merck (MRK: Research, Estimates) advanced $3.06 to $73.19, J.P. Morgan (JPM: Research, Estimates) jumped $5.94 to $166.74, and Coca-Cola (KO: Research, Estimates) jumped $3.19 to $52.75.

Intel pressured tech selling

Market leader Intel had been choppy in recent weeks as concern about the chip maker's third-quarter results prompted volatile swings in the company's share price. The uncertainty stemmed from a downgrade in early September by U.S. Bancorp Piper Jaffray analyst Ashok Kumar.

Investors had been braced for earnings warnings, but nothing could prepare the market for the heavy tech selling at the opening bell.

"Either people are going to reposition away from technology and seek a home in the migration away from technology, which is why you have other sectors moving," said Barry Hyman, chief market strategist at Weatherly Securities. "For those who are tech players, it's going to leave those stocks that may have some concerns over future earnings and it's going to stay there."

A slew of analyst downgrades followed the news that Intel would miss its revenue targets. Lehman Brothers cut its earnings estimate for 2000 to $1.63 a share from $1.74 a share, Credit Suisse First Boston lowered its earnings estimate to $1.67 from $1.77, and Merrill Lynch reduced its 2000 revenue estimate to $34.7 billion from $34.97 billion.

A revenue assurance from direct computer seller Dell Computer (DELL: Research, Estimates) did little to help support that stock. A revenue assurance from direct computer seller Dell Computer (DELL: Research, Estimates) did little to help support that stock.

Dell shares fell $2 to $35.94 after executives said the company still is on track to post a 30 percent revenue gain for the year despite only a 25 percent increase in the second quarter.

Other tech issues faced a rapid sell-off. Cisco Systems (CSCO: Research, Estimates) fell 81 cents to $60.31, Applied Materials (AMAT: Research, Estimates) dropped $3.50 to $70, and Microsoft (MSFT: Research, Estimates) slid 94 cents to $63.25.

|