|

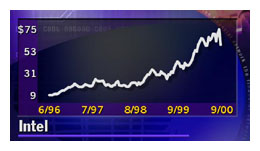

Has Intel's time come?

|

|

September 25, 2000: 2:45 p.m. ET

Investors, competitors signal that Intel might be alone in losing its grip

By Dan Briody

|

SAN FRANCISCO (www.redherring.com) - Misery loves company. But after momentarily dragging the entire tech sector down with its bombshell revenue shortfall announcement, things are starting to get cold and lonely for Intel.

As the market mulled the curious news and Intel's (INTC: Research, Estimates) explanation of its shortcomings, various partners of Intel's distanced themselves from the chip giant, leaving the company with a lot more explaining yet to do.

Early on, analysts had no reason to suspect that Intel's explanation of its fiscal woes, the company predicted a 3-to-5 percent increase in third quarter revenue, as opposed to the expected 9 to 12 percent -- was anything but weakening demand for PCs in Europe. After all, Intel was coming clean on the revenue shortfall; why would it make up the reasons behind it? Early on, analysts had no reason to suspect that Intel's explanation of its fiscal woes, the company predicted a 3-to-5 percent increase in third quarter revenue, as opposed to the expected 9 to 12 percent -- was anything but weakening demand for PCs in Europe. After all, Intel was coming clean on the revenue shortfall; why would it make up the reasons behind it?

But the market chose mainly to punish Intel, rather than the entire PC and semiconductor sectors, on Friday. It was a stark contrast to Thursday, when many PC and chip stocks were bludgeoned in after-hours trading.

On Friday, the stocks of various PC companies and direct Intel competitors actually went up. And companies were quick to defend themselves against Intel's claims of sluggish PC demand, with Dell Computer, Compaq, Gateway and Hewlett-Packard all releasing brief statements to assure investors that they were still on track. It's as if the collective voice of the PC industry was saying, "This is Intel's problem, and we're not going to take the heat for it."

Out of clout

The reaction of the market speaks to Intel's eroding position as the PC market bellwether stock, let alone its former status as a semiconductor bellwether. And the company's claims that the PC market is the cause of its problems won't be gaining them any brownie points with their PC original equipment manufacturer (OEM) customers, many of whom are already unhappy with Intel.

"This mostly feels like an Intel execution issue," says Alex Guana, analyst at Bank of America Securities. "They haven't been making their customers happy for some time, and they are dealing with some personnel defection issues. Looks like the world has finally gotten it: the semiconductor industry has no bellwether."

But the implications of the market's reaction to Intel's woes run even deeper than that. It used to be a given that when Intel's numbers started to come down, it was the end of the infamous semiconductor cycle for all chip stocks. But in a semiconductor market that is being driven by more than just PCs, there are a number of different semiconductor cycles that will each have their own timeline.

But it will take more than Intel's separation from the rest of the market to wean investors off their old habits.

"The market will probably continue to behave cyclically, because they've been conditioned to do that," says Mr. Guana. "But earnings won't. It used to be a PC-driven world, but it's a lot more complex now."

Not my problem

As evidence of the separation, Intel lost more than 20 percent of its value when the bad news hit Thursday night. After brief dips, however, Intel rival Advanced Micro Devices was up more than 8 percent on the day, while Gateway, which does very little business in Europe, finished nearly 9 percent higher.

In one of the shortest press releases in history, Peter Blackmore, senior vice president of sales and services at Compaq, said, "Our worldwide momentum is clearly continuing, and European demand is currently tracking within our expectations," helping Compaq's stock along to a 5 percent increase on the day.

So what is going on? The mixed signals that flew around the market all day Friday confounded investors, but the answer is far simpler than the countless data points flitting around the Internet.

Intel is struggling. They are the three words that very few people outside of AMD headquarters really want to hear, but the facts in the case are indisputable. All eyes are now turning to AMD when it reports quarterly results in October, to see if the company has capitalized on Intel's stumbling. Intel is struggling. They are the three words that very few people outside of AMD headquarters really want to hear, but the facts in the case are indisputable. All eyes are now turning to AMD when it reports quarterly results in October, to see if the company has capitalized on Intel's stumbling.

Many market experts thought the news from Intel would have had the Nasdaq selling off hundreds of points. But the tech-laden index lost a mere 25 points Friday, or .66 percent. It makes you proud that investors didn't hit the panic button based on bad news from one company, but it makes you wonder even more what Intel's future looks like, given that the once dominant semiconductor giant wasn't able to take the tech stocks with it.

Discuss private companies and venture capital in the Rising Startups forum, or check out forums, video, and events at the Discussions home page.

© 1997-2000 Red Herring Communications. All Rights Reserved

|

|

|

|

|

|

|