|

Kodak warns on 3Q profit

|

|

September 26, 2000: 1:37 p.m. ET

Firm cites sudden sales slump, strong dollar, higher material costs

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - Eastman Kodak Co. warned Tuesday that a disappointing earnings picture is developing, saying sales will miss targets in the current period and fourth-quarter results also are at risk.

Kodak (EK: Research, Estimates), the world's biggest producer of film and photographs, blamed an unexpected drop in September sales for the problems. The company had been counting on a strong September sales gain to offset rising raw materials costs, a strong dollar and investment in digital imagining.

The news comes as Kodak finally has rebuilt credibility with investors following a series of disappointing results and cost-cutting moves over the past few years. Kodak had put together five consecutive quarters of beating forecasts before meeting the second-quarter estimates with a record profit. But this new warning scared some investors that the bad old days are back. The news comes as Kodak finally has rebuilt credibility with investors following a series of disappointing results and cost-cutting moves over the past few years. Kodak had put together five consecutive quarters of beating forecasts before meeting the second-quarter estimates with a record profit. But this new warning scared some investors that the bad old days are back.

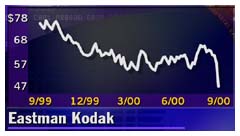

The warning sent shares of Kodak, a component of the Dow Jones industrial average, plunging in early trading Tuesday. Shares lost $12.75, or 22 percent, to $46.25 in early trading, accounting for about a 75 point drop in the Dow, or just less than half of the midday decline in that benchmark.

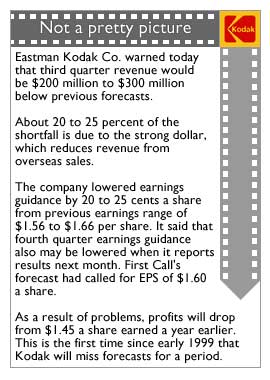

Kodak said earnings would be 20-to-25 cents a share below its previous guidance of $1.56-to-$1.66 a share in the third quarter, meaning that it will see a drop rather than a gain in earnings per share. Analysts surveyed by earnings tracker First Call had forecast the company would earn $1.60 a share in the current period, up from $1.45 a share a year earlier.

The company said it plans to give further guidance on the fourth quarter when it releases third-quarter results Oct. 18.

|

|

VIDEO

|

|

Take a peek at Kodak's snapshot.

Take a peek at Kodak's snapshot.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

"If current sales trends persist and worldwide economic growth continues to slow, a downward revision to fourth-quarter earnings expectations may be necessary," the company's statement said. The current First Call forecast calls for the company to earn $1.44 a share in the fourth quarter, up from $1.27 a share a year ago.

In a call with analysts, Bob Brust, the Rochester, N.Y., company's chief financial officer, said revenue would be about $200 million-to-$300 million below sales targets. He estimated about 20-to-25 percent of that shortfall was due to the strong dollar, which reduced the revenue the company receives from overseas sales.

Brust said the weakness is across just about all of the company's products and sales territories, with the biggest surprise being weak U.S. sales. He said the company was surprised by the shortfall and is still searching for its reasons. Brust said the weakness is across just about all of the company's products and sales territories, with the biggest surprise being weak U.S. sales. He said the company was surprised by the shortfall and is still searching for its reasons.

"We don't know if there is any significant share shift," he said. "If our big retailers slowed us down to adjust inventory, it could come back in October. That's what we're scrambling around to determine right now. You could work yourself into believing we're having an economic slowdown here, but I don't know that. What's amazing is how fast it happened, and how our sales flattened out after a strong August."

That lack of information about the revenue problems helped punish the stock, said Peter Enderlin, analyst with Ryan Beck.

"I think they in a sense made things worse for themselves in not having much details in where the revenue shortfall occurred, let alone why," said Enderlin. He said the stock might bounce back later as details become known, especially if it turns out that this was simply a matter of inventory adjustment by vendors.

But Enderlin and other analysts say there is a chance that this is a sign that the recent growth in traditional film business is finally being impacted by the growth of digital cameras.

"There is a concern out there that the problems may be a little bit deeper than a one time or a few weeks of sale issue," Jonathan Rosenzweig, analyst with Salomon Smith Barney, told CNNfn Tuesday. "There may be some general concern about the longer-term growth potential of the company is in the face of a major transition to digital technology." (358KB WAV) (358KB AIFF)

While company officials made no comments on 2001 or future earnings, one analyst, Ben Reitzes of PaineWebber, lowered his earnings estimates for the first quarter of next year as well as the second half of this year. He also downgraded the stock rating to "neutral" from "attractive."

"While over time Kodak could unlock some significant value through asset sales, we would not be surprised if current problems lingered into 2001, when revenue comparisons remain tough until the second half," he said.

The only good news for Kodak investors Tuesday was that Brust said the company should increase the number of shares repurchased in the fourth quarter due to the lowered share price. But he did not give details of any such increase.

The company struggled during much of the decade, cutting about 20,000 jobs during the six-year tenure of George Fisher, who served as chief executive until he was succeeded by Dan Carp. A price war with Japanese competitor Fuji hurt results and eroded the company's market share during that time.

Brust made no mention of new pricing pressure during his call to analysts, and the shortfall seemed to be far more on the top line than on the cost side. Brust said continued cost-cutting efforts are pretty much in line with expectations in the current period. But he said if sales remain this soft going into the fourth quarter, some plants would have to be shut temporarily, and that would raise costs for the period.

Kodak competitor Polaroid Corp. (PRD: Research, Estimates) issued a statement Tuesday following Kodak's announcement saying its sales are tracking close to company expectations despite the weak euro.

Polaroid's statement did not comment directly on earnings forecasts. First Call's estimate calls for Polaroid earnings to rise to 54 cents a share from 50 cents a share a year earlier.

Shares of Polaroid lost 81 cents to $13.88 in trading Tuesday.

|

|

|

|

|

|

Eastman Kodak Co.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|