|

Selkin: Likes Ciena

|

|

September 26, 2000: 5:43 p.m. ET

Joseph Gunnar chief market strategist bullish on Brocade, Vertical Net

|

NEW YORK (CNNfn) - Donald Selkin, chief investment strategist, Joseph Gunnar, advised investors Tuesday to add Vertical Net and Applied Micro Devices to their portfolios, while cautioning them against Ameritrade and other online brokerage stocks.

Every day at 1 p.m. ET, CNNfn viewers are invited to call in to the "Talking Stocks" segment and ask equity-related questions of the guest expert. The toll-free number is: 800-304-FNET. Every day at 1 p.m. ET, CNNfn viewers are invited to call in to the "Talking Stocks" segment and ask equity-related questions of the guest expert. The toll-free number is: 800-304-FNET.

Click here to send your stock questions to the next guest

Name: Mohammed, California.

Question: Vertical Net. (VERT: Research, Estimates). VERT is currently trading in the low 30s.Should I buy more of the stock, and what's your position on this stock for the short and long term?

Answer: This is a stock that should do better than it has based on the fundamentals. When a stock is acting poorly despite positive news, one should then look to the overall industry as perhaps not doing as well as original expectations. At this level I would add on and sell on a rally to $50.

Name: Mohammed, California.

Question: Applied Micro Devices (AMD: Research, Estimates). I bought AMD at $80 before it split. After Intel's recent nosedive, AMD followed. What is your position on AMD?

Answer: One would think that AMD would benefit from Intel's problems but there is such negativity toward the entire group now that the ones with the good prospects are being hurt as well. I would add on at current levels, and sell on a rally back to the old high of $48.50.

Name: Paul, New York.

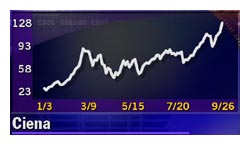

Question: Ciena (CIEN: Research, Estimates). What is your six-month outlook for Ciena?

Answer: This stock is in the hottest industry now, which is fiber optics. I would hold this stock. I think it will go much higher, at least to $150.

Name: Ray, North Carolina. Name: Ray, North Carolina.

Question: Ameritrade (AMTD: Research, Estimates). What do you think about Ameritrade?

Answer: Unfortunately I do not see much upside on these online brokerage stocks mainly because there's too many of them offering the same services. Too much competition will keep these stocks depressed.

Name: Antonio, New York.

Question: Brocade Communications (BRCD: Research, Estimates). I would like to know your short-term outlook for BRCD. Also, why is the stock down so much?

Answer: This is a great stock that made a new all-time high yesterday. The fact that it is down a little bit is a function of an overbought condition and the general market weakness that we've see recently. Longer term, this stock has great prospects and I would hold on to it.

CNNfn welcomes your e-mail questions for our "Talking Stocks" guest. Please include your first name, state and one stock question per e-mail. Please keep in mind: "Talking Stocks" is for specific stock questions only.

If you do not see an answer to your e-mail here, it is because our guest does not cover the company.

-- compiled by Parija Bhatnagar

Disclaimer

|

|

|

|

|

|

|