|

Corning in $3.6B purchase

|

|

September 27, 2000: 3:10 p.m. ET

Fiber optic company buys Pirelli's 90% stake in optical component maker

|

NEW YORK (CNNfn) - Corning Inc. agreed Wednesday to buy Italian tire and cable company Pirelli SpA's stake in an optical components and devices venture for nearly $3.6 billion cash, giving the U.S. company critical leverage to grow its dominant fiber optic business on a global scale.

The transaction will give Corning (GLW: Research, Estimates) Pirelli's 90 percent interest in a optical component and submarine optical transmission systems collaboration struck with U.S. Internet equipment maker Cisco Systems Inc. (CSCO: Research, Estimates) late last year. Cisco will retain its 10 percent stake in that venture, which produces the components primarily in Europe.

Corning officials said the deal will significantly strengthen Corning's optical transmission capabilities, particularly in the submarine business, which involves laying fiber optic cable under the ocean. The Corning, N.Y.-based company already controls more than half of the worldwide fiber optic cable market, but lacked significant component manufacturing ability in Europe to help keep up with demand.

Specifically, the Pirelli operation is a leading maker of lithium niobate modulators and pump lasers used in optical networks. Specifically, the Pirelli operation is a leading maker of lithium niobate modulators and pump lasers used in optical networks.

The acquisition comes just two months after Corning ended talks to purchase Nortel Networks' optical component business, a transaction some had valued at upwards of $100 billion.

"The combination of Pirelli's business with our leading position in optical fiber and photonic technologies enables us to continue to provide our customers with an enhanced value proposition for high-speed next generation systems," Corning Chairman and CEO Roger Ackerman said.

Terms of the transaction, expected to close by year-end, call for Corning to make an initial $3.4 billion payment to Pirelli, followed by a $180 million payment contingent on certain business milestones being met.

Charlie Willhoit, communications components analyst with J.P. Morgan, said considering the optical unit's projected sales, Corning paid a fair price. (275K WAV or 275K AIFF)

Corning said it will finance the transaction through equity and convertible debt securities. Corning expects the purchase to dilute its 2001 pro-forma earnings per share by 3 to 4 percent, or roughly 15 cents per share.

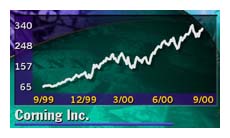

That helped send Corning shares down $9.75 to $315.25 in early trading Wednesday, but analysts said the transaction is a positive from a long-term point of view.

"For modest dilution, Corning has positioned itself to gain several new market opportunities," Salomon Smith Barney analysts Timothy Anderson said, noting the significant European presence the acquisition will provide.

Anderson also said it gives Corning exposure to the submarine optical business for the first time. While not yet profitable, some industry experts expect that business to grow at a 60 percent rate in coming years.

Milan, Italy-based Pirelli said it will reinvest the proceeds of the transaction in its telecommunications, energy transmission and tire manufacturing operations.

Pirelli has gradually been shedding slower-growth units to compensate for slower sales in its tire division. The company also has been exiting areas where it cannot achieve a leadership position, and the fiber-optic cable business -- which is dominated by Corning, Lucent Technologies Inc. (LU: Research, Estimates) and Alcatel -- is one of them.

Pirelli shares gained 9.4 percent in mid-afternoon trading in Amsterdam.

|

|

|

|

|

|

|