|

Don't fall into Web scams

|

|

September 27, 2000: 6:05 a.m. ET

Web sites allegedly socking consumers with bogus charges

By Staff Writer Rob Lenihan

|

NEW YORK (CNNfn) - On the Internet some "free" services can be mighty expensive.

That's because cyber scam artists are looking to nail consumers in a tangled Web of deception. Government investigators say they have recently filed charges or obtained judgments against Web site operators who were illegally billing consumers for services that were advertised as free.

Experts say many of the scams are descendants of earlier telephone rip-offs, while others have been spawned on the Internet.

The National Consumers League said consumers lost over $3.2 million to Internet fraud last year. The group said 1999 saw a 38 percent increase in Internet fraud complaints coupled with an average consumer loss of as much as $580.

"It's the new breeding ground," said Shirley L. Rooker, president of Call For Action, a consumer advocacy organization in Bethesda, Md. "There's a whole host of things going on there."

Consumers often find they have no idea where the company they are dealing with is located, Rooker said. If Web sites are headquartered outside of the United States, getting a refund can be difficult or impossible.

Land of the free?

In recent months the Federal Trade Commission has charged three adult Web site operators with using "free" or unauthorized services to separate consumers from their money. These cases include:

· Xpics Publishing Inc. The FTC charged the company and its principals, Mario G. Carmona and Brian M. Shuster with hosting a variety of adult Web sites offering "free" viewing or "free 30-day" or 90-day trials. Consumers had to submit their credit card numbers to verify their age, but soon found their credit cards were billed—sometimes within hours—after they registered for the "free" trial. Some consumers who tried to cancel their registration were upgraded to more expensive service and some had unauthorized charges put on their credit card accounts even though they never visited any of the company's adult sites. A settlement agreement with the government requires the Web operators to provide refunds to consumers and post "clear and conspicuous" disclosures of their billing practices on their Web site.

· Crescent Publishing Group. The FTC and the New York State Attorney General's Office filed a joint complaint against the owners and operators of the Playgirl and High Society Web sites for illegally billing thousands of consumers for "free" services and for billing others who never visited the sites at all. New York City-based Crescent Publishing, its owner, Bruce Chew, and principal David Bernstein, are named as defendants in the federal court complaint along with 64 affiliated corporations that operate the adult entertainment Web sites  . The complaint charges the "Free Tour Web Sites" generated income of $188 million between 1997 and October 1999 -- $141 million of which was generated in the first 10 months of 1999 alone. Consumers had to give their credit card numbers as proof of age, but thousands were charged recurring monthly membership fees ranging from $20 to $90. The defendants allegedly use billing names different than the Web site names, so consumers often didn't know who was billing them or why and had difficulty contacting the defendants for refunds. After Visa disqualified the defendants from using its credit card system, the defendants allegedly moved their merchant banking relationship to Guatemala. A woman answering the telephone at Crescent refused to comment on the case. . The complaint charges the "Free Tour Web Sites" generated income of $188 million between 1997 and October 1999 -- $141 million of which was generated in the first 10 months of 1999 alone. Consumers had to give their credit card numbers as proof of age, but thousands were charged recurring monthly membership fees ranging from $20 to $90. The defendants allegedly use billing names different than the Web site names, so consumers often didn't know who was billing them or why and had difficulty contacting the defendants for refunds. After Visa disqualified the defendants from using its credit card system, the defendants allegedly moved their merchant banking relationship to Guatemala. A woman answering the telephone at Crescent refused to comment on the case.

· J.K. Publications Inc., MJD Service Corp., Herbal Care Inc., Discreet Bill Inc. Earlier this month, the FTC announced it had won a $37.5 million verdict against Kenneth and Teresa Taves, Dennis Rappaport and their businesses. The government charged the defendants billed customers without authorization for alleged visits to adult Web sites. The FTC said the defendants had purchased access to a database of credit card numbers provided by Charter Pacific Bank of Agoura Hills, Calif. The defendants illegally used the account numbers to place charges on the accounts. The FTC said over 90 percent of the defendants' $49 million a year in "sales" were actually unauthorized charges. U.S. District Court Judge Audrey B. Collins said "a shocking 40 percent- to-50 percent of the calls received by the defendants were from people who said they did not have a computer and had not given their credit card numbers to anyone."

ScamCentral.com

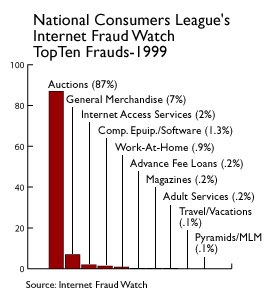

The National Consumers League said online auction sales were the No.1 Internet fraud last year, increasing from 68 percent of the frauds reported to the group's Internet Fraud Watch to in the previous year to 87 percent in 1999.

Other top frauds for 1999 were non-auction sales of general merchandise, Internet access services, computer equipment/software and work-at-home plans. Consumers lost an average of $580 per person to online purchases of computer equipment or software and $465 to general merchandise sales.

The average loss per consumer to online auction sales was $293, the league said. Experts advise consumers and business people to check their credit card and telephone bills carefully to make certain they are not being hit with unauthorized charges.

Rooker of Call For Action said elderly people are often the victims of Internet start up scams that promise great profits just by starting a Web site.

"A Web site does not guarantee you anything," she said, "except that you have a Web site. You have to ask about advertising. What product is being offered on the site? Big companies are failing on the Internet."

Like so many other scams, if the work-at-home deal sounds too good to be true it probably is.

The National Consumer League pamphlet "Be E-Wise: How to Shop Safely Online" lists tips for consumers for shopping online. Always guard your personal information and check the seller's -- learn as much as you can about companies and individuals before you do business with them. Credit cards are generally the safest way to pay because you have the right to dispute the charges if the product or service is misrepresented or never delivered.

If a person or company can't accept credit card payments, have an escrow service hold your money until you have confirmed you have received the product or service. And always keep records of your transaction, the Consumer League said, including product description, delivery information, warranties and any confirmation notices the seller sends you.

|

|

|

|

|

|

|