|

2Q GDP growth revised up

|

|

September 28, 2000: 12:05 p.m. ET

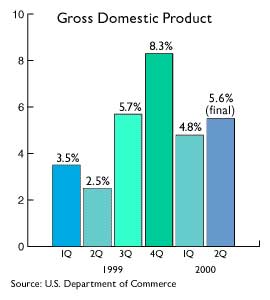

Final Report: Economy grew at 5.6 percent rate, but inflation was down

|

NEW YORK (CNNfn) - The U.S. economy grew faster than previously estimated in the second quarter, although there was less inflationary pressure than earlier indicated, a government report said Thursday.

The Commerce Department's final report on second-quarter gross domestic product said the nation's output of goods and services grew at an annual rate of 5.6 percent, up from a 4.8 percent rise in the first quarter.

The government's previous estimate for the quarter had been for a 5.3 percent growth rate in the broadest measure of the U.S. economy. Analysts had forecasted the report to show little change at either 5.3 or 5.4 percent. The government's previous estimate for the quarter had been for a 5.3 percent growth rate in the broadest measure of the U.S. economy. Analysts had forecasted the report to show little change at either 5.3 or 5.4 percent.

The GDP chain deflator, which accounts for prices and is a closely watched inflation indicator, was revised down to a 2.4 percent increase during the quarter. The previous estimate was for a 2.6 percent increase in the period.

"This suggests the government saw more real growth and less inflation in the quarter," said Gary Thayer, chief economist for A.G. Edwards, in an appearance on CNNfn's Before Hours program Thursday.

The final second-quarter report is a relatively ancient look at the economy, and many reports looking at July and August statistics suggest the rate of economic growth has cooled off considerably since then. That mitigates the impact of this report.

"The upward revision results from the slightly lower than previously estimated trade deficit," said Mark Vitner, economist with First Union. "We've already seen in July data that trade deficit has worsened in the third quarter."

No impact seen on Fed meeting next week

The report comes as the Federal Reserve prepares to meet Tuesday to consider its next move on interest rates. The Fed has raised rates six times over the last 15 months in a bid to slow the economy and ward off inflation.

While this report is stronger than expected, most analysts expect policy makers at the Fed, the nation's central bank, to leave short-term rates unchanged for their third straight meeting, citing signs of slower economic growth, as well as November's presidential election.

"The chance of a rate hike is almost nonexistent," said Vitner. "They've never moved this close to the election, and I don't think there's any need to. There's really no denying the economy is growing less than it did in the mid-'99 to mid-2000 period."

Thayer said that he believes it's even possible the Fed's next move will be to lower rates, although he doesn't see that happening until next year.

"It's sort of like tapping on brakes on a car," he said. "When you want to slow down, put your foot on the brake, but eventually when things slow down you let up a bit. I don't think they overdid it, but I think they did what they thought they had to do." (302KB WAV) (302KB AIFF)

Vitner and Thayer said the price and inflation measures contained in Thursday's GDP report were encouraging. The Commerce Department said the price index for gross domestic purchases, which measures prices paid by U.S. residents, rose 2.1 percent in the second quarter, down slightly from the earlier estimate and well below the 3.8 percent increase in the first quarter.

Inflation measure revised higher

The Labor Department revised another measure of inflation Thursday when it changed its closely watched Consumer Price Index in all but two months of the year due to a recently discovered software problem.

The software problem, which was revealed Wednesday, affected calculation of the rent components of the index. The overall index number was increased by 0.1 percentage points in each month of the year except for May and July, which were not revised.

The change means that for the first eight months of the year, the CPI rose 3.5 percent on a seasonally adjusted basis instead of the 3.4 percent increase originally reported.

The revision, while small, is significant since the CPI is closely watched by the Federal Reserve when setting interest rates, and is used by the federal government to make cost-of-living adjustments in Social Security payments and other benefits. It also is used to calculate raises in some labor contracts in the private sector.

Investors apparently liked the data, as stocks rose in midday trading while bond rates were little changed.

In a separate Labor Department report Thursday, first-time unemployment claims unexpectedly fell to 287,000 last week from 311,000 the previous week. Analysts surveyed by Briefing.com had forecast that claims would rise to 320,000.

|

|

|

|

|

|

|