|

Stock picks by the pros

|

|

September 28, 2000: 5:44 p.m. ET

Lincoln National, Washington Mutual, Phone.com, Intel win mention

|

NEW YORK (CNNfn) - Market strategists and sector analysts reviewed stocks in the technology, pharmaceutical, financial and banking sectors Thursday, recommending companies such as Johnson & Johnson, Abbott Laboratories and Research in Motion.

While the markets climbed in late trading, recent guests on CNNfn commented on the stocks they are buying and why.

"Lincoln National (LNC: Research, Estimates) used to be incredibly cheap; now it's only cheap. It's done fairly well. You know, this is a great franchise, a tremendous franchise. They have the ability to sell a lot of things, but primarily the thing that interests me more than anything else is their annuity business. The demographics are perfect for annuities. The need for yield is very strong," said stock strategist John Manley of Salomon Smith Barney.

Johnson & Johnson (JNJ: Research, Estimates) is a growth stock. I mean, you know, what's defensive? Utilities have done better and they're changing also. But I look at J&J and I see not only a steady stream of earnings, but one that's accelerated, a really good company and not far from a market multiple. Again, it's done well, we've liked it for some time. But I think you dodge some of the issues short term about the election and health care. You get the growth and you get the demographics. Then you get a very good company," Manley said.

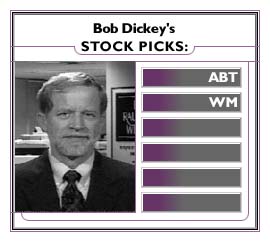

"Abbott Laboratories (ABT: Research, Estimates) had their troubles here about a year ago. And that stock's been on an improving trend here for the past several months. Most of the other pharmaceuticals also have been kind of stalled out here for the past year. We're starting to see some better improvement in the group as a whole, too," said Bob Dickey, technical market analyst for Dain Rauscher Wessels.

"Washington Mutual's (WM: Research, Estimates) earnings continue to come in very strongly. Even though we've had a rise in interest rates, these financial stocks have been able to continue to increase their earnings - a very good sign -- and I think we're going to see these financials in general move higher into year-end and early next year," Dickey said.

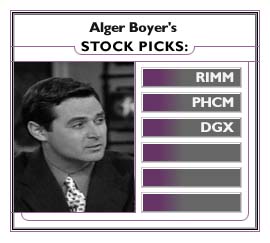

"Research In Motion (RIMM: Research, Estimates) provides two products, but they're basically a mobile messaging product manufacturer. And what they provide is the opportunity for enterprise users, so companies like ourselves at Piper Jaffray have a unique set of users communicate to each other extremely quickly, utilizing traditional e-mail circuits," said Alger Boyer, associate director of equity research at U. S. Bancorp Piper Jaffray.

"And everyone has one. So within the abilities of the system, or the technology of your server system, you can talk to each other almost in real time from almost anywhere in the world," Boyer observed.

"Phone.com (PHCM: Research, Estimates), what they provide is actually the software that goes onto wireless. It's a wireless service software provider, and basically it allows your phones to get Internet access for all intents and purposes," he said.

"This is the type of company that has all of those things. As you may know, they recently have merged with Software.com, and they've announced a new CEO, Don Listwin, formerly of Cisco Systems, a senior exec at Cisco. So it has -- and they're going to be profitable within about six quarters. Revenues should be doubling between 2000 and 2001," Boyer continued.

"We're very interested in Quest Diagnostics (DGX: Research, Estimates)," he asserted. "In fact, what we've decided to do is: the best way we can educate and help to educate our institutional clients is to provide them opportunities to talk with companies that do specifically that. We're doing a diagnostics symposium here tomorrow here in New York and Quest is actually going to be there speaking with them, talking to us about what their prospects are and how their business model should unfold over the next 12 months. We like Quest," said Boyer.

"You said that sales are going to slow, revenues are going to slow down. That's the key thing. The key thing in analyzing new-economy-type stocks is to look for that expanding top line as opposed to the bottom line, which can be manipulated through, let's say, cost reduction or any one of a number of other things. Right now, take the case of Intel (INTC: Research, Estimates) last Thursday. Intel was knocked down because they said that their sales were only going to grow three to five percent, as opposed to the expected 10 percent. Now that's not a big difference, but the Street took it down 22 points and then two points the next day," said Michael Carty, with New Millennium Advisors.

"Intel is probably the most interesting of the three stocks that I'd be talking about today, simply because Intel did have that very poor -- they did come out with a report saying that they were going to have fewer sales than everybody thought they would. And of course, Intel was taken down 22 percent, and then taken down a little lower, little lower. Right now it's down quite a bit off its high for the year. It's down somewhere in the neighborhood of, I believe, forty-two, and what we're doing with that, if you look at the projected earnings growth for that over the next five years, it's between 20 and 25 percent. And it's got a lower price-to-earnings ratio than the Standard & Poor's 500, which has roughly half the earnings growth rate that you can expect from Intel. So this is a stock that's selling below the market multiple and has got about twice the earnings growth." "Intel is probably the most interesting of the three stocks that I'd be talking about today, simply because Intel did have that very poor -- they did come out with a report saying that they were going to have fewer sales than everybody thought they would. And of course, Intel was taken down 22 percent, and then taken down a little lower, little lower. Right now it's down quite a bit off its high for the year. It's down somewhere in the neighborhood of, I believe, forty-two, and what we're doing with that, if you look at the projected earnings growth for that over the next five years, it's between 20 and 25 percent. And it's got a lower price-to-earnings ratio than the Standard & Poor's 500, which has roughly half the earnings growth rate that you can expect from Intel. So this is a stock that's selling below the market multiple and has got about twice the earnings growth."

-- compiled by Staff Writer Lucy Banduci

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|