|

Sun stumbles into next era

|

|

September 28, 2000: 2:05 p.m. ET

Network server supplier rolls out new products, outlines long-term vision

|

SAN FRANCISCO (www.redherring.com) - When Sun Microsystems executives first envisioned the unveiling of a reinvented company this week in New York, they probably hoped it would turn out better than it actually did.

Between the faulty demos and hand-drawn slides, Sun's "Net Effect" presentation didn't exactly bring the house down. But the company did manage to unleash a few new products on the market as well as a confusing, if not convincing, vision of their future direction.

The centerpiece of the day was the announcement of the long-awaited UltraSparc III processor, which Sun (SUNW: Research, Estimates) is calling the "cornerstone" of its next-generation network architecture. Along with the chip, Sun execs paraded on stage touting the next five-year phase of the company, cleverly named "Net Effect."

<-[if gte vml 1]>  Aside from looking a lot like the company's last five-year plan, called "Dot-Com the World," Net Effect seemed to have an increased focus on bandwidth and network speed. Consistent with many of its other previous mantras, such as "the Network is the Computer," Net Effect relies on centralized computing power and thin client devices to increase overall productivity. And according to Sun, this is just the beginning. Aside from looking a lot like the company's last five-year plan, called "Dot-Com the World," Net Effect seemed to have an increased focus on bandwidth and network speed. Consistent with many of its other previous mantras, such as "the Network is the Computer," Net Effect relies on centralized computing power and thin client devices to increase overall productivity. And according to Sun, this is just the beginning.

"We've had this reinvention every five years," said Sun President and Chief Operating Officer Ed Zander. "Today's success of Sun is based on the bets we made in 1995. And right now, we think we are only in year two of a 10- to 15-year network build-out."

Net defects

In total, the day yielded no fewer than eight product announcements from Sun. The new products, especially the Sunblade 1000 technical workstation and the Sun Fire 280R rack-mounted server, were repeatedly compared to Hewlett-Packard's (HWP: Research, Estimates). But Sun pressed on with its vision, sending Chief Technology Officer Greg Papadopolous to the stage to elaborate on Net Effect. Mr. Papadopolous literally drew the audience a picture, in magic marker on a transparency, of how he saw developers shifting their focus away from client-based applications and onto network-based applications. The drawing, later described by Mr. Zander as "a nerdy picture," left many in attendance scratching their heads.

Mr. Papadopolous also officially unveiled the UltraSparc III, a 900-Mhz, 29-million transistor, .15-micron hot-rod processor around which Sun is building its future. The company will continue to invest in the extremely popular UltraSparc II processor for at least the coming year.

Technology will lead the way

As for expanding into other markets, namely consulting, Mr. Zander quashed any and all rumors rather decisively. After HP's announcement earlier this month that it was in talks to buy the consulting arm of PricewaterhouseCoopers, Mr. Zander was asked whether he had plans to take similar actions to beef up Sun's consulting.

"You mean like buy PwC?" responded Mr. Zander. "No. We have been a technology-focused company, putting 11 percent into R&D. We are going to continue to do what we do best. If HP wants to become a services company, that's fine. Maybe someday they will OEM [original equipment manufacture] some of our products."

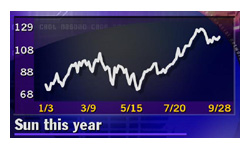

Sun has been extremely successful during the past five years and its vision has proven to be prescient. At a time when most software and hardware companies were focused on the PC, Sun remained steadfast in believing the future was in the network. The company's success has been apparent in its success in emerging markets like the burgeoning service provider industry. And the stock has performed handsomely; it has gained more than 50 percent so far this year and is now hovering at around $120, just off its all-time high of $129. Sun has been extremely successful during the past five years and its vision has proven to be prescient. At a time when most software and hardware companies were focused on the PC, Sun remained steadfast in believing the future was in the network. The company's success has been apparent in its success in emerging markets like the burgeoning service provider industry. And the stock has performed handsomely; it has gained more than 50 percent so far this year and is now hovering at around $120, just off its all-time high of $129.

But after a long run-up in price, Sun now trades at a healthy multiple of 89 times 2001 earnings estimates, so it is by no means a cheap stock. And today's presentation didn't go a long way toward increasing investor confidence.

"We've been scaling back on them for a while now," said an asset manager for a large institution that owns a position in Sun. "From a pure valuation standpoint, it wasn't making a lot of sense right now."

After botching the third consecutive live demo, the frazzled technical assistant jokingly offered his resume to the crowd, since he figured his career at Sun was over. Considering Sun's execution of its presentation, it may want to consider at least hiring a consultancy if not outright buying one. And considering its stock price, investors would do well to wait to see how the company executes its long term vision.

With any luck, the rest of Sun's next five years will go a lot more smoothly than the first five hours.

© 1997-2000 Red Herring Communications. All Rights Reserved

|

|

|

|

|

|

|