|

Apple warns on earnings

|

|

September 28, 2000: 6:34 p.m. ET

Computer maker cites slow education, G4 Cube sales for shortfall

|

NEW YORK (CNNfn) - Apple Computer warned on Thursday that its earnings for the fourth quarter ending Sept. 30 will be substantially below expectations because of slower-than-expected sales in September.

The Cupertino, Calif.-based company said that it expects to report revenue of between $1.85 billion and $1.90 billion, and earnings per diluted share, excluding investment gains, of between 30 cents and 33 cents, when actual results are announced on October 18.

Analysts had expected Apple (AAPL: Research, Estimates) to earn 45 cents per share for the quarter, according to estimate tracker First Call.

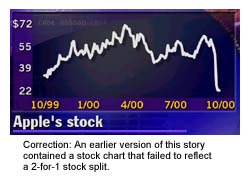

In response, Apple's stock plunged to $29 in after-hours trading, down 46 percent from its Thursday close of $53.50. The decline knocked about $8.9 billion off the company's market value.

Fred Anderson, Apple's chief financial officer, said that the company's education-related sales, which normally peak during September, were lower than expected. In addition, its Power Mac G4 Cube is off to a slower-than-expected start, he said in a statement. Apple indicated that the sales slowdown is more than a one-quarter problem.

"We are currently re-evaluating our plans going forward, and will provide lower growth targets for next quarter and the next fiscal year when we announce our final results on Oct. 18," Anderson said.

"We've clearly hit a speed bump, which will result in our earning, before investment gains, approximately $110 million rather than the expected $165 million for the September quarter," said Steve Jobs, Apple's chief executive. "Though this slowdown is disappointing, we have so many wonderful new products and programs in the pipeline, including Mac OS X early next year, and remain positive about our future."

Third-quarter report contained signs of slowdown

Apple's third-quarter earnings report, which came out last July, gave hints of a slowdown in the company's business. When the company reported its third-quarter results, it said that sales of its iMac machine were below expectations, apparently because consumers are waiting for the company to introduce a new version.

"I don't think we have any evidence that it is an industry-wide slowdown," Anderson said during a conference call with analysts after the third-quarter earnings were released.

Merrill Lynch analyst Steve Fortuna had forecasted that Apple would have 13 percent unit growth and an 8 percent rise in average unit prices in the third quarter. Instead, Apple delivered 12 percent unit growth but only a 3.5 percent increase in average unit prices because of changes in its product line.

Not industry-wide

Apple's problems appear to be limited to the company, rather than being part of an industry-wide slowdown in personal computer sales. After Intel (INTC: Research, Estimates) warned that its third-quarter revenue growth could be as little as half what some analysts had expected, analysts surveyed PC companies to see if they also were experiencing slumping sales. Several of the major PC makers responded that their revenue and earnings were on target for the quarter.

Computer maker Hewlett-Packard (HWP: Research, Estimates) announced one day after Intel's warning that it should meet revenue and earnings goals for its fiscal fourth quarter and that it would conduct a $1 billion share-buyback program. Likewise, Dell Computer's (DELL: Research, Estimates) chief executive said that the company is on track to achieve 30 percent revenue growth for the full year and that Dell hasn't changed its outlook because of Intel's problems in Europe.

In an interview on CNNfn's Moneyline News Hour Thursday, Michael Capellas, chairman and chief executive of Compaq (CPQ: Research, Estimates), the world's leading PC maker, pointed out that his company operates in a much different market than Apple and said Compaq "feels good" about where it is headed, strategically. [160K WAV or 160K AIFF]

Capellas would not comment specifically on the company's third quarter results.

Apple's revenue and earnings have been driven largely by sales of its iMac and PowerBook computers. As of the end of the company's third quarter, Apple had shipped 3.7 million iMacs since its introduction. Apple introduced the G4 Cube on July 19. The Cube, which is less than one-fourth the size of most PCs, won praise for its innovative design and the ease with which accessories could be added. However, it was criticized for being too expensive at $1,800 and for shipping with too little random access memory.

|

|

|

|

|

|

|