|

Doing math on a match

|

|

September 29, 2000: 6:25 a.m. ET

401(k) plans are great, but matches can confuse even the smartest among us

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - If you're like a lot of people, calculating what your company's 401(k) match means to you in real-dollar terms calls up that special dread you used to feel whenever your high school math teacher, smiling like a maniac, announced a pop quiz.

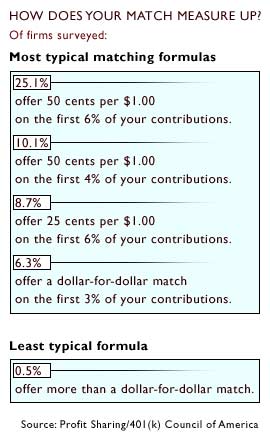

Rather than being told your company will contribute a flat $100 or $200 per pay period into your 401(k) account, you get "formulas" based on the money you put in -- say, a 25 percent match on the first 5 percent of your pre-tax salary that you contribute.

You know that having a match is good, but if you're like some people, calculating the dollars-and-cents aspect can make you feel as if you're staring at one of those psychedelic zebra patterns spinning round and round.

Back to basics

CNNfn.com asked 401(k) plan provider Fidelity, a benefits specialist, and a financial planner for an easy "plug 'n chug" calculator to help you along. But, alas, but they couldn't point to one all-purpose tool, since matching formulas can vary widely from plan to plan.

For instance, some firms may offer "bi-level matches" -- i.e., 100 percent on the first 3 percent you contribute and 50 percent on the next 2 percent.

Nevertheless, there is a simple approach you can apply to figure out how much you will receive on a yearly basis if you contribute the maximum amount your employer offers a match on. For bi-level matches, you can perform the calculations twice and then add the results. Nevertheless, there is a simple approach you can apply to figure out how much you will receive on a yearly basis if you contribute the maximum amount your employer offers a match on. For bi-level matches, you can perform the calculations twice and then add the results.

Take the example shown at the left. Let's say you make $100,000 and you get a 25 percent match on the first 5 percent of your pre-tax salary that you invest in your 401(k).

First calculate 5 percent of $100,000, which is $5,000 (0.05 multiplied by 100,000).

Your company will pay 25 cents for every dollar you contribute up to $5,000. So you need to calculate 25 percent of $5,000, which is $1,250 (0.25 multiplied by $5,000).

That means over the course of the year your company will contribute $1,250 to your 401(k) account if you put in at least $5,000.

Not an endless pot of gold

Of course, if you put in anything above that $5,000, you still will only receive $1,250 in matching funds, since the limit on matches that the employer sets is firm.

But, experts say, don't let that stop you from contributing more, so long as you don't exceed the federal limit for annual employee contributions, which is $10,500 for 2000.

The more you build up, the greater the benefits of compounding and the easier it will be for your nest egg to grow. (Click here for a Fidelity contribution calculator to see how much more you can save if you increase your contribution.)

Take the money and run

Keep in mind, too, that some companies will offer you the same match on any amount you put in up to the ceiling amount, while others will pay a lesser match if you contribute less than the ceiling amount - i.e., while you get 25 cents on the dollar if you put in 5 percent, you may only get 20 cents on the dollar if you contribute 3 percent. And it's possible some companies won't offer any match at all unless you contribute the full ceiling amount.

In any case, retirement savings experts urge you to contribute at least the ceiling amount to guarantee you get the fullest match possible. In any case, retirement savings experts urge you to contribute at least the ceiling amount to guarantee you get the fullest match possible.

"Otherwise, you're leaving money on the table. That's not smart," said certified financial planner Tom Grzymala, whose firm Alexandria Financial Associates serves as investment adviser for 401(k) plans.

Look at it this way, he said: If a company is contributing a 25 percent match, "you're automatically making a 25 percent profit" on the part of your contribution that qualifies for the match.

If you are still having trouble calculating how much your match is worth, check with the benefits specialist at your company and be sure to request a copy of the Summary Plan Description (SPD) to make sure you have all the details you need about your 401(k).

|

|

|

|

|

|

|