|

Coach IPO still on track

|

|

October 2, 2000: 2:23 p.m. ET

Sara Lee remains intent on offering even as Waterford eyes leather goods unit

|

NEW YORK (CNNfn) - Sara Lee Corp. affirmed Monday that it remains intent on pursuing this week's initial public offering slated for Coach Inc., its leather goods subsidiary, despite word that crystal glass maker Waterford Wedgewood was interested in buying the company.

Sara Lee spokeswoman Julie Ketay said the initial public offering remains on track to price Thursday and the company intends to complete the tax-free spin-off of Coach within the next 12 months.

Her comments came in response to statements from Waterford Chairman Tony O'Reilly, who told reporters Monday the Kilbarry, Ireland-based company had a close working relationship with Sara Lee and would look at a possible acquisition.

"They have said they are going to sell Coach at some stage over the next year. Certainly it's a company we must take a look at," O'Reilly said.

"I don't know what he meant," Ketay said when asked about Sara Lee's intent to sell Coach. "We plan to list the company on Thursday and complete the tax-free split-off with the next 12 months."

The Coach IPO is among the most watched new issues expected to hit Wall Street this week. The New York-based company hopes to raise nearly $111 million by selling 7.38 million shares at $14-to-$16 per share in a deal led by Goldman Sachs. The Coach IPO is among the most watched new issues expected to hit Wall Street this week. The New York-based company hopes to raise nearly $111 million by selling 7.38 million shares at $14-to-$16 per share in a deal led by Goldman Sachs.

Though a decidedly "old economy" retailer, analysts are expecting a strong reaction to the offering, given the company's strong balance sheet and the solid first-day results turned in by other retailers so far this year. The company will trade under the ticker "COH."

For its part, Sara Lee hopes to use the IPO as a mechanism to unlock some of the value in its own beleaguered stock price.

Still, the company made similar comments about another former subsidiary, PYA/Monarch, the nation's No. 4 food service company. Like Coach, PYA/Monarch was slated for an IPO this fall, but then Sara Lee announced a deal to sell the company for $1.57 billion.

In an interview with CNNfn.com shortly after the sale, Sara Lee Chairman and Chief Executive C. Steven McMillan said it was "unlikely" the same thing would happen with Coach.

""I think Coach will be a superb IPO," he said. "I'm very pleased with the progress, I'm very pleased with the business right now. So I would be very surprised" if it was sold.

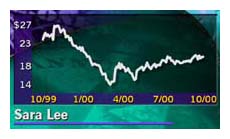

Sara Lee (SLE: Research, Estimates) shares lost 31 cents to $20 per share in mid-afternoon trading.

|

|

|

|

|

|

Sara Lee Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|