|

DLJ gobbles up IBP

|

|

October 2, 2000: 9:50 a.m. ET

U.S. investment bank to buy world's top beef producer for $2.4 billion in cash

|

NEW YORK (CNNfn) - The merchant banking arm of Donaldson, Lufkin & Jenrette struck a deal Monday to purchase IBP Inc., the world's largest producer of fresh beef and pork, for $2.4 billion in cash -- a move that will give IBP management greater control over the company's stock.

The agreement calls for DLJ, the U.S. investment bank which agreed to an $11.5 billion takeover offer from Credit Suisse Group in late August, to pay $22.25 a share in cash for IBP (IBP: Research, Estimates), a nearly 22 percent premium above the company's closing price Friday. DLJ (DLJ: Research, Estimates) will also assume or refinance $1.8 billion in IBP debt.

The transaction would make DLJ's merchant banking arm the largest shareholder of the Dakota Dunes, S.D.-based IBP and will combine the company with Rawhide Holdings Corp., a wholly owned subsidiary of DLJ Merchant Banking Partners III.

Though at first blush a seemingly unusual deal combining a leading U.S. investment bank and a top meat provider, DLJ's merchant banking division will periodically make acquisitions they believe can either reap large revenue gains down the line or a substantial profit by reselling the company.

The Arthur Daniels Midland Co. (ADM: Research, Estimates), which currently owns about a 12 percent stake in IBP, will remain a shareholder and could increase its stake to up to 20 percent. The company's current management team, which owns about 1 percent of IBP's stock now, would also have the ability to raise its stake to 18.5 percent.

While a premium for shareholders, analysts largely called the purchase price low and said the deal was designed to help IBP essentially work through the nuances of its ongoing brand refocus project as a private company.

"The bottom line is that this is a low bid for a company that has enough earnings power to fuel a $30 stock price even with the heavy upfront spending for its case-ready products," said John McMillin, an analyst with Prudential Securities, in a research note published Monday.

"IBP wants to disappear as it becomes a stronger company over the next several years with a much more focused brand," McMillin said. "[But] again, seeing the takeout price lower than IBP's 52-week high is not satisfying."

IBP, the world's biggest producer of fresh beef, has ventured into packaged meat products and prepared foods in recent years to help guard against price swings in the meat market. IBP purchased processed food maker Corporate Brand Foods America late last year as part of that transition. IBP, the world's biggest producer of fresh beef, has ventured into packaged meat products and prepared foods in recent years to help guard against price swings in the meat market. IBP purchased processed food maker Corporate Brand Foods America late last year as part of that transition.

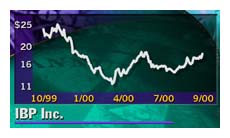

But while the company, which employs 50,000 people worldwide, generated about $14.1 billion in sales last year, its stock has traded well off its historical highs in recent months as Wall Street abandoned the sector.

IBP's stock climbed $3.38 to $21.69 in late afternoon trading Monday. McMillin said while there has been some persistent speculation Smithfield Foods (SFD: Research, Estimates), which bought a roughly 6 percent stake in IBP last year, was interested in buying the company outright, it was unlikely the company could cobble together a competitive bid quickly enough.

"Our belief is [Smithfield Chairman] Joe Luter wants to buy IBP, but whether he can pull something off this quickly would require a lot of work in a short period of time," he said.

In late afternoon trading, DLJ shares fell 6 cents to $89.38.

|

|

|

|

|

|

|