|

Your 'right stuff' planner

|

|

October 2, 2000: 5:53 a.m. ET

Investors can seek an adviser who specializes in their field

By Staff Writer Jennifer Karchmer

|

NEW YORK (CNNfn) - You wouldn't ask your lawyer to diagnose your stomach flu. And you probably wouldn't go to an eye doctor for tax advice. So why would you go to a financial planner who wasn't well suited to your occupation or lifestyle?

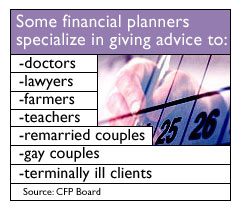

Today advisers specialize in a variety of areas catering to doctors, farmers, gay couples, and clients with terminal illness. So when you're ready to seek professional advice, experts say you should look for a hand-in-glove fit with someone who knows your career and your background.

"I think investors need to know the other type of clients their adviser is dealing with," said Patty Drivanos, a certified financial planner (CFP) who advises people with AIDS and other life threatening illnesses. "I've gone through more boxes of tissues in my office than you'd believe. And even when you have a healthy client, there are other non-financial issues you talk about."

The butcher, the baker, the candlestick maker

When you sit down with your financial planner -- tax returns and retirement paperwork in hand -- you'd like to know you're facing someone who knows where you're coming from.

"There are specific needs for various professions," said Scott McDuffee, spokesman with the Financial Planning Association, membership association for CFPs.

Here's a printable checklist of questions to ask a CFP

CFP Bill Howard, whose clients are mostly doctors, said he approaches physicians professionally but with a level of handholding.

"They're a unique niche to work with," said Howard, in Memphis, Tenn. "They've been told what to do, where they're going to be, working under lots of hours; then after their years of training, they're making substantial incomes. They need the basics," in investing.

Howard's clients typically own an expensive home, have children in private school, are married to a spouse who isn't involved in money issues, and have amassed a large retirement nest egg. So he's used to giving advice to people who arrive at his office with little time but with the attitude, '"get me organized, get me some comfort, give me piece of mind,'" he said.

Lawyers are another breed of investor, notes CFP Tom Haunty, who says his clients tend to be practical, yet still need thorough advice.

"They know what they don't know," Haunty said of his clients who are mostly lawyers. "Lawyers are very overworked, and stressed out." Many of his clients need small business advice because they move from large firms to opening their own practice and need information on retirement plans like the SEP-IRA or Keogh.

Lifestyles of the typical client

In addition to whether you're a computer programmer, a chef, or a high-level CEO, your lifestyle plays a role in financial planning. Maybe you're in a same-sex relationship or you're a divorcee dealing with child support payments?

"There's a ton of issues to deal with. Who's going to pay for what?" said Wendy Hobbs, a CFP in Tucson, Ariz., who advises remarried couples. "There are prenuptials, and some couples are just living together and not married because they don't want to lose benefits."

Estate planning for remarried couples that have children from previous marriages is also an important issue for her clients.

Here are more questions to ask a CFP

"I'm definitely a marriage counselor too." One couple she recently advised came to her office in disagreement about selling property they owned. After one session of discussing the details, the couple settled on an action and left in agreement. "I was a negotiator," Hobbs said. "I wasn't so much a (financial) planner."

So like the local bartender or the mailman, many planners are willing to learn personal details about clients while going over their finances.

Patricia Drivanos, a CFP with Bandfield & Drivanos in New York, had advised high-level executives for years until she decided to take on terminally ill clients because she found the work more rewarding and sensitive.

"Investing is totally different" for my clients, said Drivanos, whose clients are HIV-positive, living with cancer or multiple sclerosis. "You're going more for liquidity and stability and you're going more for growth," since the life expectancy of her clients is shortened due to illness. Also her clients are concerned with health insurance and long-term disability benefits, more so than a typical healthy client.

But her planning goes beyond number crunching. Drivanos has to be prepared for a client suddenly canceling due to sickness or an unexpected doctor's appointment.

"There are times when I've gone to their house or gone to the hospital for a meeting," she said. "The situation in my appointment calendar is flexible."

Seek the right fit

Hopefully, you're not terminally ill searching for a financial planner, but you may be remarried, a small business owner, or in a unique line of work that requires some special financial attention.

So as you're flipping through the yellow pages for a professional, how do you know who's going to gear the advice right for you?

Click here to locate a financial planner in your area!

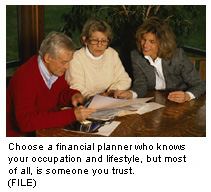

Experts say you should ask advisers to describe their typical client by age, occupation, lifestyle and needs.

It's important to note that planners who hold the CFP license have completed the same training to give financial advice. It's all about comfort and finding a rapport with the right planner. It's possible that you find an adviser whose typical client is just like you, but you and the planner just don't see eye to eye.

"People who develop those specialties find they have a general practice but enjoy working with those types of clients," said Doug Nogami, manager for media relations for the Certified Financial Planner Board of Standards. The CFP Board has no formal requirements for planners to specialize in a certain area.

But whether you're a dentist or a farmer, a good financial planner will suggest clients do the basics, like diversifying their portfolio, said Cherie Brown, a CFP who advises farmers in Rapid City, S.D. "There are things that are going to hold true for any profession," said Brown, who's married to a wheat farmer.

Her clients are mostly concerned with small business retirement plans, cattle and crop insurance, and estate planning when passing a farm down through the generations.

But she notes the most important aspect of financial planning is trust and rapport.

"As a CFP, it's educating your clients to what is out there to make choices on what they're most comfortable with," Brown said.

-- Staff Writer Jennifer Karchmer covers retirement issues for CNNfn.com. Click here to send her comments.

|

|

|

|

|

|

|