|

Micron shreds 4Q forecast

|

|

October 4, 2000: 7:12 p.m. ET

Computer chip maker beats Street by 24 cents on sales that rose 179%

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Computer memory-chip maker Micron Technology on Wednesday reported a fiscal fourth-quarter profit of $1.20 per share, exceeding the analyst consensus estimate by 24 cents.

After the close of trading, Micron said its net income was $727 million, or $1.20 per share, for the period ended August 31. Excluding one-time gains, the company said it earned $1.16 per share.

That compares with a net loss of $17.4 million, or 3 cents per share, during the corresponding period last year. Analysts polled by earnings tracker First Call had expected Micron to earn 96 cents per share during the quarter.

Micron's (MU: Research, Estimates) sales during the quarter came in at $2.3 billion, up 179 percent from $820.9 million a year ago.

The Boise, Idaho-based company is one of the world's leading suppliers of dynamic random access memory, or DRAM, the most common memory chips used in personal computers.

DRAM chips are among the most abundant components sold in the electronics industry. However, DRAM prices are also extremely volatile, sometimes wildly fluctuating within short periods of time. Therefore, it is not uncommon for there to be a wide disparity between Micron's reported earnings and the Street's estimates.

Dan Scovel, a semiconductor analyst at Needham & Co., recently raised his earnings estimate for Micron to $1.09 per share and his revenue forecast to $2.57 billion. Other analysts reached earlier in the day Wednesday said they had expected earnings to come in around 20 cents per share higher than the First Call estimate. Dan Scovel, a semiconductor analyst at Needham & Co., recently raised his earnings estimate for Micron to $1.09 per share and his revenue forecast to $2.57 billion. Other analysts reached earlier in the day Wednesday said they had expected earnings to come in around 20 cents per share higher than the First Call estimate.

For all of fiscal 2000, the company said its net income was $1.5 billion, or $2.56 per share, on sales of $7.3 billion. That compares with a fiscal 1999 net loss of $69 million, or 13 cents per share, on sales of $1.8 billion.

Roughly one third of Micron's revenue is derived from Micron Electronics (MUEI: Research, Estimates), a computer maker in which it owns a 61 percent stake.

Executives at Micron credited higher average selling prices for semiconductors for the strong fourth-quarter performance. They also said they expect a strong fiscal first-quarter as computer makers gear up to meet the typically strong demand during the holiday season.

However, they pointed out that customers who buy memory from Micron under contract had built up a lot of inventory in the most recent quarter, expecting a supply crunch in the typically strong back-to-school season. Much of that supply was not used and was sold into the spot market, driving down prices toward the end of the quarter, according to Mike Sadler, Micron's vice president of sales.

Year-end PC sales looking up

Even so, Sadler said the PC makers Micron sells memory to are signaling a strong end of the year. "Our customers are asking us to be prepared for a typically strong selling season. We would expect that to begin to materialize as early as the middle of October," he said.

The second half of the year usually is the strongest for the PC industry as demand increases during the back-to-school and holiday seasons.

There has been a lot of uncertainty in the marketplace lately about the strength of the PC market, and Micron was the first PC-related company to report its most recent quarterly earnings.

Just before Micron released its earnings, Dell Computer (DELL: Research, Estimates) was the latest computer company to warn of slower sales during the summer months, blaming a falloff in demand in Europe. Late last month, Intel (INTC: Research, Estimates), the world's largest supplier of PC microprocessors, made a similar revelation, also citing weakness in Europe.

Apple Computer also warned last month that weaker sales in September took a big bite out of its bottom line.

"The bad news is that this is the first primary indication that we've seen confirming weakness in the August-September time frame," said Needham's Scovel. "The bad news is that this is the first primary indication that we've seen confirming weakness in the August-September time frame," said Needham's Scovel.

"The good news is that they have indications from their customers that the normal seasonal patterns will pick up in the next week or two," Scovel added. "But that implies that today it is not happening. That's pretty abnormal for this season."

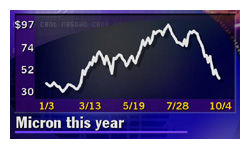

Micron shares rose $3.88 to $46.94 ahead of the earnings report, which came after the market close. They were up about $1 in after-hours trade, as enthusiasm that might normally have been prompted by the upside surprise was overshadowed by Dell's more gloomy forecast.

Over the past 12 months, Micron's stock has ranged between $97.50 and $29.12.

|

|

|

|

|

|

Micron Technology

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|