|

Penney warns about 3Q

|

|

October 5, 2000: 1:32 p.m. ET

Retailer cites soft retail environment, sluggish drug sales, promotions

By Staff Writer John Chartier

|

NEW YORK (CNNfn) - Wracked with internal problems and fierce competition, J.C. Penney Inc. said Thursday its fiscal third-quarter earnings will miss Wall Street's revised forecasts because of increased promotions, sluggish retail sales and disappointing results at its Eckerd drugstore chain.

The Plano, Texas-based company, which has been struggling in the wake of competition from Kohl's (KSS: Research, Estimates) despite massive streamlining, said it expects to report results ranging from a small profit to a loss for the period. Analysts had expected the company to earn 10 cents a share, according to First Call, which tracks profit forecasts by Wall Street analysts. The Plano, Texas-based company, which has been struggling in the wake of competition from Kohl's (KSS: Research, Estimates) despite massive streamlining, said it expects to report results ranging from a small profit to a loss for the period. Analysts had expected the company to earn 10 cents a share, according to First Call, which tracks profit forecasts by Wall Street analysts.

In August, Penney's said it would miss the Street's then third-quarter predictions of 31 cents a share profit for the same reasons.

"The main problem is that Penney's is positioned to be the value retailer, the fashion retailer, but they don't' communicate value effectively, the don't communicate fashion effectively," Steve Kernkraut, a retail analyst at Bear Stearns said, adding that Kohl's in particular has been siphoning sales.

The bad news comes even after the retailer initiated sweeping changes, closing more than 40 underperforming department stores and 300 Eckerd stores.

Nevertheless, troubles continue at Eckerd and huge markdowns have hurt sales and earnings. Promotions tend to draw more sales, but hurt margins, and Penney's has had to lower clearance prices so much that it actually impacted upon profitability.

That was a contributing factor to its September sales, which dropped 4 percent at stores open at least a year, even as most retailers reported gains, reversing recent downward trends driven by the slowing economy and high oil prices.

The company suffered through a weak back-to-school season, as did a host of other retailers in the wake of decreased consumer spending and a fashion malaise that has settled over the apparel industry the last few years. But in contrast, Kohl's said it had its best back-to-school season ever, helping it to post a nearly 10 percent September sales gain.

Total department store sales fell 4.8 percent in September to $1.21 billion. Sales at Eckerd increased 3.8 percent to $1.2 billion.

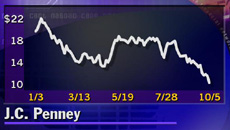

J.C. Penney (JCP: Research, Estimates) shares nose-dived $1.06, nearly 10 percent, to $10.25, setting a new 52-week low. The stock has been in steady decline since last November when it was trading near $40.

The Eckerd Drug store business has helped that decline with its ongoing weak sales and inventory problems, Kernkraut said. The company had been without a leader until last month, when Penney's tapped former Grand Union CEO Wayne Harris for the post. That instability also contributed to the division's woes.

Eckerd, the 4th-largest U.S. drug store chain, has more than $12 billion in annual revenue.

Excluding 300 drug stores the company closed as part of a massive restructuring earlier this year, comparable store sales at Eckerd increased 8.8 percent, led by a 14.3 percent increase in pharmacy sales. However, including those stores, sales decreased 1.2 percent mainly because of more promotions. The company expects to post an operating loss for the chain in the third quarter.

September catalog sales, including online sales, decreased 2.9 percent from the year-earlier period. However, Internet sales alone have jumped to $25 million in September compared with $7 million a year earlier, and $137 million for the year-to-date compared with $26 million a year earlier.

Direct marketing sales were flat.

But Kernkraut sees a silver lining in new CEO Allen Questrom, who took the helm Sept. 15. Questrom, who is credited with engineering a turnaround at Federated Department Stores (FD: Research, Estimates) where he held the top spot, received a warm Wall Street welcome.

"I'm very encouraged that Questrom is there. I think he's a real winner," said Kernkraut, who has a "neutral" rating on the stock. He said it's too early for investors to shelve Penney's in the attic. Rather, he urges shareholders to at least wait until after the holidays to give Questrom a chance to institute some changes.

The company has also brought in some new talent in the form of Vanessa Castagna, a former Wal-Mart executive, to be the new chief operating officer for stores and catalogs. Penney's is looking to Castagna to streamline the stores and better market key brands in the stores and catalog.

But Penney's, the No. 5 U.S. retailer, isn't alone in its struggles. Retailers across the board have seen sales retreat in the face of higher interest rates and oil prices. If the trends continue, Kernkraut said, he is concerned about the effects on the all-important holiday season.

"Higher oil prices are an issue that has yet to come home to roost. I think that consumers are enjoying a pretty strong economy, there's only 4 percent unemployment," Kernkraut said. "I think that you have a lot of good things that are going on but, I'd be nervous on a near-term basis about how consumers change their shopping patterns. Somehow, when $500 or $600 additional comes out of your pocket to pay for gasoline, or home heating oil, or natural gas, you're going to cut back spending in other areas."

-- Click here to send e-mail to John Chartier

|

|

|

|

|

|

J.C. Penney

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|