|

Warner, EMI may yet deal

|

|

October 5, 2000: 6:15 p.m. ET

Music companies may resurrect deal after AOL-Time Warner pact is approved

|

NEW YORK (CNNfn) - Their marriage plans spoiled, EMI and Warner Music may yet wed -- but only after regulators in Europe and the United States bless the merger of America Online and Time Warner, Warner Music's parent.

London-based EMI Group PLC and Time Warner on Thursday said they abandoned their $20 billion music joint venture amid decided protests from European regulators.

The European Commission, the executive arm of the European Union, had consistently raised objections to the pact because it would have reduced the number of global music companies from five to four. It also voiced fears the new entity would come to dominate the online delivery of music.

But analysts suggested the companies may explore another deal, tweaked and retooled to please competition watchdogs, after America Online's (AOL: Research, Estimates) $130 billion purchase of Time Warner (TWX: Research, Estimates), the parent company of CNNfn, passes regulatory muster. But analysts suggested the companies may explore another deal, tweaked and retooled to please competition watchdogs, after America Online's (AOL: Research, Estimates) $130 billion purchase of Time Warner (TWX: Research, Estimates), the parent company of CNNfn, passes regulatory muster.

"Ultimately the deal could get resurrected after the AOL-Time Warner deal is done," Salomon Smith Barney analyst Jill Krutick told CNNfn.com.

In a detailed note to clients, Krutick explained that by pulling the deal now, the companies avoided EU refusing their pact and making the documents involved in the process available to third parties. In addition, the AOL-Time Warner deal might have been tainted in the eyes of the EU.

She believes that once the larger pact is approved, EMI and Warner will return to the bargaining table.

"Our confidence that the proposed merger with AOL will go through is strengthened by the temporary removal of this potential stumbling block," she said. "We think Time Warner and EMI are earnest in their verbal commitments to proceed with this deal after AOL-Time Warner gains EU approval. "

Earlier on Thursday, EMI Group Chairman Eric Nicoli renewed his opinion that the joint venture with Warner Music Group would be beneficial for EMI shareholders, artists, consumers and employees.

Time Warner President Richard Parsons said the companies would continue "to explore ways to structure a combination that will make sense for the two companies and be acceptable to the commission."

Beatles, Motown, Garth make EMI attractive

Despite the challenges, EMI would make a beefy catch for another entertainment company or media concern. The No. 3 music operation in the world, EMI has a current roster of about 1,500 artists and more than 1,000 albums released each year.

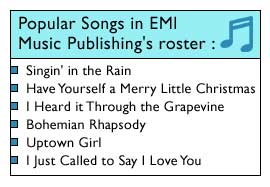

The company's assets include recordings from artists Garth Brooks, Phil Collins, and Lenny Kravitz, and a publishing catalogue boasting Beatles and Motown songs, and classics such as "Over the Rainbow" and "Have Yourself a Merry Little Christmas." The company's assets include recordings from artists Garth Brooks, Phil Collins, and Lenny Kravitz, and a publishing catalogue boasting Beatles and Motown songs, and classics such as "Over the Rainbow" and "Have Yourself a Merry Little Christmas."

EMI has said that no other potential buyers or joint venture partners have stepped up either before or after the Warner deal was born.

Analysts noted that bids from other suitors, such as News Corp., Yahoo or other companies not directly related to music, could appear.

But Time Warner remains the most likely partner, Krutick said.

"Since no other firms formally approached EMI in the period leading up to the original announcement of the Time Warner-EMI deal, we continue to believe this deal may be resurrected," she said.

Moreover, another proposal, particularly one from Japan's Sony Music or Germany's Bertelsmann (BMG), would likely face exhaustive regulatory scrutiny. Sony, BMG, Warner, EMI and Seagram's Universal Music control the vast majority of world's music industry.

"I don't particularly believe there are any other people for EMI to do business with," a fund manager controlling more than two percent of the British company told Reuters. "Bertelsmann would face the same regulatory problems."

He said he would still support the deal even if it required the sale of EMI's Virgin record label and Warner's Chappell Music publishing business to satisfy the European Commission.

|

|

|

|

|

|

|