|

ECB airs surprise rate hike

|

|

October 5, 2000: 9:50 a.m. ET

Central bank ups key rate to 4.75% as high oil prices, weak euro spur inflation

|

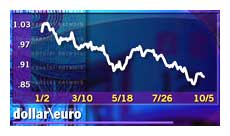

LONDON (CNNfn) - The European Central Bank unexpectedly raised its leading interest rate by one-quarter point Thursday, against a backdrop of gathering inflation pressures aggravated by a weak euro and high oil prices.

The ECB, which sets monetary policy for the 11-nation euro zone, lifted its minimum bid rate to 4.75 percent, its sixth rate rise this year. Higher rates make it more expensive for consumers and companies to borrow money, which tends to curb spending and ease inflationary pressures.

A poll showed that 34 of 48 economists surveyed by Reuters expected the ECB to leave the official rate unchanged. A poll showed that 34 of 48 economists surveyed by Reuters expected the ECB to leave the official rate unchanged.

"I'm surprised by this increase," Juergen Michels at Sal. Oppenheim in Cologne told Reuters. "But I think we have to see this in the context of the weak euro, which might be the major reason for the increase. Everyone expected the ECB to act in the next weeks, but ... we didn't expect it" at Thursday's meeting.

Duisenberg targets inflation

ECB President Wim Duisenberg told reporters the move was aimed at counteracting the effects of a weak euro, which last month fell to a record low against both the U.S. dollar and Japanese yen, and high oil prices. The price of Brent crude oil rose in September to 10-year highs, and although it has retreated slightly since, Duisenberg said the threat to inflation remains.

The euro got a modest lift from the rate hike. The currency rose to 87.71 U.S. cents from 87.45 cents in late New York trading Wednesday. Higher rates tend to strengthen a currency by making assets denominated in that currency more attractive.

The European Central Bank recently orchestrated a joint defense of the embattled euro with its counterparts in the U.S., Japan, Canada and the U.K., and Duisenberg said he was "very satisfied" with the effect of the intervention.

Economists highlighted the quandary ECB officials have faced in recent weeks, with inflation high but consumer and business confidence waning - suggesting economic growth might also slow. A report released shortly before the ECB decision showed weakening sentiment in the 11-nation euro zone.

Eurostat, the European Union's statistics agency, also reported Thursday that labor costs in the 15-country bloc came in at a greater-than-expected 3.5 percent in the second quarter compared to a year earlier. That was down from a revised rate of 3.6 percent in the first quarter.

Euro-zone consumer price inflation came in at an annualized rate of 2.3 percent in August, above the bank's target of 2 percent. Duisenberg said inflation probably rose higher still in September, adding that it will be "some time" before the inflation rate drops below the ECB's target level.

While the European economy is humming, economic conditions remain more favorable in the United States - prompting many investors to seek dollar-denominated assets, spurring a rally for the U.S. currency.

U.S. interest rates are higher than in Europe, but Duisenberg said he hoped the ECB's rate hike Thursday, which narrowed the gap, would draw more funds into euro-denominated assets.

Lorenzo Codogno, an economist with Bank of America in London, said that barring unforeseen swings in either oil prices or the euro, the ECB might have carried out its last rate rise for the year.

"We don't see another rate rise, but we recognize that the risk is still there, due largely to oil prices -- the oil market remains vulnerable for both supply and demand reasons," said Codogno.

Bank of England holds rates

The ECB rate hike came shortly after the Bank of England, as expected, held its leading interest rate unchanged, judging that inflation pressures were cool enough as U.K. economic growth continued to slow, amid a recent weakening in the pound's value against other currencies.

The announcement left the BoE's official lending rate at 6 percent for the eighth straight month. Thirty-two of 34 economists polled by Reuters last week predicted that the MPC would not raise rates. That was despite close outcomes in the voting by the panel's members at the two previous monthly rate meetings.

The MPC raised rates four times between September last year and February 2000 to head off a runaway boom that was pushing up inflation.

|

|

|

|

|

|

|