|

Tech earnings preview

|

|

October 9, 2000: 12:48 p.m. ET

Investors to get first glimpse of tech firms third-quarter performance

By Staff Writers David Kleinbard and Richard Richtmyer

|

NEW YORK (CNNfn) - More than a dozen well-known technology names will report quarterly earnings this week, giving investors more solid evidence of how semiconductor, Internet, and PC companies fared between July and September.

Investors are especially concerned about the earnings growth of personal computer companies and the strength of Internet advertising. The stocks of PC and PC-related companies have declined sharply following earnings and revenue warnings from Intel (INTC: Research, Estimates), Dell Computer, and Apple Computer (AAPL: Research, Estimates). Dell (DELL: Research, Estimates), for example, dropped to $25.19 on Oct. 5 from $47.43 on July 5, a 47 percent plunge over the quarter.

At the same time, online advertising dollars have started to dry up as a slew of small, second-tier dot.coms have gone bankrupt. The surviving dot.coms are conserving their cash, since investors are reluctant to provide them with second or third rounds of funding. An analysis by Lehman Brothers and Booz Allen & Hamilton found that 75 percent of all online advertising revenue went to just nine sites, most notably America Online (AOL: Research, Estimates) and Yahoo! (YHOO: Research, Estimates).

Yahoo! has said that its advertising revenue growth remains strong, despite the financial distress among dot.coms. Analysts and investors are more skeptical, however. The Web portal's stock has dropped to $84.69 on Oct. 5 from $120.81 on July 5, a 30 percent loss, although Yahoo! has fared better than many other Web stocks.

Despite the high-profile earnings warning from technology companies recently, the number of confessions coming out of the tech sector for the third quarter is about the same as it was last year, according to Chuck Hill, director of research at First Call, a firm that tracks companies' earnings performance.

In total, 351 companies have issued third-quarter earnings warnings so far this year, compared with 281 last year. In the technology sector, there have been 62 warnings, compared with 60 a year ago, Hill said.

"The problem is not in tech; it's in other areas," he said. "The problem is not in tech; it's in other areas," he said.

Even with the warnings from big-name tech outfits such as Intel, Dell, Apple and Xerox, Hill said the impact on third-quarter tech earnings overall has been relatively mild, with earnings growth expectations now around 34 percent, compared with the 36 percent expected before the recent warnings. "That's probably not even the normal trimming," he said.

Estimates for the fourth quarter, however, have been brought down more than usual. Since July 1, First Call has trimmed its fourth quarter technology earnings growth forecast to 27 percent from 31 percent, according to Hill.

"The third-quarter numbers are going to look good for technology, in the aggregate," he said. "I think the worries are if technology is going to start running out of gas in the fourth quarter."

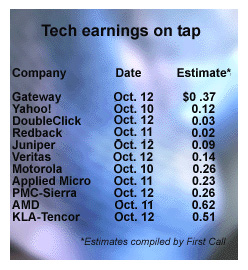

Click here for a list of upcoming earnings reports

Gateway -- Investors will get better insight into how PC companies performed during the quarter when Gateway (GTW: Research, Estimates) reports its third-quarter results on Oct. 12. Robust year-over-year growth in PC sales to consumers, coupled with increased sales of PC-related products and services, enabled Gateway to record a second-quarter profit of $122 million, or 37 cents per diluted share, a 36 percent increase over the second quarter of last year.

In the second quarter, 40 percent of Gateway's net income came from non-PC sales, such as Internet service, financing and training. Gateway aims to get that number up to 45 percent by the end of this year. In addition, only 6 percent of Gateway's revenue comes from Europe, which is where Dell and Intel have encountered a sluggish market.

In mid-September Gateway executives expressed comfort with the consensus estimate of 46 cents per share in earnings and $2.5 billion in revenue for the third quarter.

Yahoo -- Yahoo's third-quarter earnings report on Oct. 10 is going to be the key indicator of the state of the Internet advertising market. In the second quarter, the Web portal reported better-than-expected revenue of $270 million and pro forma net income of $74 million, or 12 cents per share.

Merrill Lynch analyst Henry Blodget said in a research note Monday that he expects Yahoo to report third-quarter revenue of $280.6 million, earnings per share of 12 cents, an operating margin of 37.5 percent, 741 million page views per day, and 165 million monthly unique visitors.

"We continue to think some upside is possible to these estimates, despite weakness in the online advertising market," Blodget said in a research note. "We are not looking for as much upside as in the past, however."

DoubleClick -- Internet advertising firm DoubleClick's (DCLK: Research, Estimates) third-quarter earnings report on Oct. 12 will be another key indicator of the strength of Internet advertising. In the second quarter, the company served 149 billion ads globally using its DART platform, up from 29 billion ads in the same period last year, for an annual increase of more than 400 percent. Analysts expect the company to report third-quarter revenue of about $147 million, and net income of 3 cents per share.

Redback Networks -- designs communications systems for deploying Digital Subscriber Line (DSL), cable, and wireless Internet access. Redback (RBAK: Research, Estimates) is growing rapidly and has a market valuation that reflects that fact. Its market value is $19 billion, even though its revenue in the second quarter was only $48.7 million. Pro forma net loss for the second quarter was $5.7 million, or 5 cents per share. Analysts expect the company to lose 2 cents per share in the third quarter when it reports on Oct. 11, according to First Call.

Juniper Networks -- makes high-speed Internet backbone routers used to direct data along phone company networks. Juniper (JNPR: Research, Estimates) has been successful competing against the much larger Cisco Systems in the high-end router market, with revenue for the first six months of 2000 reaching $176.9 million, compared with $27.6 million for the same six-month period in 1999. Pro forma net income for the first six months of the year was $39.1 million, or 11 cents per share. When Juniper reports its third-quarter results on Oct. 12, analysts expect the company to have net income of 9 cents per share, according to First Call.

Veritas -- is the leading maker of data-storage software used in corporate networks. The Internet has created an exploding need for data storage, helping drive Veritas' (VRTS: Research, Estimates) stock price to $130 recently from around $32 a year ago and giving the company a $52 billion market cap. The company reported second-quarter revenue of $275.4 million, an increase of 77 percent over last year's pro forma second-quarter revenue of $155.7 million. Pro forma net income, which excludes purchase accounting adjustments, increased to $57.2 million, or 13 cents per share, in the second quarter from $29.3 million, or 7 cents, for the same period last year. When Veritas reports its third-quarter results on Oct. 12, analysts expect the company to earn 14 cents per share.

Motorola -- Motorola is the world's second-largest manufacturer of wireless handsets and the No. 6 supplier of semiconductors. Analysts expect Motorola (MOT: Research, Estimates) to turn in a profit of 26 cents per share when it reports its third-quarter results. That would be a 98 percent gain over the 16 cents per share Motorola earned during last year's third quarter. The Street will be paying close attention to sales growth in the company's handset division. That division's sales came in slightly short of some expectations during the second quarter, and concerns about a slowdown in global handset sales have been mounting. Motorola is expected to report its results on Oct. 10.

Applied Micro Circuits -- As a player in the booming market for fiber-optic networking, Applied Micro Circuits (AMCC: Research, Estimates) is expected to post a more than 287 percent annual increase in earnings when it reports on Oct. 11. Analysts are expecting the company to report a profit of 23 cents per share, compared with 8 cents per share a year ago. Applied Micro focuses on developing semiconductors that enable the transport of voice and data over fiber-optic networks. Applied Micro shares have soared over the past year, ending Friday's session at 184, up more than 576 percent from their 12-month low of $27.18.

PMC-Sierra -- Like Applied Micro, analysts expect PMC-Sierra (PMCS: Research, Estimates) to post substantial profit growth, driven by strong sales of the communications chips it sells. When the company turns in its latest results, Wall Street is expecting a profit of 26 cents per share, double the 13 cents per share reported during the same period last year. PMC-Sierra specializes in designing chips used in broadband networking systems built by companies such as Cisco Systems and Lucent Technologies.

Advanced Micro Devices -- AMD is the world's second-largest supplier of microprocessor chips for PCs, behind industry leader Intel. The company has been on a tear recently, stepping up sales of its low-end Duron and high-end Athlon microprocessors. When AMD (AMD: Research, Estimates) reports its latest quarterly results on Oct. 11, analysts are expecting to see a profit of 62 cents per share. That's compared with a loss of 36 cents per share during the same quarter last year. Late last month, Intel warned investors that its latest quarterly results would fall short of previous expectations, blaming weak sales in Europe. Although AMD has not followed suit with a warning of its own, there is no clear consensus on the Street as to whether the company has suffered similar ill effects.

KLA-Tencor -- KLA-Tencor, one of the world's largest suppliers of equipment used in semiconductor manufacturing, is expected to report a more than 168 percent rise in quarterly earnings when it reports its latest results on Oct. 12. Wall Street is expecting KLA-Tencor (KLAC: Research, Estimates) to report earnings per share of 51 cents, up from 19 cents during the same period a year ago. As semiconductors manufacturers have scrambled to meet soaring demand for semiconductors, chip equipment makers over the past year have posted solid revenue and earnings gains.

|

|

|

|

|

|

|