|

Motorola makes 3Q mark

|

|

October 10, 2000: 7:01 p.m. ET

Wireless handset and chip maker meets Street estimates of 26 cents per share

|

NEW YORK (CNNfn) - Motorola, the world's No. 2 maker of wireless phones, on Tuesday reported a third-quarter profit that was in line with Wall Street's expectations.

Excluding special charges, Motorola logged earnings from ongoing operations of $598 million, or 26 cents per share. That compares with a profit of 16 cents per share during last year's third quarter and matches the consensus estimate of analysts polled by earnings tracker First Call.

Sales from ongoing operations rose to $9.5 billion from $8.1 billion a year earlier.

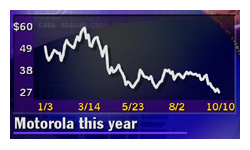

After falling 75 cents to $26.25 in regular trading ahead of the announcement, Motorola (MOT: Research, Estimates) shares fell to $25.88 in after-hours activity.

Click here to see which stocks are moving after hours

Although the earnings met Wall Street's expectations, the company's top line fell short of what some had forecast.

Analysts at U.S. Bancorp Piper Jaffray earlier in the day said they thought Motorola would report $10.1 billion in sales for the quarter. Motorola's top line even missed Credit Suisse First Boston's more conservative forecast of $9.8 billion.

Handset margins improve

But at least one area of Motorola's business that Wall Street had its eye on did perform up to expectations during the most recent quarter.

Motorola said its operating profit margin in its personal communications segment, which includes its production of wireless phones, rose to 6 percent of sales, compared with 4 percent in the second-quarter and 2 percent in the first quarter.

That number had been hotly anticipated by analysts, who had expected a rise of between 5.5 percent and 6.5 percent.

Personal communications segment sales rose 4 percent to $3.2 billion, but orders were $3.3 billion, down 23 percent from the same period last year. Motorola said last year orders were extraordinarily strong because of concerns over tight supplies of wireless telephones and many components used in their manufacturing.

The company said that those supply constraints are no longer a factor in its business and it expects order growth during the fourth quarter of 2000 to return to a more normal relationship with sales growth.

Sales of wireless telephones increased significantly in the Americas, and also were higher in Asia, but decreased significantly in Europe, Motorola said. Last month, Intel (INTC: Research, Estimates), the world's largest supplier of computer chips, said its latest results would be lower because of weak sales in Europe. Dell Computer (DELL: Research, Estimates) made a similar revelation as well. Sales of wireless telephones increased significantly in the Americas, and also were higher in Asia, but decreased significantly in Europe, Motorola said. Last month, Intel (INTC: Research, Estimates), the world's largest supplier of computer chips, said its latest results would be lower because of weak sales in Europe. Dell Computer (DELL: Research, Estimates) made a similar revelation as well.

Executives at Motorola in Schaumburg., Ill., plan to host a teleconference with analysts at 8:00 a.m. ET Wednesday to further discuss the company's latest results. The call will also be available via Webcast through the company's investor relations site.

Outlook of tempered optimism

In a statement, Christopher B. Galvin, Motorola's chairman and chief executive, acknowledged that the company has been feeling pressure from the same forces that have prompted warnings from Intel, Dell and others recently. He said the company plans to cut costs in order to maintain its earnings growth.

"We have been assessing the impact these factors have had on us, as well as on other companies, particularly in the last 30 days," Galvin said. "We have begun to take additional actions to streamline our portfolio and reduce the cost of our operations."

"Despite the recent erosion of equity values in high-tech or 'new economy' companies, we continue to believe that we will create shareholder value by being the leader in bringing wireless, broadband and the Internet to our target markets of the person, the work team, the home, and the car," Galvin added.

Chip, broadband sales also on the rise

In addition to its strong position in the market for wireless handsets, Motorola stands as the world's sixth largest supplier of semiconductors, another area of technology where there have been mounting concerns about growth.

The company said its semiconductor segment sales rose 30 percent during the quarter while orders increased 19 percent to $2.2 billion. Operating profit in Motorola's semiconductor business increased to $190 million from $60 million a year ago, the company said.

Chip orders during the quarter rose significantly in Asia as well as in Europe and the Americas, with demand strongest for chips used in networking and computing applications, Motorola said.

Sales of broadband communications equipment, such as cable modems, rose 47 percent to $917 million, and orders increased 41 percent to $941 million from a year ago, the company said. Operating profit in the segment rose to $154 million from $77 million a year earlier, Motorola said.

Sales within the company's global telecom solutions segment -- formerly known as the network systems segment -- increased 23 percent to $2.0 billion and orders rose 21 percent to $1.8 billion, Motorola said.

|

|

|

|

|

|

|