|

GM posts record 3Q EPS

|

|

October 12, 2000: 1:45 p.m. ET

Largest automaker credits buyback; looks at spinoff or sale of Hughes unit

|

NEW YORK (CNNfn) - General Motors Corp. posted record third-quarter earnings per share Thursday, edging past recently lowered forecasts, and said it may spin off or sell its Hughes Electronics subsidiary.

The world's largest automaker earned $829 million, or $1.55 a diluted share. The per share figure surpassed the $1.54 consensus estimate of analysts surveyed by First Call, although that forecast has been lowered from a consensus of $1.59 in the last week after the release of September auto sales data.

The company earned $1.33 a share in the year-earlier period. The EPS growth in the face of lower net income -- the year-earlier figure was $877 million -- was due primarily to share repurchases.

Revenue slipped to $42.6 billion from $42.8 billion a year earlier as auto sales slowed from a record pace a year ago. The total number of cars and trucks sold slipped to 2.04 million from 2.05 million a year earlier, and market share slipped slightly in both North America and Europe.

The company also said increased incentives in the industry caused net pricing, which reflects the price less the cost of incentives and marketing, to ease 0.3 percent from a year ago, according to John Finnegan, the company's acting chief financial officer.

GM expects net pricing to be off 1.7 percent in the fourth quarter, Finnegan said, and it doesn't appear likely to improve next year. Analysts said the latest information on pricing and the problems with sales in Europe will likely prompt reduced earnings estimates for the fourth quarter and 2001 soon.

"The outlook for the fourth quarter is not so hot," said John Casesa, analyst with Merrill Lynch, told CNNfn. "It is very clear that results in North America will be compressed by all this price cutting."

David Healy, analyst at Burnham Securities, said he believes the problem in Europe will cause most of the downward pressure on earnings forecasts.

"The size of the loss in Europe was a surprise to me, and up to the last week or so it was a surprise to GM as well," he said.

Click here for a roundup of Thursday's earnings news.

GM officials said efforts to control costs will be able to make up for the downward pressure on pricing in the coming quarters.

"These results reinforce the need to step up our efforts to eliminate waste and lower costs," GM CEO Rick Wagoner said. "The industry continues to venture into new territory -- near-record demand mixed with unprecedented price pressures and intensely strong competition on all fronts."

The European auto results were hit by the he launch of the new Opel/Vauxhall Corsa, The European auto results were hit by the he launch of the new Opel/Vauxhall Corsa,

GM's highest-volume model, that was more expensive than expected. Net income in North America rose to $728 million from $671 a year earlier, but GM Europe lost $181 million compared with a $32 million profit in the earlier period.

Profitability also improved in Asia and Latin America, but overall automotive net income fell to $568 million from $613 million a year ago.

Company edging away from Hughes

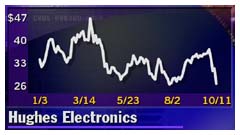

GM's loss from Hughes, which primarily provides the DirecTV satellite television service, rose to $88 million from $30 million a year earlier.

Company officials have said in the past they were looking for alternatives for Hughes that would unlock shareholder value. But Thursday's statement seemed to move it more toward a sale or spinoff of the highly valued unit than previous statements.

"Due to rapid consolidation in the media and telecommunications industries, GM is now considering alternative strategic transactions involving Hughes and other participants in those industries," GM Vice Chairman Harry Pearce said in the earnings statement. "Any such transaction might involve the separation of Hughes from General Motors."

Much of the speculation about a Hughes buyer has centered on News Corp. and its chairman, Rupert Murdoch. The company has long sought a U.S. satellite television operation such as DirecTV to fill out Sky Global's expansive international operations, which currently reach more than 85 million households despite a gaping hole in the United States. Much of the speculation about a Hughes buyer has centered on News Corp. and its chairman, Rupert Murdoch. The company has long sought a U.S. satellite television operation such as DirecTV to fill out Sky Global's expansive international operations, which currently reach more than 85 million households despite a gaping hole in the United States.

News Corp. recently agreed to take a significant stake in Gemstar (GMST: Research, Estimates), the world's leading provider of interactive programming guides, a move seen as a step toward a deal for Hughes.

The announcement was not a shock due to the rumors of interest in Hughes, analysts said. Both Hughes and GM analysts said Thursday they now expect a sale soon.

Casesa said he believes Hughes is worth about $21 a share to GM shareholders, and that the automaker will see some premium when a sale is completed. But despite that potential one-time windfall for GM, Casesa said GM is stock still is unattractive. (430KB WAV) (430KB AIFF). Other analysts echoed that concern.

"I think if they do a deal for Hughes, the stock will go up. The implied value is there somewhere," Dain Rauscher Wessels analysts Jonathan Lawrence said. "But Hughes is a one-time issue. There's fundamental things wrong with the core automotive business."

Tech analysts who follow Hughes said there is a lot of interest in the company beyond News Corp. (NWS: Research, Estimates)

"The real question is around who would make a good partner," said Robert Peck, analyst for Bear Stearns. "The leading partners are Murdoch, Disney, GE, Viacom, even Microsoft. I think all would be very interested in gaining that access to the home."

GM has been under pressure to do something with Hughes, as its tracking stock has a market capitalization of $23.2 billion, or about 74 percent of GM's overall market cap. But when the company allowed shareholders to exchange some of their GM shares for Hughes shares in February, it suggested it wanted to hang on to the company.

"GM has no current plans or intention to separate Hughes or any of its businesses from GM, whether by means of a spinoff, split-off or any other transaction," the company said in the Feb. 1 statement. "However, GM will continue to evaluate what Hughes ownership structure would be optimal for the two companies and GM stockholders."

When financier Carl Icahn announced his intention Aug. 18 to buy a stake in the automaker, GM's statements seemed more open to a separation of Hughes, although it still wasn't as outgoing as Thursday's statement.

"We continue to look at ways to further unleash value from our ownership of Hughes while preserving our strong credit ratings," GM Chairman Jack Smith said at the time of Icahn's statement. Icahn reportedly has sold his stake in the automaker since then.

Smith often has spoken of the value of retaining Hughes as more in-car communications, such as the Internet and satellite broadcasts, are developed, but he gave up his CEO title at the company earlier this year.

Shares of GM (GM: Research, Estimates), a component of the Dow Jones industrial average, started out higher in morning trading, but was down $1.50 cents to $57.13 in midday trading Thursday, while shares of its tracking stock for Hughes (GMH: Research, Estimates) gained 80 cents to $27.40, although that was off its high of the day of $28.45.

|

|

|

|

|

|

|