|

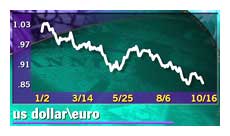

ECB remarks deflate euro

|

|

October 16, 2000: 10:01 a.m. ET

Duisenberg rules out intervention to prop up currency amid Mideast turmoil

|

LONDON (CNNfn) - The euro slipped Monday to within a fraction of its all-time low against the U.S. dollar after the head of the European Central Bank appeared to indicate he would not recommend a further round of international central bank support for the ailing currency.

Wim Duisenberg, president of the ECB, signaled the bank and the Group of Seven industrial nations would not buy the currency in the exchange markets if the Middle East crisis sparked a sharp fall in the single currency.

The euro fell almost a cent to 84.58 U.S. cents in afternoon trading in Europe, marginally above its record low of 84.40 cents, the level at which the ECB last month led the G7 in a concerted effort to prop up the tumbling currency by selling dollars and yen and buying euros.

Duisenberg, in an interview published Monday in The Times of London, said it would be inappropriate for the G7 to step into markets if external events, such as war in the Middle East, led to extreme exchange rate volatility. Duisenberg, in an interview published Monday in The Times of London, said it would be inappropriate for the G7 to step into markets if external events, such as war in the Middle East, led to extreme exchange rate volatility.

Currency dealers were surprised by Duisenberg's comments, which they said could put the euro under further pressure.

"The ECB's fighting for the euro's future and in a fight like that you never rule anything out; you always keep the market guessing," said a dealer at a U.S. bank.

Duisenberg, speaking last week after the lynching of Israeli soldiers by a Palestinian mob sent oil prices to 10-year highs, rejected suggestions that central banks should consider cutting interest rates to counteract the impact that high oil prices might have on economic growth. But he said the oil price might justify raising interest rates to head off concerns about quickening inflation.

"Our fear would be that (the oil prices) would over time work their way into consumer prices, into new wage rounds. And that may make us undertake some action, as we have done a few weeks ago," he told the Times.

Duisenberg said economic growth rates in the euro zone for the next two to three years might be nearer to 3.0 percent or 3.5 percent, rather than in the range 3.5 percent to 4.0 percent.

--from staff and wire reports

|

|

|

|

|

|

European Central Bank

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|