|

Micron Tech downgraded

|

|

October 17, 2000: 12:15 p.m. ET

U.S. memory chip maker is downgraded as DRAM spot prices plunge

|

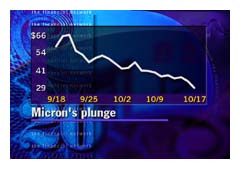

NEW YORK (CNNfn) - The already battered stock of Micron Technology, the leading U.S. maker of computer memory chips, fell another 12 percent Tuesday morning after two analysts downgraded it, citing plunging prices for dynamic random access memory, or DRAM.

Micron (MU: Research, Estimates) shed $4.19 to $29.50 Tuesday after Morgan Stanley Dean Witter analyst John Cross and PaineWebber analyst David Wong downgraded the stock and reduced their earnings estimates. Over the past week, spot prices in Asia for 64 megabits of DRAM have fallen to $4.50, having been at $6 for several weeks. Demand for memory chips from PC makers, which usually increases at this time of year, hasn't picked up enough to result in favorable pricing for DRAM, the analysts said.

"While we had expected that PC builds would pick up significantly in October and DRAM pricing would firm, the DRAM price environment has continued to weaken in October," Cross said in a research report. "PC demand appears to be good, but not great. While we hate to downgrade a stock that is already discounting a lot of bad news, we are hard pressed to find a catalyst."

Cross lowered his rating on Micron to "outperform" from "strong buy," slashed his target price to $50 from $100, and lowered his 2001 earnings estimate to $3.50 from $4.20 Cross lowered his rating on Micron to "outperform" from "strong buy," slashed his target price to $50 from $100, and lowered his 2001 earnings estimate to $3.50 from $4.20

Wong downgraded Micron to "attractive" from "buy," cut his price target to $50 from $110, lowered his fiscal 2000 estimate to $4.11 from $4.92, and cut his fiscal 2001 estimate to $5.35 from $5.45.

Deterioration of DRAM pricing has caused Micron's stock to plunge to $33.68 at Monday's close from $92.56 on Aug. 24, a 64 percent drop within about seven weeks.

"DRAM contract prices came down faster than I expected," Wong said in an interview with CNNfn.com "They were at $8 for 64 megabits for several months, and I expected them to be in the $7 level at this point. Now I'm expecting Micron to take on contracts at the $6 level."

"DRAM pricing is still at a level where Micron is strongly profitable," Wong said. "I'm not negative on the company - I'm just pointing out that the situation is not as rosy as it was." Wong estimates that it costs Micron $2-to-$3 to make 64 megabits of DRAM.

Morgan Stanley Dean Witter's Cross said that one of the main problems for DRAM pricing is the lack of a driver for increased memory content in PCs. The corporate rollout of Microsoft's new Windows 2000 operating system, which has the potential to increase demand for memory chips, has been lackluster this year, Cross said.

"Although the Morgan Stanley Dean Witter CIO survey found that about 50 percent of CIOs expect to migrate to Windows 2000 in the first half of 2001, we currently believe the rollout may not be sufficient to offset seasonal weakness for the DRAM market," Cross wrote in his research note.

|

|

|

|

|

|

|