|

Top strategy to beat bears

|

|

October 18, 2000: 2:27 p.m. ET

The market's down, your nest egg's down, you're down. What to do?

By Staff Writer Jeanne Sahadi

|

NEW YORK (CNNfn) - Admit it. You saw the Dow and Nasdaq plummet Wednesday and you began to wonder, if only for a moment, whether that retirement nest egg of yours was coming undone. If investors have learned anything this year, it's that the opportunity for no-brainer, bullish gains is over.

But the word from investing experts is "Relax." Don't bury your head in the sand, of course. But keep a cool perspective on your long-term portfolio, and remember what you need it to do for you in the coming years.

Whether you're 30, 50 or 70, they say, there's reason to stay invested in the market and there's little justification for rearranging your 401(k) or IRA asset allocation just because Wall Street is in a volatile mood and prone to some downward doozies of a day.

No one denies it's a tough market for making money. Indeed, said certified financial planner (CFP) Donald H. Boegel of Plymouth, Minn., whenever you're invested in the stock market, "There's a substantial risk of losing money in one year."

But having a well-diversified portfolio and a realistic assessment of when and how much to draw from your nest egg is your best protection against an unpredictable market.

"You have to be able to put yourself in a position to be able to ride out those downturns," Boegel said.

Keep an eye on short-term loss

No one enjoys losing money - even on paper or even when it's profits not principal you're giving up - but the key to minimizing the pain is first to put a buffer between you and the losses. Historically, the stock market rebounds over the long-term, experts say, and the longer you can wait it out, the better your chances of gain.

That means no matter how old you are, you don't invest money in the market that you need as cash in the next three years, said CFP Tom Grzymala of Alexandria, Va. And if you're in retirement already, you should ensure that you always have two years' of income invested in highly liquid instruments such as a money market account, Boegel said. "Two in the hand is worth one in the bush."

But it doesn't mean you pull up stakes and head for the nearest savings account with the rest of your money. Say you're 65. You've begun to draw on your nest egg, but much of it will remain invested for as many as 20 years, more if you start believing the life expectancy tables. You, like your 40-year-old neighbor, need some growth in your portfolio. And for that, said Russ Kinnel, Morningstar's director of fund analysis, the stock market "is still a very compelling place to be." But it doesn't mean you pull up stakes and head for the nearest savings account with the rest of your money. Say you're 65. You've begun to draw on your nest egg, but much of it will remain invested for as many as 20 years, more if you start believing the life expectancy tables. You, like your 40-year-old neighbor, need some growth in your portfolio. And for that, said Russ Kinnel, Morningstar's director of fund analysis, the stock market "is still a very compelling place to be."

In fact, the people who can afford most to be conservative are those whose nest egg will yield more than they need in a given year, Boegel said. Planners say historical returns on a stock portfolio average about 8 percent per year. So if your nest egg has grown fat during a market run-up, and you project that you can live comfortably drawing only 6 percent from your holdings per year, that's when you can take some of your long-term money and put it into bonds if that makes you more comfortable, he said.

Funds can't escape Big Blue

And maybe when Wednesday's closing numbers come in and you look at how some of your mutual funds performed, you might be tempted to do just that.

That's because IBM, which shook the market after it missed its revenue target, is a fairly widely held stock among funds. Its price-to-earnings multiple is far less than many other technology stocks, which makes it attractive to both growth and value fund managers alike, Kinnel said. That's because IBM, which shook the market after it missed its revenue target, is a fairly widely held stock among funds. Its price-to-earnings multiple is far less than many other technology stocks, which makes it attractive to both growth and value fund managers alike, Kinnel said.

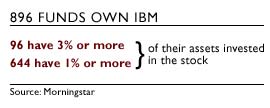

"I don't see any area that's terribly safe," Kinnel said in the morning, noting that 896 funds own Big Blue, and 96 of those have invested 3 percent or more of their assets in the stock. "Everyone's going to have a bad day."

Click here to check your mutual funds' performance.

Technology funds are less likely to have IBM in their portfolios because it doesn't have an aggressive growth bent, but nevertheless the sector was getting clocked in the morning on dampened revenue sentiment spurred by IBM's earnings report.

But there is solace in any sell-off, Kinnel said. Down days on the market are "great news if you're investing 10 or 20 years out."

Buying opportunity

Indeed, the planners CNNfn.com spoke to view drops like the one following IBM's earnings report Wednesday as a potential buying opportunity for those clients with cash to spare.

Looking back at other times of high anxiety in the market, such as 1998, "these are excellent periods to invest and make money," CFP Mari Adam of Boca Raton, Fla., said.

Click here to read about three sure-fire portfolios.

But for those people who don't have spare cash, she recommends they "sit tight. ... Let the market shake out. People are not trading on facts. Facts don't change 500-points' worth."

If you must sell something, Boegel said, he recommended looking first to any bond holdings you might have to tide you over.

The temptation to rearrange how your 401(k) or IRA is invested also may be tough to resist. But try, Adam cautioned. "These are long-term investments and you picked the allocation you picked for a reason. That has not changed," she said.

Reassess your allocation

Rather than making a rash decision to sell some of your holdings or reallocate into a highly conservative strategy, what you might do in the next few weeks is take another look at how your portfolio is allocated and make sure it is in tune with your investment philosophy and your financial needs, Grzymala said.

Of course, you can't entirely ignore market momentum. And for that reason, he suggests you might want to consider adding some more value into your holdings, since many growth stocks are coming down off what many experts believe were unrealistic heights.

That's why he believes that the occasionally steep drop on the Dow or Nasdaq can be healthy. "It validates the reason you're diversified," he said. And, he added, "It's bringing prices down to where they should be."

That may translate into sound investment opportunities long-term. But only if you can put aside near-term anxiety, yours and others, and be on the lookout for good companies and hold onto their stocks.

"Patience and tuning out the noise is what really gets rewarded in the market," Kinnel said.

* Disclaimer

|

|

|

|

|

|

|