|

EMC sneaks by estimates

|

|

October 18, 2000: 2:07 p.m. ET

Storage giant beats third-quarter earnings, revenue estimates by a hair

|

NEW YORK (CNNfn) - Data storage giant EMC Corp. reported third-quarter revenue and earnings that inched past analysts' estimates, as the company's sales were modestly constrained by a high-end component shortage.

Before the market opened Wednesday, Hopkinton, Mass.-based EMC reported that its third-quarter net income rose to $458.18 million, or 20 cents per share, from $295.8 million, or 13 cents, in the same period last year. The mean analyst estimate was 19 cents per share, according to earnings estimate tracker First Call.

The company's revenue rose 33.5 percent to $2.28 billion from $1.71 billion, as the Internet and data warehousing have creating an exploding demand for data storage hardware and software. EMC's third-quarter revenue was slightly ahead of the $2.22 billion that CS First Boston analyst Amit Chopra had forecasted.

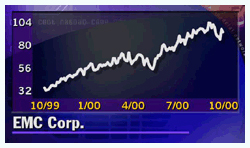

EMC's (EMC: Research, Estimates) stock declined $2.88 to $92.06 in mid-afternoon trading. It is more than triple its 52-week low of $30.

EMC derived 94 percent of its revenue from storage products. Total storage revenue for the third quarter grew 47 percent to $2.14 billion, compared with the third quarter of 1999, marking EMC's highest rate of storage revenue growth in more than five years. This accelerated growth was achieved by strong performance across all major product areas, including 61 percent year-over-year growth in enterprise storage software revenue, a 43 percent increase in enterprise storage systems revenue, and 40 percent growth in midrange storage revenue.

"We undoubtedly gained market share again during the quarter, not only in the overall market for storage but also in each of the market segments we have identified as EMC priorities," said Mike Ruettgers, EMC's chief executive officer, in a statement.

As of last May, EMC held a 23 percent share of the total storage market, ahead of Compaq, IBM and Sun Microsystems. The majority of storage products now are internal to a server or server attached. However, more sophisticated forms of storage -- namely storage area networks (SANs) and network attached storage (NAS) -- are growing rapidly. The IT research firm IDC estimates that server-attached storage will decline to 81 percent of the market in 2001 from 92 percent in 1999.

The networking of storage was a major growth driver for EMC in the quarter. Its storage area networks revenue was $480 million in the third quarter, up nearly fivefold compared with the year-ago quarter. Revenue from network-attached storage nearly tripled from last year's third quarter to $133 million, as EMC continues to be the fastest-growing participant in that storage segment.

"We believe demand for EMC's core products remains as strong as ever, with potential upside residing in the company's ability to penetrate the mid-range and NAS storage markets with its Clariion and Celerra offerings," said CS First Boston's Chopra in a research note.

|

|

|

|

|

|

|