|

Honeywell, United Tech in talks

|

|

October 19, 2000: 4:56 p.m. ET

Companies discussing $40B merger to create industrial equipment titan

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Dow components United Technologies Inc. and Honeywell International Inc. are discussing a possible merger that would create an international manufacturing titan producing everything from jet engines to elevators, the companies confirmed Thursday.

In a two-sentence joint statement released after the closing bell, the companies confirmed they were "in discussions regarding a possible business combination," but said they would not comment further.

A source familiar with the negotiations said Hartford, Conn.-based United Technologies was offering to acquire Honeywell in an all-stock transaction that would swap 0.74 shares of United Technologies stock for each outstanding Honeywell share.

Based on Thursday's closing prices, those terms would value Morristown, N.J.-based Honeywell at $50.32 per share -- a more than 37 percent premium above the company's 4 p.m. closing price of $36.62 Thursday and a nearly 50 percent premium above its closing price Wednesday of $33.69.

Honeywell's stock rose sharply during the last half-hour of trading Thursday on speculation a deal might be in the works, according to one arbitrageur who follows the stock. Honeywell's stock rose sharply during the last half-hour of trading Thursday on speculation a deal might be in the works, according to one arbitrageur who follows the stock.

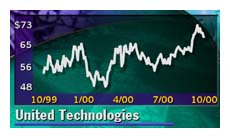

That climb continued after the closing bell, with Honeywell (HON: Research, Estimates) soaring in after-hours trading to $41.75 shortly after 6:30 p.m. EST, up 24 percent from its opening price, according to Instinet. United Technologies (UTX: Research, Estimates), meanwhile, fell to $63.50 per share in after-hours trade, down 6.7 percent from its 4 p.m. close of $68.

The boards of both companies are expected to vote on the deal this weekend, the source said.

The terms being discussed value Honeywell at more than $40.3 billion, well above its current market capitalization $29.3 billion. United Technologies has a current market capitalization of $31.8 billion.

United Technologies Chairman and Chief Executive George David would run the combined company as chief executive, while Honeywell Chairman Michael Bonsignore would retain a similar post in the combined organization, the source said.

A merger between the companies would create a powerful international manufacturing conglomerate producing everything from turbo jet engines to aircraft navigation systems to heating and cooling systems. Both companies have been consolidating operations for several months now and divesting of non-core assets, but would still feature several areas of product overlaps, including the manufacturing of jet engines.

Still, analysts said the merger would make sense for both companies, which could gain significant synergies, particularly in the aircraft parts and operations systems.

"I think it would be a great fit for both sides," said Brian Langenberg, an analyst with CS First Boston. "They would gain synergies in several areas, including engines, flight systems and avionics, and home and building contracts."

"The attraction for United Technologies to buy Honeywell is the aircraft maintenance and replacement parts business, which generates very high operating margins of 19-to-20 percent and predictable earnings streams," said Robert Friedman, an analyst with S&P Equity Group, who noted the combination likely would give the companies a dominant position in the aircraft maintenance overall business. "The attraction for United Technologies to buy Honeywell is the aircraft maintenance and replacement parts business, which generates very high operating margins of 19-to-20 percent and predictable earnings streams," said Robert Friedman, an analyst with S&P Equity Group, who noted the combination likely would give the companies a dominant position in the aircraft maintenance overall business.

Still, analysts note the merger would raise serious integration issues. One glaring example is Honeywell, which has come under heavy criticism for failing to deliver the earnings and revenue growth promised when it merged with AlliedSignal in 1999 a $15 billion deal, creating Honeywell International.

"We're talking about two huge companies," Friedman said. "I've seen time and time again how the expected benefits on paper don't always pan out."

Earlier this week, Honeywell reported third-quarter earnings in line with expectations, but warned its fourth-quarter profit would fall slightly below expectations, its second earnings warning this year.

"They need to do something," Langenberg said. "They certainly haven't been delivering on the top or bottom line numbers."

To help tighten its broad portfolio of products and help reduce expenses, the company has gradually shed several units, including the planned sale of its consumer products group that produces Prestone antifreeze and FRAM air filters, and is in the midst of a restructuring program that will trim 6,000 jobs of the company payroll.

Investors have remained wary, however, reducing the stock's value by nearly half since it hit its 52-week high of $64 per share late last year.

United Technologies has likewise moved to trim its portfolio in recent months, focusing on its aerospace and building service divisions. The company, which produces everything from Pratt & Whitney aircraft engines, Otis elevators and Carrier heating and cooling systems, announced plans to cut 1,700 jobs earlier this year.

|

|

|

|

|

|

|