|

Gillette profit off, CEO out

|

|

October 19, 2000: 4:56 p.m. ET

Company says 3Q profit, revenue slipped; board removes Hawley

|

NEW YORK (CNNfn) - Gillette Co., maker of men's and women's shaving supplies, replaced Chairman and CEO Michael Hawley Thursday, a sudden move that comes as the company reported a drop in third-quarter profits and sales.

Executives for the Boston-based company, which also produces Paper Mate pens, Oral-B toothbrushes and Right Guard deodorant, said Hawley resigned at its request. They cited no particular reason or event that sparked the shuffle, citing only the 12-member board's thirst for another person who could better perform the job.

Hawley, 62, joined Gillette in 1961 and was elected to his current positions in April 1999. He plans to retire from the company. Hawley, 62, joined Gillette in 1961 and was elected to his current positions in April 1999. He plans to retire from the company.

In the interim, the company named President and Chief Operating Officer Edward DeGraan, 57, as acting CEO and Richard Pivirotto, 70, as non-executive chairman of the board, effective immediately.

Gillette will launch a search for a new chairman and CEO.

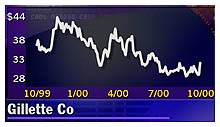

Gillette has posted disappointing results during the past year as it struggled with currency-exchange woes and restructuring moves. On Sept. 18, Gillette warned that lower sales from the weak euro would cause a 6 percent revenue drop in the third quarter. A lower euro hurts multinational companies when they have to translate sales in Europe back into dollars.

"After careful consideration, the board decided that a change in management is in the best interest of the company's shareholders," Warren Buffett, a board member and one of the company's largest shareholders, told analysts on a conference call Thursday.

Berkshire Hathaway, of which Buffett is chairman, currently owns about 96 million Gillette shares, or a little more than 9 percent of those outstanding, according to First Call/Thompson Financial.

On the conference call, analysts questioned whom the company hopes to find to lead Gillette, where results have been lackluster recently despite its strong global brand.

"You need an outstanding manager - you can define that in many ways... but you are looking for the best player out there," said Buffett. "We are looking for the best player in this kind of business in the world."

"There is nothing wrong with Gillette or the distribution and worldwide brand," he added. "It's just a question of getting the job done."

Asked about the abrupt nature of Hawley's removal, Buffett argued that the board, upon deciding that a change was necessary, had no choice but to act.

"There's no way of dragging this thing over a couple of months," he said. "You've got a board [of directors], and when they coalesce on a given view it would be withholding information, frankly. I don't know any other way of doing it."

Shares of Gillette rose after the announcement, climbing $4.69, or about 16 percent, to $33 in late afternoon trade on the New York Stock exchange.

Third-quarter sales, earnings down

Gillette said Thursday its third-quarter income from continuing operations slipped to $350 million from $355 million in the year-ago period. Income on a per-share basis was 33 cents, in line with analysts' average expectations, according to First Call, and up from 32 cents last year.

The per-share figures are based on fewer outstanding shares in the current year, 1.06 million, compared to last year's 1.1 million shares.

Sales from ongoing businesses were $2.32 billion, off slightly from $2.35 billion in the third quarter of 1999.

Blade and razor sales rose 3 percent and profits rose 4 percent from a year ago, driven by improving conditions in developing countries and strong sales gains of its Mach3 shaving system in Europe and North America. Blade and razor sales rose 3 percent and profits rose 4 percent from a year ago, driven by improving conditions in developing countries and strong sales gains of its Mach3 shaving system in Europe and North America.

Profits of Gillette's Braun products grew 4 percent, despite a 1 percent drop in sales. The company cited continued growth of power-assisted oral care products.

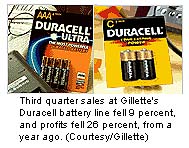

But in Gillette's Duracell battery segment, sales fell 9 percent and profits plunged 26 percent. Aggressive competition in North America, softness in the European battery market and sharply higher marketing expenses bruised the brand's results, the company said.

|

|

|

|

|

|

|