|

Honeywell talks called off

|

|

October 20, 2000: 6:16 p.m. ET

United Tech ends proposed $40B acquisition in face of competing offer

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - United Technologies Corp. broke off negotiations to acquire fellow Dow component Honeywell Inc. Friday afternoon after an unnamed company, rumored to be U.S. conglomerate General Electric Co., submitted a last-minute competing bid for Honeywell.

In a two-sentence statement released shortly before 3:00 p.m. Friday afternoon, United Technologies said it was advised that the Morristown, N.J.-based Honeywell was considering "an alternative proposal" received Friday morning, leading it to break off its own merger discussions with the aerospace and defense company.

In a separate statement, Honeywell confirmed the talks had ended and that it was considering "alternative proposals," indicating it had received more than one other offer. The company said it would not comment further at this time.

The Financial Times reported Friday that the talks broke down after a Friday morning phone call from Jack Welch, GE's retiring chairman, to his counterpart at Honeywell, Michael Bonsignore, offering a competing bid. The bid came just as Honeywell's board was preparing to meet and vote on United Technologies' offer, which initially valued the company at more than $50 per share, sources said.

A GE spokesman declined to comment on the speculation.

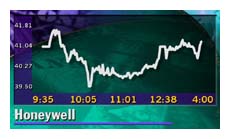

Both Honeywell and United Technologies stocks were halted for trading before the statement was released. Honeywell (HON: Research, Estimates) ultimately closed Friday at $46 per share, up $10.12 for the day -- a sharp rise from the $41.13 level it traded at prior to being halted. The stock climbed an additional $1.50 to $47.50 in after-hours trading.

United Technologies (UTX: Research, Estimates), meanwhile, ended the day down $3 to $65, using a late-afternoon surge to bounce back off its lows for the day. United Technologies (UTX: Research, Estimates), meanwhile, ended the day down $3 to $65, using a late-afternoon surge to bounce back off its lows for the day.

The decision to end talks caught traders and analysts off guard. Sources told CNNfn.com Honeywell and United Technologies were engaged in serious merger discussions as late as Friday morning.

The proposed arrangement called for United Technologies to swap 0.74 of a share for each outstanding Honeywell share, valuing the company at $40 billion based on Thursday's closing price and creating an international industrial conglomerate producing such diverse items as aircraft engines and air conditioners.

Analysts spent most of the day Friday praising the possible combination, noting the companies could gain more than $1 billion in synergies from a merger and add approximately 25 cents per share to United Technologies' bottom line next year.

Following the breakdown in negotiations, analysts said leaks to the media about the negotiations allowed for the competing bid that United Technologies, at least at this point, appears to be unwilling to match.

"It's a little too early to tell what happened," said Joseph Campbell, an analyst with Lehman Brothers. "This had the appearance of a well-planned and well-negotiated deal that was designed to be released on Monday."

A trio of potential partners

Neither United Technologies nor Honeywell indicated what company submitted the competing offer, but market speculation immediately turned to acquisition-minded Tyco International (TYC: Research, Estimates), direct competitor General Electric Co. (GE: Research, Estimates) and German electronics titan Siemens AG.

Exeter, N.H.-based Tyco was rumored to be interested in acquiring Honeywell before the United Technologies talks were revealed, but a source familiar with the company's thinking said Friday it did not make the competing offer.

A Tyco spokeswoman declined to comment Friday shortly after United Technologies made its announcement, but investors immediately bid the company's shares up, leaving Tyco up $2.88 to $50.50 for the day.

Most analysts viewed General Electric as the most likely bidder. Like United Technologies, the diversified U.S. conglomerate would likely be able to gain significant synergies from a combination with Honeywell, analysts said. The two companies compete in several areas, including producing aircraft engines and industrial control equipment.

Such a deal could also be a significant blow to United Technologies, whose Pratt & Whitney unit has been losing ground to GE on aircraft engine orders, analysts said.

GE shares fell $3.38 to $52.25 Friday, posting a majority of its loss shortly after United Technologies made its announcement, as investors speculated GE might have placed a bid higher than the $40 billion United Technologies had offered.

Munich, Germany-based Siemens likewise would be able to generate significant synergies, though the company has shed several businesses since last year to trim costs and refocus its businesses.

Campbell said he also wouldn't rule out a last-minute bid from United Technologies.

"This is a company that was willing to spend $40 billion," he said. "I think United Technologies can come back at the same exchange ratio, but add some other incentives or options as well to sweeten their bid."

|

|

|

|

|

|

|