|

Lucent names new CEO

|

|

October 23, 2000: 7:28 p.m. ET

Telecom equipment maker also warns revenue will fall 7% in fiscal 1Q

|

NEW YORK (CNNfn) - Lucent Technologies Inc., which has disappointed investors several times this year, on Monday ousted its chairman and chief executive officer, Richard McGinn, and named an interim replacement while it searches for new talent to fill the top slot.

At the same time, Lucent (LU: Research, Estimates) issued its fourth earnings warning so far this year, saying it expects pro forma revenue from continuing operations for the fiscal first quarter to decline about 7 percent and pro forma earnings per share from continuing operations to break even. The consensus analyst estimate called for Lucent to earn 23 cents a share, compared with 33 cents a share a year ago, according to First Call.

Murray Hill, N.J.-based Lucent said it expects sequential improvement in results from operations each quarter for the rest of the fiscal year. That guidance does not include the effect of plans for a business restructuring charge, the company said.

Lucent moved up the release of its fiscal fourth-quarter 2000 results, previously scheduled for Tuesday morning, to after the close of the New York Stock Exchange Monday. It reported fourth-quarter earnings per share that were 1 cent ahead of analysts' reduced expectations. Lucent moved up the release of its fiscal fourth-quarter 2000 results, previously scheduled for Tuesday morning, to after the close of the New York Stock Exchange Monday. It reported fourth-quarter earnings per share that were 1 cent ahead of analysts' reduced expectations.

Lucent reported that its fiscal fourth-quarter net income declined to $600 million, or 18 cents per share, from $768 million, or 24 cents, in the same period last year. Its results were in line with an earnings warning the company issued on Oct. 10.

Investors, analysts say new leadership needed

Investors and analysts, who felt that McGinn had failed to understand the company's problems and didn't communicate them clearly to investors, were pleased by the board's decision. The company's stock initially rose $1.32 to $23.94 in response to the announcement, although it was down 56 cents at $22.06 later in the afternoon.

"Investors felt that they had been lied to and not told about the extent of the problems by Rich McGinn," said Ariane Mahler, an analyst at Dresdner Kleinwort Benson. "For someone to go into Lucent at this time would take guts. Hopefully, the new CEO will be someone coming from a 'new economy' company, rather than a Boeing." "Investors felt that they had been lied to and not told about the extent of the problems by Rich McGinn," said Ariane Mahler, an analyst at Dresdner Kleinwort Benson. "For someone to go into Lucent at this time would take guts. Hopefully, the new CEO will be someone coming from a 'new economy' company, rather than a Boeing."

"Having to search for a chairman and CEO could delay the turnaround for some period of time," said Charles DiSanza, an analyst at Gerard Klauer Mattison. "They have a somewhat diminished but still strong market position."

In an interview on CNNfn's Moneyline News Hour Monday, J.P. Morgan analyst Greg Geiling said he thinks Lucent is reeling and needs someone to stabilize it, a process that could take several months just to get underway. [126K WAV or 126K AIFF]

"Things unraveled more quickly in the past year than they thought internally, so they need to get someone from the outside to improve investor perception, preferably someone from the data networking industry," CIBC World Markets analyst Martin Pyykkonen said.

Schacht becomes interim chairman and CEO

Lucent named Henry Schacht, 66, as its interim chairman and CEO until the board completes its search for a replacement for McGinn. Schacht was Lucent's initial CEO from 1995 to 1997, after the company was spun off from AT&T (T: Research, Estimates).

Schacht retired as chairman and CEO of Cummins Engine Co. in 1995, after 31 years with that company, and became chairman and CEO of Lucent. He stepped down as CEO in 1997 and retired from Lucent as chairman in 1998.

In March, Schacht was tapped as chairman of the Lucent spin off, Avaya Inc. (AV: Research, Estimates). He will remain a member of the Avaya board but will step down immediately as top executive.

In a meeting this weekend, the board reviewed Lucent's recent performance and outlook for the current quarter and determined that an immediate change in leadership was necessary.

"The board felt a different set of skills was required at this point in the company's life," Franklin Thomas, Lucent's senior director representing the board, said in a statement.

January warning

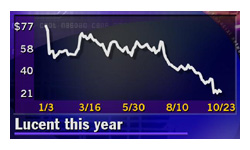

Lucent first stunned investors last January when it said it would miss revenue and earnings targets for its fiscal first quarter, causing its stock to lose $23 billion in market value in one day. Last July, Lucent warned investors for a second time, lowering its revenue and earnings guidance for the fourth quarter of fiscal 2000 and the first quarter of 2001. That warning caused Lucent's stock to drop another 19 percent in one day. Overall, Lucent stock, one of the most widely held in the U.S., has tumbled 72 percent from its 52-week high of $84.18

One of Lucent's problems is that the company hasn't moved fast enough into a form of fiber optic technology called OC-192, a market now dominated by Nortel Networks (NT: Research, Estimates). In addition, sales of the company's older networking products are declining faster than it had expected, and startups to which it extended credit are having financial problems. Making matters even worse, Lucent lost large equipment contracts in Saudi Arabia.

"On the January conference call, McGinn didn't lower guidance for the rest of the year, which shows he hadn't assessed the full extent of the problems," Dresdner Kleinwort Benson's Mahler said. "He thought he just crack the whip and get people back to work. But getting into optical networking is a three-year process, and they only started last year."

CIBC World Markets' Pyykkonen estimates that 55 percent of Lucent's revenue comes from non-growth or low-growth areas. Pyykkonen said that Lucent should spin off its low-growth circuit-switched telephone equipment business, as it already has done with its enterprise voice communications and call center systems unit. That would allow Lucent to focus on high-growth areas, such as optical networking, wireless communications, and data networking, he said.

S&P places Lucent on CreditWatch

In a related development, Standard & Poor's Monday placed Lucent's corporate credit rating on CreditWatch "with negative implications."

"Lucent's operating profitability has been declining for several quarters, as the company missed a major generation of optical transmission equipment, while sales in the core central office equipment product line have been declining more rapidly than anticipated," S&P analyst Bruce Hyman said. "Furthermore, the company has reassessed its reserves for bad debt among its speculative-grade competitive local exchange carrier customers."

While Lucent does have management problems, the company still is in a position to benefit from the convergence of traditional circuit based switching and data packet transmission, analysts said. Demand for Lucent's products is being driven by the expansion of Internet traffic over existing networks --both wireline and wireless -- as well as the construction of new and improved networks. The company has product offerings in telecom switches, optical networking equipment, wireless equipment, communications software, data networking, microelectronics, and optoelectronics.

"It will take many, many years to unwind, but we wouldn't count Lucent out, even with some of these problems," said Christin Armacost, an analyst at SG Cowen.

|

|

|

|

|

|

Lucent

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|