|

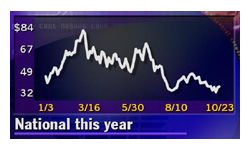

National Semi warns

|

|

October 23, 2000: 5:59 p.m. ET

Chip maker says inventory corrections will weigh on 2Q and 3Q results

|

NEW YORK (CNNfn) - National Semiconductor Corp. on Monday said its fiscal second-quarter and third-quarter sales and earnings may fall short of previous expectations.

The news sent shares of the Santa Clara, Calif.-based chip maker tumbling more than 50 percent in after-hours trading.

Blaming inventory corrections being made by some of its customers in the wireless handset market, National said it expects second-quarter sales to decline between 6 and 8 percent from the first quarter and to resume sequential growth in the third quarter.

This may result in a second-quarter drop of approximately 2.5 percentage points in gross margin from the 53 percent in the first quarter and a corresponding decline in earnings per share on unchanged operating expenses from the company's previous outlook.

Earnings per share, excluding one-time charges, were 76 cents on sales of $641 million in the first quarter of fiscal 2001. The company said it expects sales and earnings in both the second and third quarters of fiscal 2001 to be below that level. Earnings per share, excluding one-time charges, were 76 cents on sales of $641 million in the first quarter of fiscal 2001. The company said it expects sales and earnings in both the second and third quarters of fiscal 2001 to be below that level.

National (NSM: Research, Estimates) shares rose 81 cents to $36.94 ahead of the warning, which it issued after the close of trading. They plummeted $15.50 in after-hours trading, trading 51 percent lower at $24.44.

At last count, the consensus estimate of 17 analysts polled by earnings tracker First Call was for National to earn 77 cents per share during the fiscal second quarter and 79 cents per share during the fiscal third quarter.

In addition to the weakness in demand for its wireless communications chips, National said bookings for its PC-related products have strengthened, but at a lower rate than expected during the season.

National is the latest chip maker to report that the wireless handset market has not been living up to expectations.

In reporting their latest quarterly results, executives at Texas Instruments (TXN: Research, Estimates) cautioned last week that they anticipate lower revenue from wireless chips as handset makers work through existing inventories. On Monday, Anadigics (ANAD: Research, Estimates) also blamed inventory corrections at its largest customer, Sweden's LM Ericsson (ERICY: Research, Estimates), for a sequential decline in wireless revenue.

Executives at National plan to host a teleconference at 8:45 a.m. ET Tuesday during which they are expected to provide more details about the revenue shortfall. The call also will be available by Webcast through the company's Web site.

|

|

|

|

|

|

|