|

Asia mixed, Tokyo slides

|

|

October 25, 2000: 6:02 a.m. ET

Chip, electronics makers hit Nikkei as Hong Kong gets boost from telecoms

|

LONDON (CNNfn) - Tumbling technology stocks in Tokyo ravaged Japan's leading share index Wednesday, while Hong Kong's market benchmark got a lift from renewed investor interest in telecom shares.

In Tokyo, the Nikkei 225 average closed down 307.72 points, or 2 percent, at 14,840.47. Among the shares hit hardest were makers of fiber-optic telecommunications equipment, after Nortel Networks (NT: Research, Estimates) of Canada reported lower-than-expected sales. Jitters about looming earnings reports weighed on top tech firms. In Tokyo, the Nikkei 225 average closed down 307.72 points, or 2 percent, at 14,840.47. Among the shares hit hardest were makers of fiber-optic telecommunications equipment, after Nortel Networks (NT: Research, Estimates) of Canada reported lower-than-expected sales. Jitters about looming earnings reports weighed on top tech firms.

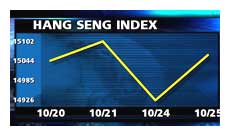

Hong Kong's Hang Seng index ended up 0.9 percent at 15,061.14, with Internet company Pacific Century CyberWorks rebounding 2.6 percent from the previous day's 11 percent tumble, triggered by its announcement of a forthcoming sale of new shares and debt. Gains for telecom stocks also buoyed the index.

The Straits Times index in Singapore edged up 0.3 percent to 1,922.28 as telecom market leader Singapore Telecommunications rallied 2.5 percent. Sydney's S&P/ASX 200 index also rose 0.1 percent, supported by Australian telecommunications company Telstra up 1.9 percent.

The mixed picture in Asia echoed the divergent returns on of Wall Street's major indexes Tuesday. The Dow Jones industrial average rose 121.35 points, or 1.2 percent, to close at 10,393.07, but the Nasdaq composite slid 48.90, or 1.4 percent, to 3,419.79.

In the currency market, the U.S. dollar was stronger against the Japanese yen, fetching ¥108.17, compared with ¥107.79 in late trading in New York Tuesday.

Chip, cable companies in the red

Asian chip-sector companies retreated a day after U.S. microprocessor maker National Semiconductor (NSM: Research, Estimates) plunged 34 percent on Wall Street after warning of slowing sales late Monday.

Japan's Advantest, a maker of semiconductor testing devices, fell 7.4 percent, while semiconductor equipment producer Tokyo Electron shed 4.8 percent.

In Singapore, Chartered Semiconductor Manufacturing dropped 0.7 percent and Venture Manufacturing shed 0.6 percent.

But fiber-optic companies took the biggest hits in Tokyo after Nortel's report. Electric wire and cable maker Fujikura sank 12.2 percent, industry leader Furukawa Electric plummeted 14 percent and Sumitomo Electric Industries dropped 3.9 percent.

Electronic goods maker Sanyo Electric shed 10.1 percent after president Sadao Kondo said Tuesday he was ready to quit after it was found that a company subsidiary had made defective solar power generators.

Fujitsu, Japan's largest computer maker, slipped 1.1 percent ahead of its earnings report for the April-September period, due later in the day.

Battered mobile-phone subscription firm and Internet investor Hikari Tsushin fell 5.8 percent amid continuing concern over its financial health. Softbank, Japan's largest Internet investor, fell 4.6 percent.

Bandai rocketed 15.2 percent after Japan's largest toy maker said it expects its group net profit to rise 700 percent to ¥10 billion ($95 million) for the year ending March 2001.

Telecoms turn upbeat

In Hong Kong, mainland mobile-phone operator China Mobile (Hong Kong) rose 2.5 percent, keeping Internet and telecom company Pacific Century CyberWorks company on the leader board.

Telecom stocks in other markets had gained overnight amid investor relief that Europe's latest auction of third-generation mobile licenses had ended with bidders paying lower-than-expected prices for the right to operate in Italy. Analysts said that should cut costs for operators such as Andala, a consortium backed by Hong Kong telecom-to-real estate conglomerate Hutchison Whampoa. Shares of Hutchison rose 0.3 percent, and SmarTone Telecommunications gained 3.3 percent.

Hang Seng Bank rose 3.3 percent, but real estate developer Cheung Kong (Holdings) slipped 0.9 percent and rival Sun Hung Kai shed 1.8 percent. Hang Seng Bank rose 3.3 percent, but real estate developer Cheung Kong (Holdings) slipped 0.9 percent and rival Sun Hung Kai shed 1.8 percent.

Among Asia's other big markets, the KOSPI index in Seoul closed down 0.5 percent at 542.33, with the debut of heavy machinery maker Hanjung weighing on the South Korean bourse. Hanjung fell 190 won from its sale price to end at 5,010.

Heavyweight chipmaker Samsung Electronics dropped 3.9 percent. Rival Hyundai Electronics Industries gained 1.2 percent on optimism the company would achieve a profitable sale of its overseas subsidiaries.

Tech shares rallied in Taipei despite National Semiconductor's warning, sending the Taiwan Weighted index up 1.8 percent to end at 6,023.78. Chipmaker United Microelectronics rose 4 percent and rival Taiwan Semiconductor Manufacturing gained 1.4 percent, while Acer surged 6 percent.

Makers of dynamic random access memory (DRAM) chips were also higher, with Mosel rising by the 7 percent daily limit and Winbond up 6.5 percent.

In other markets, the KLSE composite in Kuala Lumpur gained 1.2 percent, the PHS composite in Manila rose 0.9 percent, while Bangkok's SET index was 1.9 percent lower in late trading. Jakarta's stock market was closed for a holiday.

--from staff and wire reports

|

|

|

|

|

|

|