|

A big 3Q for Big Oil

|

|

October 24, 2000: 12:56 p.m. ET

Exxon Mobil, Texaco, Chevron and Sunoco all beat Street estimates

|

NEW YORK (CNNfn) - Big Oil posted big earnings Tuesday, as Exxon Mobil Corp. and Texaco Inc. saw profits nearly double in the third quarter and No. 3 U.S. oil company Chevron did even better, posting record results.

All three, as well as Sunoco, handily beat Wall Street profit forecasts for the period. But the strong results did little to help shareholders, as all four oil companies' shares were off slightly in midday trading.

Oil analysts said there are investor concerns that the current profits, lifted by high crude oil prices, are a high point for the companies and that earnings are likely to decrease in the future, despite merger savings.

"The problem is that we are now at a position where the second-, and the third- and the fourth-quarter earnings, which will be quite parallel to each other, represent the peak," Charles Maxwell, energy analyst for Weeden & Co., told CNNfn's Ahead of the Curve program Tuesday just before the earnings reports were released. "We probably will see earnings flatten in early 2001, and then begin to weaken towards the end of 2001." "The problem is that we are now at a position where the second-, and the third- and the fourth-quarter earnings, which will be quite parallel to each other, represent the peak," Charles Maxwell, energy analyst for Weeden & Co., told CNNfn's Ahead of the Curve program Tuesday just before the earnings reports were released. "We probably will see earnings flatten in early 2001, and then begin to weaken towards the end of 2001."

He said that takeover speculation is more likely to drive future stock price gains than will earnings performance. (224KB WAV) (224KB AIFF)

Click here for roundup of Tuesday's other earnings news.

Exxon Mobil, the biggest oil company in the United States, earned $4.3 billion, or $1.22 a share, excluding merger-related charges, up from $2.2 billion, or 62 cents a share, in the year-earlier quarter. Analysts surveyed by First Call forecast a profit of $1.16 a share. Sales jumped to $58.9 billion from $49.0 billion.

Including special items, the quarter's net income came to $4.5 billion, or $1.28 a share, up from $2.2 billion, or 62 cents a share, in the year-earlier quarter. Including special items, the quarter's net income came to $4.5 billion, or $1.28 a share, up from $2.2 billion, or 62 cents a share, in the year-earlier quarter.

For the first nine months, earnings, excluding special items, came to $11.8 billion, or $3.35 a share, up from $5.7 billion, or $1.61 a share, in the year-earlier period. Revenue climbed to $168.9 billion from $130.9 billion a year earlier.

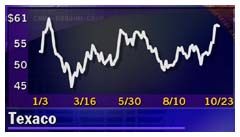

No. 2 U.S. oil company Texaco, which last week agreed to be purchased by Chevron Corp. (CHV: Research, Estimates), said it earned $815 million, or $1.49 a diluted share, before special items, bringing it above Wall Street forecasts of $1.37 a share. A year earlier it earned $453 million, or 83 cents a share. For the recently completed second quarter however, the company had missed estimates despite soaring profits.

Texaco's revenue rose to $13.4 billion from $9.7 billion. Texaco's revenue rose to $13.4 billion from $9.7 billion.

Chevron earned $1.6 billion, or $2.53 a diluted share, from operations in the period, up from $702 million, or $1.07 a share, a year earlier. Analysts had forecast only $1.99 a share for the quarter.

Including special items, net income rose to $1.5 billion, or $2.35 a share, up from $582 million, or 88 cents a share, in the year-earlier quarter. Revenue increased by a third to $13.6 billion from $10.2 billion a year earlier.

Year-to-date earnings, excluding special items, rose to $2.1 billion, or $3.76 a share, from $844 million, or $1.53 a share, a year earlier, as revenue climbed to $36.7 billion from $25.1 billion.

In other oil earnings, Sunoco Inc. (SUN: Research, Estimates) easily topped forecasts for the period.

The company, which exited its oil exploration and production activities to focus on refining and station sales, earned $104 million, or $1.20 a diluted share, in the third quarter, excluding special items. The First Call forecast was for 91 cents a share. Year-ago earnings were $13 million, or 14 cents a diluted share. Sales rose to $3.7 billion from $2.7 billion a year earlier.

Shares of Exxon Mobil (XOM: Research, Estimates), a component of the Dow Jones industrial average, slipped 50 cents to $88.56 Tuesday while Texaco (TX: Research, Estimates) shares fell 38 cents to $58.75. Chevron lost 13 cents to $82.44. Sunoco shares were unchanged at 25 cents $29.06.

|

|

|

|

|

|

|