LONDON (CNNfn) - European markets stumbled to the close Wednesday with technology stocks leading declines after third-quarter sales at heavyweight Canadian telecom equipment maker Nortel Networks fell short of analysts' estimates.

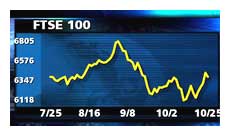

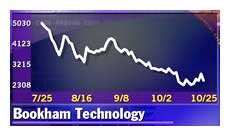

London's benchmark FTSE 100 index dropped 70.6 points, or 1.1 percent, to 6,367.8, with fiber-optic component maker Bookham Technology (BHM) and phone equipment firm Marconi (MNI) the index's two biggest fallers. London's benchmark FTSE 100 index dropped 70.6 points, or 1.1 percent, to 6,367.8, with fiber-optic component maker Bookham Technology (BHM) and phone equipment firm Marconi (MNI) the index's two biggest fallers.

The blue-chip CAC 40 in Paris lost 45.84 points, or 0.7 percent, to 6,277.90 led by data network operator Equant (PEQU) and telecom network maker Alcatel (PCGE).

Frankfurt's Xetra Dax slipped 54.59 points, or 0.8 percent, to 6,748.22, in choppy trade. Chipmaker Infineon Technologies (FIFX) and its parent company, Siemens (FSIE), were among the biggest decliners.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

In other markets, the AEX index in Amsterdam dropped 0.9 percent, Milan's MIB 30 fell 0.1 percent, and the SMI in Zurich dipped 0.5 percent.

The broader FTSE Eurotop 300 index, a basket of Europe's largest companies, slid 0.8 percent, driven lower by a 4 percent drop in its information technology sub-index. Its telecom sector dipped 1.6 percent.

U.S. markets were mixed midday Wednesday. The technology-heavy Nasdaq composite tumbled 2.5 percent to 3,335.47, while the blue-chip Dow Jones industrial average edged up 0.1 percent to 10,402.69.

In the currency market, the euro fell to a record low of 82.64 U.S. cents, with strategists expecting little support for the fledging currency from this week's economic discussions by ministers of the Group of 20 nations.

"People are clutching at straws if they think that the G20 will offer some kind of supportive comment for the euro," Steve Barrow, a currency economist at Bear Stearns, told CNNfn.com. "There are other countries at the G20 that are aggrieved at the weakness of their currency against the dollar -- Australia for one."

In a note to investors, Bear Sterns said the best time for the European Central Bank and the Group of Seven developed nations to intervene to prop up the euro will be this Friday.

"If the follow-through from possibly weak Q3 U.S. GDP growth numbers on Friday saw the euro rally in response, then the ECB could give the move some more impetus by putting some extra welly behind a rallying euro," the report said.

Fiber-optic component maker Bookham Technology (BHM) took a trouncing in London, diving 13.3 percent, while British telecom equipment maker Marconi (MNI) slumped 8.4 percent and French rival Alcatel (PCGE) dropped 8 percent. Fiber-optic component maker Bookham Technology (BHM) took a trouncing in London, diving 13.3 percent, while British telecom equipment maker Marconi (MNI) slumped 8.4 percent and French rival Alcatel (PCGE) dropped 8 percent.

Nokia, the world's biggest mobile-phone maker, fell 1.6 percent and close rival Ericsson lost 3.8 percent. Both companies are big providers of equipment to telecom network operators.

Information technology consultant Cap Gemini (PCAP) tumbled 5.1 percent in Paris and counterpart Logica (LOG) lost 7.2 percent in London.

Some telecom operators slipped. In London, the country's biggest Internet data carrier, Energis (EGS), fell 4.7 percent and the world's biggest mobile phone operator, Vodafone Group (VOD), dropped 2.5 percent, while Equant (PEQU), a Dutch data network operator with shares traded in Paris, fell 3.7 percent.

Chip stocks weaken

Germany's Infineon Technologies (FIFX) shed 4 percent and Siemens (FSIE) lost 1.7 percent, leaving the two at the bottom of the pile in Frankfurt. French chipmaker STMicroelectronics (PSTM) lost 2.9 percent.

U.K.-based drug firm AstraZeneca (AZN) shed 2.5 percent after warning it would not achieve its target of double-digit revenue growth this year. British rival SmithKline Beecham (SB-) dropped 1.2 percent and its intended merger partner, Glaxo Wellcome (GLXO), slipped 0.9 percent.

However, Sanofi Synthelabo (PSAN) rose 2.5 percent in Paris while Germany's Schering (FSCH) gained 1.7 percent, Bayer (FBAY) added 0.9 percent, and BASF (FBAS) climbed 1.7 percent.

Engineering conglomerate Invensys (ISYS) was the FTSE 100's leading gainer, climbing more than 8.6 percent on continued takeover speculation.

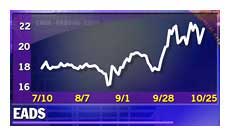

In Paris, aerospace firm EADS (PEAD) rose more than 3 percent. The company said a hefty currency hedging charge sent it into the red in the first half of 2000, but its shares rose on EADS's upbeat statement on underlying profit, fueled by growth at commercial aircraft maker Airbus Industrie. In Paris, aerospace firm EADS (PEAD) rose more than 3 percent. The company said a hefty currency hedging charge sent it into the red in the first half of 2000, but its shares rose on EADS's upbeat statement on underlying profit, fueled by growth at commercial aircraft maker Airbus Industrie.

-- from staff and wire reports

|