NEW YORK (CNNfn) - Wall Street clawed its way out of a deep hole Thursday after money poured into some of technology's hardest hit blue chips: Microsoft, Intel and Cisco Systems.

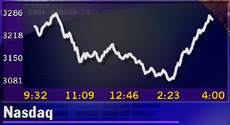

In a late turnaround, the Dow Jones industrial average erased a 61-point deficit to claim its fifth gain in six sessions. And the Nasdaq composite index, which fell within seven points of its lowest close of the year, rose for the first time all week.

"What you're seeing is these old leaders, which don't have much more downside, come back in favor," said Andrew Barrett, technology strategist at Salomon Smith Barney.

One year ago Thursday, Dow Jones & Co. decided to add Microsoft and Intel, two Nasdaq stocks, to the century-old index. Investors bought these and other tech staples, concluding some of the market's hardest hit stocks couldn't fall any further. One year ago Thursday, Dow Jones & Co. decided to add Microsoft and Intel, two Nasdaq stocks, to the century-old index. Investors bought these and other tech staples, concluding some of the market's hardest hit stocks couldn't fall any further.

"Intel and Microsoft, they've been cut in half and they came in really strong," Chris Grisanti, director of research at Spears Benzak Salomon and Farrell, told CNN's Street Sweep. "Enough stocks are down far enough that I think we're seeing some value even in technology."

In another turnaround story, fiber-optic stocks, which crashed on Wednesday and fell Thursday morning, drew buyers late in the day. Nortel Networks, whose sales disappointment ignited the rout, rose. So did supplier JDS Uniphase, which tumbled 25 percent Wednesday.

The Nasdaq composite index rose 42.61 points, or 1.3 percent, to 3,272.18 after coming within seven points of its lowest close of the year, 3,074.68, on Oct. 12. The Dow Jones industrial average rose 53.64 to 10,380.12, while the S&P 500 declined 0.46 to 1,364.44.

Market breadth was nearly even. Advancing issues on the New York Stock Exchange edged out declining ones 1,449 to 1,408. More than 1.2 billion shares traded. Nasdaq losers beat winners 1,984 to 1,909 as 2.2 billion shares changed hands. Market breadth was nearly even. Advancing issues on the New York Stock Exchange edged out declining ones 1,449 to 1,408. More than 1.2 billion shares traded. Nasdaq losers beat winners 1,984 to 1,909 as 2.2 billion shares changed hands.

In other markets, Treasury securities were mixed. The dollar fell against the euro but gained versus the yen.

Techs bounce back

After three days of losses, technology stocks drew buyers.

Microsoft (MSFT: Research, Estimates), off 33 percent in the last six months, gained $3.19 to $64.44, while Intel (INTC: Research, Estimates), down 37 percent over the prior half year, climbed $3.38 to $44.69.

Cisco Systems (CSCO: Research, Estimates), which climbed to a 52-week high of $82 this year, gained $2.94 to $53.56.

IBM (IBM: Research, Estimates), a Dow stock that's down 28 percent during the last six months, gained $5.19 to $92.75.

"Bargain hunters came out and turned things around," Art Hogan, chief market strategist at Jefferies & Co., told CNN's Street Sweep.

Blame for the market's deepest depths Thursday goes to fiber-optic stocks, hard hit after Nortel Networks posted a sales shortfall last Tuesday.

But Nortel, which lost more than 25 percent of its value Wednesday, ended higher, climbing 88 cents to $45.75.

And Nortel supplier JDS Uniphase (JDSU: Research, Estimates) jumped $3.44 to $74.44, another rebound. After the close of trading, JDS Uniphase posted earnings of 18 cents per share, more than double the year-ago figures, and two cents better than forecasts.

This fall's tech drop has already hit Internet stocks, wireless firms and chip makers. But fiber-optic equipment makers, whose products speed the flow of information delivery, had escaped the decline.

Until Wednesday.

"We are finally starting to come to those stocks that haven't given up ground yet," Charles Pradilla, chief market strategist at SG Cowen, said of fiber-optic stocks. "This is the first time that these stocks that are priced for perfection have shown some imperfections."

More news from CNNfn.com for investors:

· Gore vs. the drug makers

· Mind your 401(k) in M&A

· Vinik shuts hedge fund

The market's volatility overshadowed the day's biggest deal. In it, Kellogg agreed to acquire Keebler Foods for $3.6 billion in cash, uniting the maker of Fruit Loops with the seller of Cheez-Its. Kellogg (K: Research, Estimates) rose $1.56 to $24.31 while Keebler (KBL: Research, Estimates) gained $1.06 to $40.44.

Click here for a complete look the day's earnings.

Among the session's losers, financials stocks declined. J.P. Morgan (JPM: Research, Estimates) slid 81 cents to $145.69 and American Express (AXP: Research, Estimates) lost $2.94 to $54.44.

And WorldCom (WCOM: Research, Estimates) lost $3.50 to $21.75 after posting a profit, excluding one-time items, of $1.4 billion, or 47 cents a share, matching expectations.

ECI is friendly

In economic indictors, the Employment Cost Index rose 0.9 percent in the third quarter, the government said, below expectations. The modest gains indicate that low unemployment isn't forcing businesses to dramatically raise labor costs to retain workers.

The figures suggest that inflation, as measured by labor costs, remains contained.

"The data confirm that the labor market is still not generating the sort of cost pressures many analysts expected with 4 percent unemployment," said Ian Shepherdson, chief U.S. economist with High Frequency Economics.

Friday brings government figures on the nation's gross domestic product for the third quarter. Analysts surveyed by Briefing.com forecast that GDP rose 3.5 percent in the last quarter.

A surprise slowdown in growth could cheer hard-hit stock investors eager for signs that interest rates could fall. After rising strongly through the late 90s, the major stock indexes are all lower this year amid some of the highest interest rates in a decade. A surprise slowdown in growth could cheer hard-hit stock investors eager for signs that interest rates could fall. After rising strongly through the late 90s, the major stock indexes are all lower this year amid some of the highest interest rates in a decade.

The Nasdaq is off 19.6 percent in 2000, the Dow is lower by 9.7 percent, and the S&P 500 is down by 7 percent.

Oil prices soared this year, raising costs for business and slowing consumer spending. And Europe's currency, the euro, has fallen steadily since its inception 20 months ago, hurting profitability at multinational companies.

Still, David Briggs, head of equity trading at Federated Investors, told CNNfn's market coverage that one of Nasdaq's efforts to rally is bound to stick. (283K WAV) (283K AIFF)

|