|

U.S. GDP slowed in 3Q

|

|

October 27, 2000: 4:14 p.m. ET

Economic growth below forecasts as government, business spending slow

|

NEW YORK (CNNfn) - The U.S. economy cooled in the third quarter to the slowest pace since the spring of last year, the government reported Friday, as strong consumer spending couldn't overcome cutbacks by businesses and the government.

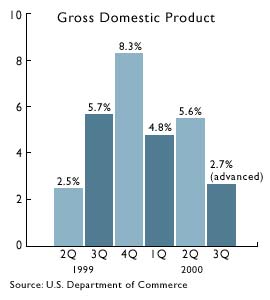

The gross domestic product, a measure for all goods and services produced in the United States that is the broadest indicator of the domestic economy, increased 2.7 percent in the recently-completed quarter, well below Wall Street forecasts and less than half the growth rate posted in the second quarter.

Despite concerns about a slowing economy and pressure on corporate profitability and sales, the report and the inflation gauges included in it were hailed by economists as another sign that the Federal Reserve won't raise rates when it meets in less than three weeks.

"Clearly the Federal Reserve is getting what it wanted with six interest rate increases," Hugh Johnson, chief investment officer at First Albany Corp., told Reuters Friday.

Analysts surveyed by Briefing.com had forecast that gross domestic product (GDP) grew at a 3.5 percent rate in the quarter, down from 5.6 percent in the second quarter.

The move prompted investment bank Goldman Sachs to cut its forecast for 2001 U.S. economic growth to 3.3 percent from 4 percent. The bank cited concerns about sustained consumer spending and business investment.

It said investment fundamentals had deteriorated in recent months with corporate borrowing costs rising and concern over profit growth sending stock markets tumbling.

A decrease in investment by businesses and a downturn in government spending were among the key factors in the slower growth, the Commerce Department said in its report. Higher imports also helped reduce the growth rate.

Those factors were partly offset by a 4.5 percent increase in personal spending by consumers, whose purchases fuel about two-thirds of the economy.

Separately, the government said orders for cars, computers and other long-lasting durable goods rose 1.8 percent last month to $221.0 billion, twice the consensus forecast of a 0.9 percent increase, but below the revised 3.5 percent gain in August.

Goldman Sachs said the rebound in consumer spending was unlikely to last long because of the unusually wide gap between consumer spending and disposable income.

The Commerce Department report said, excluding transportation orders -- which swing widely from month to month -- durable goods orders rose 0.8 percent in September versus a revised 2.5 percent August increase.

The report said electronic and other electrical equipment had the largest increase, $4.8 billion, or 11.8 percent, to $45.3 billion, due to electronic components and communications equipment. Overall orders of non-defense items increased 2.6 percent to $67.3 billion, while defense orders fell 5.6 percent to $6.9 billion.

Inflationary pressures in check

The chain deflator, a closely watched measure of inflationary pressures in the broader report on the economy, rose 2.0 percent in the third quarter, the department said. That was also below forecasts for a 2.3 percent rise and the second-quarter's 2.4 percent increase.

Still, there were some signs of increasing inflationary pressures. The price index for gross domestic purchases, which measures prices paid by U.S. residents, rose 2.4 percent in the quarter, compared with an increase of 2.1 percent the second quarter.

Stocks rose in trading on Wall Street, though the gains were modest and mostly concentrated in tech issues.

Economists agreed the report had the news that both the Fed and the markets wanted to hear. Economists agreed the report had the news that both the Fed and the markets wanted to hear.

"The good news from market perspective is that if the economy is slower, all else equal, that takes pressure off the Federal Reserve," Neal Soss, chief economist with Credit Suisse First Boston, told Cannon's Before Hours program.

Soss said that while consumer spending was strong in the report, it wasn't quite as strong as he expected. (485KB WAV) (485KB AIFF)

David Orr, chief economist with First Union, said consumer spending was in line with his estimates. He was more concerned with continued increases in business inventories in the latest report.

"The fact that inventory building remained very, very high, however, even a touch higher than in the second quarter, is not good news," he said. "It means that the inventory correction has further to run and will suppress manufacturing for another few quarters."

The Fed raised rates six times since mid-1999 in a bid to slow the economy and ward off inflation. But the central bank has held rates steady at its last three meetings. Its next meeting is set for Nov. 15.

|

|

|

|

|

|

|