|

Reed inks Harcourt buy

|

|

October 27, 2000: 3:00 p.m. ET

Anglo-Dutch firm nabs U.S. publisher for $4.5B, will sell part to Thomson

|

LONDON (CNNfn) - Reed Elsevier moved to significantly expand its scientific and medical publishing business Friday, inking a much-anticipated agreement to buy U.S. textbook publisher Harcourt General Inc. for $4.5 billion in cash.

The agreement, which also calls for the Anglo-Dutch publisher to assume approximately $1.2 billion in Harcourt debt, includes an arrangement for Reed Elsevier to sell certain Harcourt educational publishing businesses to Canadian publisher Thomson Corp. for $2.06 billion.

Acquiring Harcourt, on the selling block since June, gives Reed Elsevier a beefed-up presence in the scientific and medical publishing fields while adding a proven industry name with a strong, predictable cash flow.

It also accelerates a massive restructuring program launched late last year under the stewardship of Reed Elsevier's new chief executive, Crispin Davis, when the company announced its intention to concentrate more on business-to-business publishing, scientific and legal information. It also accelerates a massive restructuring program launched late last year under the stewardship of Reed Elsevier's new chief executive, Crispin Davis, when the company announced its intention to concentrate more on business-to-business publishing, scientific and legal information.

"The market likes this acquisition," Richard Harwood, an analyst at Gilbert Elliot & Co. told CNNfn.com. " The markets have been looking for some direction from Reed and this provides it. Davis has been downbeat about growth in the business in its present state before 2002.

"Harcourt cements their position in the science, media and technical arena," said Harwood.

Terms of the deal call for Reed Elsevier, which is owned in equal shares by London-based Reed International PLC (REED) and Amsterdam-based Elsevier NV, to pay $59 cash per share for the Chestnut Hill, Mass.-based company, more than 13 percent above Harcourt's closing price of $52.10 Thursday.

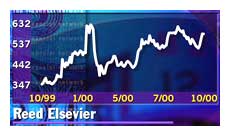

Shares of Reed jumped 8 percent to 626 pence in trading on the London Stock Exchange Friday, while Elsevier climbed 5.5 percent to  14.95 in Amsterdam. Harcourt shares climbed $4.76 to $56.86 in mid-afternoon trading. 14.95 in Amsterdam. Harcourt shares climbed $4.76 to $56.86 in mid-afternoon trading.

Analysts said the purchase price was a bit lower than the Street and even some Harcourt executives were originally expecting, but allowed Reed Elsevier to add to its profits immediately.

Sale of assets agreed

The Anglo-Dutch company agreed to sell Harcourt's college textbook division and other assets, including a large part of the corporate and professional publications unit, to Canadian publishing rival Thomson for $2.06 billion. Combined, those publications boast projected 2000 revenues of $750 million.

Reed Elsevier will keep Harcourt's scientific, medical and technical division as well as the schoolbook business.

Addressing the acquisition of Harcourt's educational publishing unit - which isn't in one of the areas that Reed has previously said will be its main focus - Harwood said: "While not a departure from its main business, it's certainly a new development."

Harwood said the move placed Reed in direct competition with Pearson PLC, which owns publishers including Scott Foresman and Addison Wesley Longman, making it one of Harcourt's biggest competitors for the title of world's No. 1 in education books. That could even encourage investors to place a higher value on Reed shares, moving them closer to Pearson's more-highly rated stock. He rates Reed shares a "hold," saying they could rise above 700 pence.

In June, Harcourt (H: Research, Estimates) retained investment bank Goldman Sachs & Co. to seek a buyer for the company, saying its market value did not reflect the quality of its business, earnings and future prospects.

Reed plans to pay for the deal, which it expects to complete in the first quarter of 2001, with a $6.5 billion bank loan. The company said it aimed to refinance the loan by selling bonds, and may also sell new stock equal to as much as 10 percent of its share capital. Reed plans to pay for the deal, which it expects to complete in the first quarter of 2001, with a $6.5 billion bank loan. The company said it aimed to refinance the loan by selling bonds, and may also sell new stock equal to as much as 10 percent of its share capital.

Reed's Davis said in a conference call there would be some job losses at Harcourt as a result of the closure of its head office. That would account for $25 million of the expected cost savings of $70 million over two years, he said.

Davis added that the company plans to plough some $40 million back into Harcourt to develop its electronic products.

The European company, which owns the Lexis-Nexis data search service and Cahners Business Information, is spending between £150 million and £200 million a year ($215 million to $287 million) to put its publications on the Web.

Reed and Thomson beat out competition for Harcourt from a consortium comprising financial buyers Thomas H. Lee Co., Bain Capital Corp. and Blackstone Group. Dutch publisher Wolters Kluwer and U.S.-based McGraw-Hill were also reported to have posted proposals.

Thomson, meanwhile, said it expects to achieve annual synergies of $75 million within the three years of the transaction's closing date, expected to be during the first quarter of next year.

The Toronto-based publisher said the deal would dilute its earnings per share by up to 12 cents during the first full year, becoming less diluted after that. There is expected to be no impact to its cash earnings per share during the first year, but it will be accretive in following years, the company said.

-- from staff and wire reports

|

|

|

|

|

|

|