|

B&N.com meets estimates

|

|

October 30, 2000: 6:10 p.m. ET

Online bookseller posts 25-cents-per share loss; sees 'record' holiday

|

NEW YORK (CNNfn) - Online bookseller Barnes & Noble.com reported a third-quarter operating loss that was in line with analysts' expectations on sales that rose 58 percent from the same period a year earlier.

Excluding one-time items, the company said it lost $36.9 million, or 25 cents per share, during the period ended Sept. 30. That compares with a loss of 15 cents per share during the same period last year and matches the expectations of analysts polled by earnings tracker First Call.

At $74.1 million, revenue came in slightly above expectations and 58 percent higher than the $47 million in revenue the company logged during last year's third quarter. Analysts had expected the company's total sales to be about $70 million during the most recent quarter. At $74.1 million, revenue came in slightly above expectations and 58 percent higher than the $47 million in revenue the company logged during last year's third quarter. Analysts had expected the company's total sales to be about $70 million during the most recent quarter.

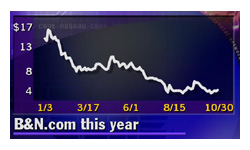

Shares of Barnesandnoble.com (BNBN: Research, Estimates) finished the regular trading session 6 cents higher at $4.25 ahead of the earnings announcement, which was made after the markets closed. They were unchanged in after-hours trade.

Click here to see which stocks are moving after hours

Executives at Barnes & Noble.com in New York said the company is continuing to gain momentum, due in large part to initiatives aimed at using its retail presence to spur online sales.

However, they did not provide any specific financial guidance for the fourth quarter, saying they would wait until the completion of the acquisition of Fatbrain.com and then provide a consolidated quarterly forecast.

During the quarter, the company said it added more than 760,000 new names to its database of online customer accounts. That's up 14 percent from the second quarter.

Repeat customer orders reached 71 percent at the end of the third quarter, up from 63 percent a year ago, which executives said reflects increased customer loyalty.

"We are pleased with our third-quarter results, and we are confident that our significant sales growth and continued market share gains in the online book market are further evidence that Barnes & Noble.com is the destination of choice for more and more book buyers on the Web," Steve Riggio, the company's vice chairman, said in a teleconference Monday afternoon.

The company's gross margin in the third quarter also improved, which Chief Financial Officer Marie Toulantis attributed to the increased direct buying of inventory as well as the opening of the company's new distribution center in Memphis.

Total third-quarter operating expenses, excluding depreciation and losses in equity method investees, were 64 percent of sales, down from 72 percent in the second quarter of 2000 and 72 percent in the third quarter of 1999, the company said.

During the second quarter, the company missed its earnings targets by a wide margin, which the company attributed in part to higher-than-anticipated expenses.

Moving ahead, Riggio said Barnes & Noble.com is in "a great position for the fourth quarter" and anticipates a record holiday season. He added that the company expects to gain traction from recently-launched initiatives aimed at using its brick-and-mortar presence to help boost online sales and add more customers.

Last week, the company said it will install "Internet service counters," powered by Barnes & Noble.com in all 551 Barnes & Noble superstores. The new counters will enable customers to order any book or other product through Barnes & Noble.com at any Barnes & Noble store.

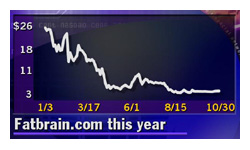

In September, Barnes & Noble.com agreed to acquire Fatbrain.com, an online bookseller that specializes in professional and technology titles for corporations and businesses, for roughly $64 million in stock and cash. In September, Barnes & Noble.com agreed to acquire Fatbrain.com, an online bookseller that specializes in professional and technology titles for corporations and businesses, for roughly $64 million in stock and cash.

Once that deal is completed, which is expected to be by the end of November, the company will provide its fourth-quarter and 2001 revenue and earnings estimates that include revenue from Fatbrain.com.

"Once we close the acquisition, we will come back and provide consolidated guidance," Toulantis said.

In the second quarter, Fatbrain.com (FATB: Research, Estimates) reported total revenue of $15.3 million and a loss of $8 million, or 71 cents per share. Shares of Fatbrain.com finished Monday's session 3 cents lower at $4, but gained all of that back in after-hours trade.

|

|

|

|

|

|

|