|

U.S. new home sales jump

|

|

October 31, 2000: 10:25 a.m. ET

September rate up 9.2%; Consumer confidence slumps in October

|

NEW YORK (CNNfn) - Consumers looking to lock in falling mortgage rates snapped up new homes at the fastest pace in six months in September, though stock market volatility and rising oil prices deterred their exuberant outlook in October, economic reports released Tuesday showed.

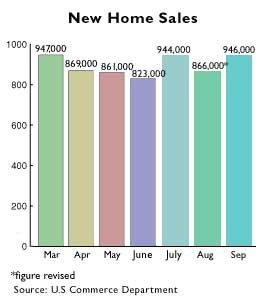

The Commerce Department said the number of new single-family homes sold jumped 9.2 percent to a 946,000-unit annual rate in September -- the highest pace since March -- topping August's revised 866,000-unit advance and well above the 900,000-unit pace expected by economists polled by Briefing.com. The Commerce Department said the number of new single-family homes sold jumped 9.2 percent to a 946,000-unit annual rate in September -- the highest pace since March -- topping August's revised 866,000-unit advance and well above the 900,000-unit pace expected by economists polled by Briefing.com.

At the same time, the Conference Board said its gauge of consumer confidence plunged to 135.2 this month from 142.5 in September, suggesting higher interest rates, higher oil prices and stock market volatility are damping Americans' confidence about the future. The latest reading was below the 140.0 economists had expected and the lowest since October 1999. Consumer spending fuels more than two-thirds of the U.S. economy.

The numbers offered yet another blurry snapshot of the U.S. economy that in some cases appears to be responding to the Federal Reserve's inflation-fighting rate increases but in others is downright ignoring them. And yet again, economists were divided on what the numbers suggest about the pace of growth and inflation for the world's biggest economy going forward.

"The housing market is clearly on a roll again, despite the -- probably temporary -- dip in confidence," said Ian Shepherdson, chief U.S. economist with High Frequency Economics.

Mixed reviews

"These figures reinforce the slowdown view," countered Sherry Cooper, chief economist with brokerage BMO Nesbitt Burns. "The weakness in confidence increases the odds that a sustained soft landing is moving into place."

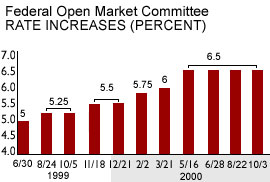

To discourage consumers from spending, the Fed has raised short-term rates six times since June 1999 to boost the cost of borrowing. The Fed's Open Market Committee has held its fed funds rate steady at 6.5 percent since May, when it jacked up the trend-setting rate by a half point. To discourage consumers from spending, the Fed has raised short-term rates six times since June 1999 to boost the cost of borrowing. The Fed's Open Market Committee has held its fed funds rate steady at 6.5 percent since May, when it jacked up the trend-setting rate by a half point.

But offsetting higher rates has been the rising value of investments, along with rising wages and benefits. While stock market volatility, particularly among high-tech companies, has caused concern among consumers, it hasn't yet damped their enthusiasm about their future economic prospects.

What has made them skittish is the prospect of a cooling job market in the wake of anecdotal evidence of dot.com layoffs and the prospect of slower economic growth going forward. The U.S. economy expanded at a 2.7 percent pace in the third quarter, less than half the 5.7 percent gain recorded in the second and the 4.8 percent pace registered in the first.

Even so, economists say other factors could work to bring the U.S. economy in for a "soft landing" -- one where growth slows to a more sustainable pace and inflation doesn't flare out of control.

Soft landing?

Indeed, yet another report Tuesday from the Chicago branch of the National Association of Purchasing Management showed that manufacturing activity in the Midwest part of the country is slowing down.

NAPM-Chicago reported production dropped "dramatically" in the sharpest fall since May 1980 and to the lowest level in 21 months, sinking to 49.6 in September from 62.4 in August. Order backlogs, inventories and employment remained "in decline, but at a slower rate." NAPM-Chicago reported production dropped "dramatically" in the sharpest fall since May 1980 and to the lowest level in 21 months, sinking to 49.6 in September from 62.4 in August. Order backlogs, inventories and employment remained "in decline, but at a slower rate."

Together, the numbers suggested that the U.S. economy is slowing but that consumers still are hot for new homes, particularly with mortgage rates down from higher levels seen earlier this year. A declining inventory of homes available to purchase also contributed to the higher sales.

"The figures leave little doubt that declines in mortgage interest rates have provided support for housing," said Mike Moran, chief economist with Daiwa Securities America Inc.

Last week, the average rate on a 30-year mortgage fell to 7.68 percent, the lowest since November of last year, according to Freddie Mac, the No. 2 buyer of U.S. mortgages. The rate was at a five-year high of 8.64 percent during the third week of May. In September, rates averaged 7.90 percent compared with 8.01 percent a month earlier.

|

|

|

|

|

|

|