|

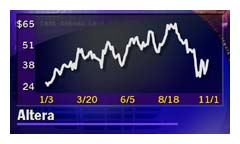

Altera slides on outlook

|

|

November 1, 2000: 11:41 a.m. ET

Company says fourth-quarter growth will be at low end of guidance

|

NEW YORK (CNNfn) - Shares of semiconductor maker Altera Corp. slid Wednesday after the company warned its fourth-quarter sales growth will be at the low end of its previous guidance to analysts.

Altera's (ALTR: Research, Estimates) statements about its October sales and future expectations also dragged down shares of Xilinx (XLNX: Research, Estimates), its main competitor. In mid-morning trading, Altera was down $6.62 at $34.31, a 16 percent loss; Xilinx was down $4.44 at $68, a 6 percent drop.

In a statement printed on its Web site, Altera said "resales in the month of October were 15 percent ahead of the first month of the prior quarter, although slightly below management expectations."

"At this time, management believes the quarter's sequential revenue growth will be at the lower end of its previous 12 percent to 15 percent guidance," the company said.

Altera makes programmable logic devices (PLDs), which are semiconductor integrated circuits that can be programmed by end users at their factories. Altera was the first supplier of Complementary Metal Oxide Semiconductor (CMOS) programmable logic devices.

CS First Boston analyst Tim Mahon said in a research note he believes Xilinx is gaining market share from Altera.

"Currently Altera is trading at a 35 percent discount to Xilinx off of 2001 (estimated) price-earnings multiples," Mahon said. While we believe that Xilinx should trade at a premium to Altera, in our opinion this gap is still excessive."

Xilinx is scheduled to release its monthly business update after the market close Wednesday.

Altera and Xilinx shares plunged Oct. 10 after Lehman Brothers analyst Daniel Niles downgraded them to "neutral," saying in a research note that revenue growth rates for the next two quarters are likely to slow "as both end customers and contract manufacturers rebalance inventory and order rates as components become more available." "The near record margin levels will make further earnings per share upside dependent on higher revenue growth," Niles wrote on Oct. 10. "Greater than 75 percent year-over-year revenue growth for both Altera and Xilinx in the September quarter is hard to reconcile or maintain when their major end markets are growing closer to 30-40 percent."

|

|

|

|

|

|

|