|

Health funds enjoy boom

|

|

November 1, 2000: 11:22 a.m. ET

They've been the stars of 2000, but can their rapid ascent continue?

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - The unprecedented ascent of biotechnology stocks has helped crown health-care mutual funds as the reigning leaders of the fund market this year. But can biotech, with its manic history of ups and downs on Wall Street, keep it up?

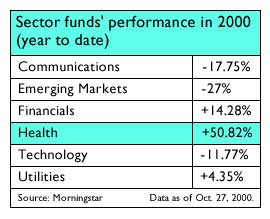

Heath-care mutual funds have registered an eye-popping 50.8 percent average gain so far this year, compared with an only 14.3 percent increase for financial services funds, a 4.3 percent increase for utility funds and an 11.8 percent drop for technology funds, according to data as of Oct. 27 from fund tracking firm Morningstar Inc. The overall S&P 500 average fell 6.34 percent during the same period.

Biotechs have fueled much of the gains for health care funds, powered by excitement over scientific advances such as the decoding of the human genome and a growing number of biotech drugs that have gone from clinical experiment to money-making product. Despite a major spring sell-off, stocks in many biotech companies are still trading many times above their year-ago prices.

"Biotech has been absolutely spectacular this year," said Emily Hall, a Morningstar analyst. "A lot of the investors that are looking for high-growth stories really started to move into biotech in late '99 and early 2000. Despite the shakeout in April, there's still a lot of interest in the sector."

Just a couple of years after shunning biotech for pharmaceutical holdings and other more conservative investments, more and more health fund managers are making biotech a larger element of their portfolios. Even the names of some of the newer overall health sector funds tip their hat to biotech, calling themselves "life sciences" funds instead of plain-vanilla health funds, Hall notes.

In mammoth health-care funds, such as the $16.3 billion-asset Vanguard Health Care Fund, "nowadays you are seeing a biotech holding or two in the Top 10, which you certainly did not in '98," Hall said. "It used to be (drug companies such as) Pfizer and Schering, and maybe SmithKline – everybody bought big pharma." The Vanguard fund is up about 46.5 percent this year.

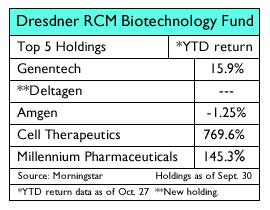

Pure-play biotech funds are up roughly 60 percent on average so far this year. The Dresdner RCM Biotechnology Fund, one of the sector's best performers, has soared 94.3 percent. The fund is made up of a smorgasbord of biotech holdings, including industry bellwethers such as Amgen Inc. (AMGN: Research, Estimates) and Genentech Inc. (DNA: Research, Estimates) as well as hot genomics stock Millennium Pharmaceuticals Inc. (MLNM: Research, Estimates) and small-cap drug discovery firm Cell Therapeutics Inc. (CTIC: Research, Estimates), which is working on new cancer treatments. The company has seen its stock surge more than 750 percent this year.

Dresdner RCM fund co-manager Camilo Martinez said the fund's focus on emerging companies has helped fuel its growth. Dresdner RCM fund co-manager Camilo Martinez said the fund's focus on emerging companies has helped fuel its growth.

"Our portfolio is comprised of core large and mid-cap companies that allow us the liquidity when we need it," he said. Also, "we invest in many small-cap companies that we feel have a lot of potential. The core part of the portfolio would probably function like many other biotech funds, however it's our investment in the small-cap sector that I think gives us an extra edge."

Health funds also are benefiting from the woes of other sectors. As investors sell their technology stocks, sparked by worries about valuation levels and slower growth prospects, they have sought out other promising sectors such as biotech and safe havens such as pharmaceuticals.

Fears about the economy also have encouraged investors to seek out health investments, because health stocks are generally considered fairly immune to inflation and other economic factors that may hurt retailers or manufacturers, for example.

Too late to get in?

This is all great for investors who bought into a health fund before the big boom. But for people who missed out, is it too late to get in?

Investors need to be pretty choosy – study a fund's holdings and try to assess whether there is still room for growth, notes Scott Kahan, a certified financial planner and president of Financial Asset Management Corp. in New York. He also discourages investors from making a sector fund – regardless of which – any more than 5 percent of a total portfolio.

And for a health fund, it should probably be even less than that, he says.

"People tend to chase returns, and if the majority of the run-up is behind us, then suddenly they are buying at the top of the market," he said. "There's probably some more room to run up, but that becomes a difficult thing and the timing becomes very important." "People tend to chase returns, and if the majority of the run-up is behind us, then suddenly they are buying at the top of the market," he said. "There's probably some more room to run up, but that becomes a difficult thing and the timing becomes very important."

It's important to remember that funds with a large percentage of its assets in biotech can be extremely volatile, he said. Also, many investors with diversified fund portfolios already may be benefiting from the health-care stock boom without realizing it, Kahan adds.

"People may be surprised to see that they already own funds that contain biotech holdings," he said, "People should look very carefully at what they already own."

Many observers question whether biotech can continue to post such impressive gains. Two previous biotech booms in the early '90s never lasted very long, and many biotech companies have seen their valuations soar amid excitement over products in development – a far cry from products actually approved by regulators and on the market.

Martinez, of the Dresdner RCM Biotechnology Fund, said he thinks the sector's growth will continue, but he cautions that gains are only likely to be seen in specific companies – not all of them.

"I think that as long as these companies do well in terms of the fundamentals -- in terms of earnings and products in clinical trials – it will be an attractive sector for most investors," he said.

|

|

|

|

|

|

|