|

Intel execs still bullish

|

|

November 1, 2000: 7:39 p.m. ET

Despite shift in seasonal patterns, company sees continued growth in 2001

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Executives at Intel Corp., the world's largest supplier of semiconductors, said Wednesday that the company is on track to post 4-to-8 percent revenue growth in the fourth quarter and they are targeting growth in the "high-teens" for 2001.

Addressing analysts and the news media in an Internet-based briefing Wednesday evening, Intel chief financial officer Andy Bryant reiterated the financial guidance he provided during the company's third-quarter earnings conference call.

Bryant also said that although the company has been seeing different quarterly patterns than it has historically, Intel has actually been posting some of its strongest-ever revenue growth this year.

During the first half of the year, Bryant said demand for semiconductors exceeded the available supply. Meanwhile, during the second half supply exceeded demand. That's the reverse of the seasonal patterns the company has typically seen, he said.

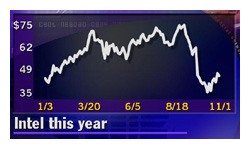

That unexpected shift in the supply-demand dynamic was largely to blame for the company's overestimating its third-quarter results, which weighed heavily on its stock and sent the broader tech sector into a tailspin in September when it warned it would miss its revenue targets.

As it turned out, Intel exceeded the reduced forecasts. But the 4-8 percent revenue growth forecast the company provided for the fourth quarter is still well below its typical growth rate for that period. As it turned out, Intel exceeded the reduced forecasts. But the 4-8 percent revenue growth forecast the company provided for the fourth quarter is still well below its typical growth rate for that period.

Even so, with two months to go before the end of the year, Bryant said he is "very comfortable" with the way things have shaped up. "In spite of all you may have read or felt about what's happening, it's actually been our strongest revenue growth for quite a while," he said.

He noted that demand for personal computers overall was a little slower than expected during the third quarter but PC sales remain "brisk," even though some manufacturers have not hit their desired volumes. He said demand is the best it's been in the last five years, with the exception of 1999.

Intel (INTC: Research, Estimates) is the world's largest supplier of PC microprocessors, although it has been facing an increasing competitive threat from Advanced Micro Devices (AMD: Research, Estimates).

Barrett still a bull

Craig Barrett, Intel's president and chief executive officer, said he expects Intel's newer businesses, which include chips designed for networking and communications equipment, will grow much faster than its core microprocessor business.

In 2001, Barrett said he expects Intel's networking and communications business, which represents roughly 20 percent of the company's total revenue, will grow roughly 50 percent. Meanwhile, he set a 10 percent growth target for the microprocessors business.

"If you combine those two, we're targeting overall growth somewhere in the high teens," he said. "That is my goal for the company as we move forward. It's not cast in concrete, but that's what we're driving for."

Separately, Paul Otellini, general manager of Intel's architecture group, said the company now plans to speed up the transition to its next-generation of PC processors, called the Pentium 4.

The company now expects unit sales of Pentium 4 chips to overtake Pentium 3 sales in early 2002. Prior expectations had been for that transition to take place in late 2002.

"We are heads-down focused on ramping the Pentium 4," Otellini said.

Intel is expected to introduce the Pentium 4 some time this month. At first, it will be targeted at high-end desktop systems. Otellini said Intel is aiming to have Intel-based systems available in all the "mainstream segments," before the end of 2001.

Executives also acknowledged that the company has in recent months made a series of embarrassing technical missteps. Among them, Intel recalled its highest speed Pentium processors and canceled plans for its low-end Timna processor. The company also has had some trouble delivering chips in sufficient quantities to some customers.

Barrett pledged that Intel was taking steps to make sure it does not repeat those kinds of mistakes in 2001.

"Operational excellence is one of our main priorities for next year," he said. "We're effectively going back to basics and reviewing all of our operational procedures."

Intel shares fell 12 cents to $44.88 in Nasdaq trade ahead of the briefing. They rose $1.38 to $46.25 in after-hours trade.

|

|

|

|

|

|

|