|

Asian banks, techs rally

|

|

November 3, 2000: 5:47 a.m. ET

Banking, telecom, chip shares lift markets; Tokyo closed for holiday

|

LONDON (CNNfn) - Banking, telecom and chip shares, in conjunction with a solid overnight boost from the Nasdaq market in the United States, propelled most Asian markets higher Friday.

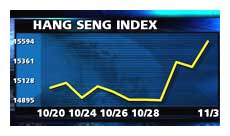

In Hong Kong, the Hang Seng Index ended 2 percent higher at 15,594.12. Tokyo markets were closed for the Culture Day national holiday. In Hong Kong, the Hang Seng Index ended 2 percent higher at 15,594.12. Tokyo markets were closed for the Culture Day national holiday.

Singapore's Straits Times index closed up 1 percent at 2,061.50.

In currency dealings, the U.S. dollar was little changed against the Japanese yen, buying ¥107.91 from ¥108.18.

In the U.S. Thursday, the Nasdaq composite index surged nearly 3 percent to 3,429.02 while the blue-chip Dow Jones industrial average eased 18.96 points to 10,880.51.

Hong Kong banking, telecom shares rise

Hong Kong banking heavyweight HSBC surged 3.1 percent to end at a record high close of HK$116.50.

"HSBC is a safe haven, people are confident on it as a global play and it has very strong management," said Dale Tsang, head of equities trading at e2-capital Securities.

Investors were optimistic that indications of a slowdown in U.S. economic growth may pave the way for a cut in U.S. interest rates early next year. Hong Kong interest rates traditionally track U.S. rates to maintain the currency's peg to the U.S. dollar.

U.S. unemployment data, due out later on Friday, are expected to give investors further clues on the direction of interest rates.

Among other shares in the interest-sensitive banking sector, Bank of East Asia rose 3.9 percent Dao Heng Bank climbed 3.3 percent, but HSBC affiliate Hang Seng Bank fell 0.5 percent.

Blue-chip heavyweight China Mobile, mainland China's biggest cellular phone company, was up 3.3 percent as some fund managers started accumulating the stock ahead of its re-weighting in the Hang Seng index on Dec. 1.

The company's $4.1 billion share placement, not including a $1 billion over-allotment option, hit the market on Friday and traders said the stock was drawing bargain hunting.

The telecom's American depository receipts (ADRs) rose 4.8 percent in the U.S. Thursday.

SmarTone Communications rose 2.2 percent.

Internet and telecom play Pacific Century CyberWorks was also higher. It rose 3.5 percent as some investors seized the last chance to buy the stock ahead of its US$1.8 billion rights issue, which closes on Friday.

Tech stocks in general were firm after an upbeat revenue forecast from chip market leader Intel Corp (INTC: Research, Estimates) boosted sentiment.

Mainland computer firm Legend Holdings rose 3.1 percent. Stone Electronics Technology, a mainland company that makes integrated word processors, surged 24.8 percent.

In Singapore, chipmaker Chartered Semiconductor Manufacturing rose 8.4 percent after the U.S. listed-shares of the local heavyweight jumped 11 percent. In Singapore, chipmaker Chartered Semiconductor Manufacturing rose 8.4 percent after the U.S. listed-shares of the local heavyweight jumped 11 percent.

Overseas Union Bank surged 12.4 percent on talk of restructuring. A spokeswoman for the bank said she was unaware of any new restructuring.

OCBC Bank rose 4.4 percent, United Overseas Bank rose 2.4 percent and Keppel TatLee rose 6 percent after the Business Times reported that the city-state's four biggest banks were to consolidate their automatic teller machine network. The banks are to make an announcement Monday, but a spokeswoman for the four declined comment.

Singapore Airlines dived 5.7 percent after an investigator said that the Singapore Airlines pilot on Flight SQ006 had taken off from the wrong runway. The jet crashed Tuesday, killing 81 people.

Singapore Telecom fell 1 percent.

In Taipei, the Taiwan Weighted index closed up 3 percent, at 5,796.08. Chipmaker Taiwan Semiconductor Manufacturing rose 5.8 percent while rival United Microelectronics Corp. gained 5.9 percent.

In Seoul, the KOSPI ended up 0.4 percent at 560.41. Hyundai Engineering & Construction soared 14.8 percent after a media report said the firm had reached an agreement with financial regulators ahead of an announcement after the market close on non-viable companies.

South Korean banks said after the close that Hyundai Engineering would face receivership if it ran into further money troubles. Chipmaker Samsung Electronics rose 3.6 percent.

Elsewhere in Asia Pacific

In Sydney, the S&P/ASX 200 index rose 1 percent to 3,321.9, boosted by strength in its largest stock, News Corp., and a further rally in the banking sector. News Corp., which represents about 12 percent of the benchmark index, was up over 5 percent.

The SET index in Bangkok was up 2.7 percent while the JSX index in Jakarta gained 0.5 percent. In Kuala Lumpur, the KLSE Composite rose 1.5 percent.

Manila's markets were closed for a public holiday.

--from staff and wire reports

|

|

|

|

|

|

|