|

Cendant buys into Fairfield

|

|

November 2, 2000: 1:18 p.m. ET

World's largest hotel franchiser acquires timeshare resort operator for $635M

|

NEW YORK (CNNfn) - Cendant Corp., the world's largest hotel franchiser, agreed Thursday to purchase vacation resort operator Fairfield Communities Inc. for at least $634.5 million, significantly improving the company's ability to market and sell its worldwide timeshare properties.

Separately, Cendant Chairman and Chief Executive Henry Silverman said Thursday he expects to resolve its nearly three-month-long negotiations with Avis Group Holdings, which it has offered to buy out for approximately $750 million, by the end of November.

The acquisition of Fairfield provides the New York-based Cendant with 33 resort complexes in 12 states and the Bahamas, as well as timeshare agreements with more than 2,500 other vacation properties worldwide. It also provides an experienced sales force for Resort Condominiums International, a timeshare exchange service already run by Cendant.

As part of the agreement, Fairfield may, at the request of Cendant, spin off the property development portion of its business to current shareholders. The spun-off company would continue to develop timeshare resorts for Cendant, which would manage and serve as the exclusive sales and marketing agent for the facilities.

"What our customers, the independent timeshares, are looking for is help with sales and marketing," Silverman said. "[Fairfield] is growing top line and bottom line at higher rates [in timeshares] than we are. This allows us to extend our product offerings in one of our core areas." "What our customers, the independent timeshares, are looking for is help with sales and marketing," Silverman said. "[Fairfield] is growing top line and bottom line at higher rates [in timeshares] than we are. This allows us to extend our product offerings in one of our core areas."

The agreement comes two weeks after the Orlando, Fla.-based Fairfield revealed it was in negotiations with an undisclosed third party. The company had its planned $775 million merger with Carnival Corp. scuttled earlier this year because of the cruise company's plunging stock price.

Terms of the transaction call for Cendant to pay at least $15 per share for each outstanding Fairfield share,� an 14.3 percent premium above the company's closing price of $13.12 Wednesday. Cendant will pay at least half of the acquisition cost in cash, and will use cash, stock or a combination of the two to pay the remaining half.

The terms are contingent on Cendant shares trading for at least $12 per share during the 20 days leading up to the deal's closing date, expected early next year. If Cendant shares average $13.60 per share or higher, Cendant will raise its buyout price to $16 per share, raising the deal's enterprise value to $691.2 million.

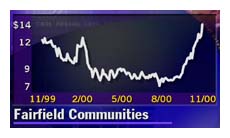

Fairfield (FFD: Research, Estimates) shares climbed $1 to $14.13 in midday trading Thursday. The company has been trading at or near its 52-week high of $13.25 since revealing it was in merger talks two weeks ago.

Cendant (CD: Research, Estimates) shares, meanwhile, climbed 31 cents to $12.44 by midday

Cendant officials said the acquisition would immediately add to the company's earnings in 2001.

Silverman said Cendant would be assuming less than $100 million worth of Fairfield debt as part of the transaction.

The transaction comes amid continuing negotiations with Avis, the car rental company that is already 18 percent owned by Cendant.

Cendant, which owns the brand names for such diverse franchises as Days Inn and Ramada hotels to Century 21 and Coldwell Banker real estate agencies, offered to acquire the Avis (AVI: Research, Estimates) shares it does not already own for $29 per share in mid-August, an offer analysts dismissed as too low.

A special committee appointed to represent Avis hired Morgan Stanley and New York law firm Cahill, Gordon & Reindel in early September to serve as its financial and legal advisers respectively during the negotiations, but the company has made no public comments concerning a possible deal since that time.

|

|

|

|

|

|

Cendant Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|