|

Europe ends mixed

|

|

November 2, 2000: 12:38 p.m. ET

Telecoms tumble in London; techs, financials lift Frankfurt; Paris dips

|

LONDON (CNNfn) - Sharp declines in telecom heavyweights drove London's leading market index into the red Thursday, with other markets across Europe ending mixed.

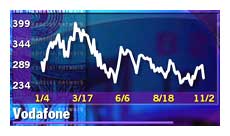

In London, the benchmark FTSE 100 index fell 65.6 points, or 1 percent, to close at 6,392.0, with mobile phone operator Vodafone (VOD) dropping 8.6 percent. In London, the benchmark FTSE 100 index fell 65.6 points, or 1 percent, to close at 6,392.0, with mobile phone operator Vodafone (VOD) dropping 8.6 percent.

The blue-chip CAC 40 index in Paris slipped 8.74 points, or 0.1 percent, to 6,400.31 as carmaker Renault (PRNO) shed 5.7 percent.

Frankfurt's electronically traded Xetra Dax gained 29.57 points, or 0.4 percent, to 7,088.64, with electronic component maker Epcos (FEPC) and sportswear maker Adidas Salomon (FADS) topping the gainers.

Among other leading European markets, the AEX index in Amsterdam was up 0.2 percent while the SMI index in Zurich rose 1.2 percent. Milan's MIB30 index fell 0.2 percent

The broader FTSE Eurotop 300 index, composed of a basket of Europe's largest companies, slipped 0.3 percent. The telecom component lost 3.2 percent while the oil and gas component shed 2.7 percent and the bank sub-index gained 1.7 percent.

click here for the biggest movers on the ftse 100 in London click here for the biggest movers on the ftse 100 in London

click here for the biggest movers on the dax 30 in Frankfurt click here for the biggest movers on the dax 30 in Frankfurt

click here for the biggest movers on the cac 40 in Paris click here for the biggest movers on the cac 40 in Paris

In the currency market, the euro was little changed against the dollar at 85.89 U.S. cents, compared to 86.09 in late New York trading Wednesday.

The European Central Bank left interest rates unchanged at 4.75 percent at its fortnightly meeting.

In New York, the Dow Jones industrial average inched up 0.1 percent while the technology-heavy Nasdaq Composite index rose 1.8 percent in midday trade.

Telecom, oil shares slump

British telecom firms tumbled as traders got the jitters from talk of a cut in analysts' earnings forecasts for Vodafone. Cable & Wireless (CW-) shed 3.2 percent, British Telecom (BT-A) and COLT Telecom (CTM) each fell 3.5 percent.

French telecom and construction firm Bouygues (PEN) rose 4.6 percent. French telecom and construction firm Bouygues (PEN) rose 4.6 percent.

Network systems provider Spirent (SPT) gained 5.9 percent in London.

French telecom equipment maker Alcatel (PCGE) rose 2.4 percent after investment bank Merrill Lynch upgraded its earnings and revenue estimates for 2000 and 2001. British rival Marconi (MNI) fell 2.8 percent.

Oil shares also dragged London down. The U.K.-listed arm of Royal Dutch/Shell Group, Shell Transport & Trading (SHEL), fell 3.6 percent after the oil firm said third-quarter net profit amounted to $3.25 billion, on the lower end of analysts' expectations. In Amsterdam, shares in Royal Dutch fell 3.4 percent.

Oil and gas exploration and production firm BG Group (BG-) dropped 3.1 percent and BP Amoco (BP-) fell 2.5 percent. Rival TotalFina Elf (PFP) lost 2 percent in Paris.

Financial shares rally

Financial stocks rose across Europe, with Germany's Munich Re up 3 percent while the world's largest insurer, AXA (PCS), rose 3.2 percent in Paris. Bank of Scotland (BSCT) jumped 5 percent in London and Germany's Deutsche Bank (FDBK) climbed 2.4 percent.

French bank Crédit Lyonnais (PCL) added 2 percent after BBVA Portugal, a subsidiary of Spanish bank BBVA, offered to buy stock in Crédit Lyonnais Portugal.

But Germany's Dresdner Bank (FDRB) fell 1.3 percent after it reported nine-month net profit fell 16.4 percent to  586 million ($503 million), compared with analysts' expectations for 586 million ($503 million), compared with analysts' expectations for  549 million, according to a Reuters poll. However, pretax profit fell 25 percent to 549 million, according to a Reuters poll. However, pretax profit fell 25 percent to  911 million, when analysts had expected 911 million, when analysts had expected  957 million. 957 million.

In Frankfurt, pharmaceutical company Schering (FSCH) sprang back from its recent weakness, to rise 3.1 percent.

Adidas Salomon rose 4.7 percent.

Auto shares were lower. Germany's BMW (FBMW) led Frankfurt's decliners, dropping 2.1 percent, and Volkswagen (FVOW) lost 1.5 percent.

Land Securities (LAND) surged 6.8 percent, after it agreed to buy unlisted property-outsourcing firm Trillium Investments for about £165 million ($238.8 million) in cash and stock.

British Airways (BAY) soared 7 percent ahead of its earnings announcement Monday.

Tech shares mixed

In the tech sector, Europe's leading software maker, SAP [FSE:FSAP3], lost 1 percent.

SAP's software consulting affiliate, SAP SI (ASSI), sank 9.6 percent on Germany's Neuer Markt despite posting a 20 percent rise in nine-month sales to  129.7 million and forecast growth of more than 20 percent for the full year. 129.7 million and forecast growth of more than 20 percent for the full year.

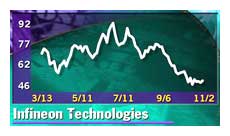

Among other techs, German chip maker Infineon Technology (FIFX) climbed 3.8 percent while Franco-Italian rival STMicroelectronics (PSTM) shed 0.6 percent. Electric component maker Epcos (FEPC) gained 3.9 percent in Frankfurt. Among other techs, German chip maker Infineon Technology (FIFX) climbed 3.8 percent while Franco-Italian rival STMicroelectronics (PSTM) shed 0.6 percent. Electric component maker Epcos (FEPC) gained 3.9 percent in Frankfurt.

Information technology consultant Cap Gemini (PCAP) rose 3.1 percent.

Aerospace firm EADS (PEAD) fell 2.7 percent while BAE Systems (BA-) dropped 3.3 percent in London.

Auto parts maker Valeo rose 5.8 percent in Paris following bid speculation after U.S. counterpart Visteon (VC: Research, Estimates) said it was looking at acquisitions, possibly in Europe.

British retailer Boots (BOOT) fell 4.4 percent after reporting a modest rise in half-year profits, which were in line with expectations. It said pretax profits before one-time items improved 23 percent to £271.3 million ($394 million).

-- from staff and wire reports

|

|

|

|

|

|

|