|

Bush winning Wall Street

|

|

November 2, 2000: 12:23 p.m. ET

Republican tax cut plan supports profit growth; Gore spending unfavorable

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - Wall Street players are famous for hedging their bets but when it comes to the upcoming presidential election, they're placing more chips in the Republican camp.

It's not that they think Republican candidate George W. Bush would necessarily make the best president, but rather that they like his promise to cut taxes. The theory goes that a tax-cut plan would put more money in consumers' hands, hence more money would show up in corporate profits. That would ultimately translate into more money flowing into Wall Street.

Bush proposes using the $2.17 trillion non-Social Security surplus to implement a $1.3 trillion tax cut, and earmarking $475 billion for domestic programs with the remaining $265 billion in reserve. Bush proposes using the $2.17 trillion non-Social Security surplus to implement a $1.3 trillion tax cut, and earmarking $475 billion for domestic programs with the remaining $265 billion in reserve.

Democratic candidate Al Gore's tax-cut proposal is nearly one-third of Bush's plan. Under Gore's plan, the $2.17 trillion surplus would be used for $480 billion in targeted tax cuts, $360 billion in Medicare programs and $879 billion in domestic programs with $300 billion kept in reserve.

"Tax cuts would probably flow directly into corporate profits. Companies are lean and mean today, compared with where they were ten years ago and if the economy is going to be stimulated by either tax cuts or new spending, I would prefer tax cuts," said Christine Callies, chief U.S. investment strategist with Merrill Lynch. "I would prefer the approach that is more profit friendly so I guess that means I don't prefer Al Gore's approach." "Tax cuts would probably flow directly into corporate profits. Companies are lean and mean today, compared with where they were ten years ago and if the economy is going to be stimulated by either tax cuts or new spending, I would prefer tax cuts," said Christine Callies, chief U.S. investment strategist with Merrill Lynch. "I would prefer the approach that is more profit friendly so I guess that means I don't prefer Al Gore's approach."

And she's not alone. According to a survey by Salomon Smith Barney Consulting Group, of the 134 money managers who were polled, 68 percent favored Bush, 13 percent chose Gore and 19 percent, or one-fifth of the managers, indicated that none of the candidates would have a positive impact on the markets.

Show me the money!

The Street's Republican stance is not overly convincing. Among the top contributors, both Citigroup and Morgan Stanley Dean Witter have given money to both Bush and Gore, according to the Center for Responsive Politics.

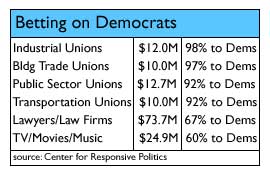

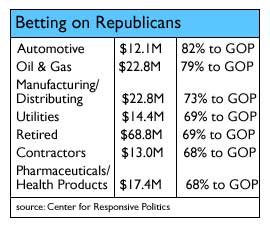

Yet, with Gore taking the populist track, Democrats have received the most support from unions and lawyers while Republicans have gained financial allegiance from the pharmaceutical/healthcare, oil & gas and the automotive industries. Yet, with Gore taking the populist track, Democrats have received the most support from unions and lawyers while Republicans have gained financial allegiance from the pharmaceutical/healthcare, oil & gas and the automotive industries.

But just because Wall Street is leaning toward Republican support does not ensure a win for Bush and it also doesn't mean stocks will plummet if Gore gets elected.

"The election is a minor uncertainty that the market would like to get out of the way," said Merrill Lynch's Callies. "Over the next couple of months I do expect stock prices will be better. I think corporate profits will turn out to be OK and the market will view some of the tensions and anxieties of the third and fourth quarter as a bit of overkill." "The election is a minor uncertainty that the market would like to get out of the way," said Merrill Lynch's Callies. "Over the next couple of months I do expect stock prices will be better. I think corporate profits will turn out to be OK and the market will view some of the tensions and anxieties of the third and fourth quarter as a bit of overkill."

Still, with Bush getting most of his support from industries that fall under government regulatory control, "Big Business" and, by extension, Wall Street, is signaling support for a Republican president.

"You look at tobacco where the government lawsuit could be settled on more favorable terms; you look at Microsoft (MSFT: Research, Estimates) where, at least psychologically, there would be a better chance of a settlement if Bush wins; you look at the energy industry and with Bush we might begin a discussion about exploration in Alaska," said Greg Valliere, managing director with Charles Schwab Washington Research Group.

Getting back to basics

With the candidates running neck-and-neck, most investors just want to get beyond the election and back to running their portfolios.

"For the broader market, I don't think it matters which (candidate) gets in. Both parties will eat into the budget surplus - if the Democrats win, they're going to spend it, if the Republicans win, they'll give a tax cut," said Barry Hyman, chief investment strategist at Weatherly Securities. "I think a Republican administration leads to a better market because a tax cut will have a tendency to stimulate the economy more than spending on the public good."

The politics of business: During the final month of the 2000 campaign, CNNfn.com will examine how key industries would fare under a Bush presidency or a Gore presidency. Each Monday and Thursday, CNNfn.com will turn its attention to a new sector. On Monday, we will wrap up our coverage with by profiling what each candidate would mean for the U.S. economy.

That may be fine for analysts but what tangible scraps do investors have to grasp onto?

Turn to the markets, say analysts. Healthcare and energy stocks have been performing well and, with Gore touting the "evils" of big pharmaceutical giants or big oil companies, the proof is in the pudding.

"Gore is putting himself as the populist candidate to fight against those big companies," said Vince Farrell, chief investment officer at Spears, Benzak, Salomon & Farrell. "You'd have to say Wall Street, right now, views Gore with fear and trepidation because he's attacked those industries in his campaign. What's been very strong has been healthcare so healthcare stocks are telling you Bush is going to win. Money managers are putting their money up front." "Gore is putting himself as the populist candidate to fight against those big companies," said Vince Farrell, chief investment officer at Spears, Benzak, Salomon & Farrell. "You'd have to say Wall Street, right now, views Gore with fear and trepidation because he's attacked those industries in his campaign. What's been very strong has been healthcare so healthcare stocks are telling you Bush is going to win. Money managers are putting their money up front."

Click here to see how drug stocks and energy stocks are performing

"The big play from a regulatory standpoint has to be healthcare in general and the drug stocks in particular. If it looks like, around Halloween [Oct. 31], Bush is going to win, I think the drug stocks will do very well. If it looks like Gore is going to win, there could be cloud over the sector," said Schwab's Valliere. "Gore's rhetoric, starting at the convention in L.A. until now, has been quite anti-business for many industries and that has been troubling for many investors."

|

|

|

|

|

|

|